As a seasoned crypto investor with a knack for navigating the tumultuous seas of digital assets, I must admit that the recent market fluctuations have left me feeling like a sailor tossed about by rogue waves. The AI sector’s 14.6% plunge in a day, following China’s anti-trust probe into Nvidia, is just another reminder of the rollercoaster ride we’re on.

As a researcher studying the field of cryptocurrencies, I observed a substantial drop in the value of Artificial Intelligence (AI)-related digital currencies. Over the course of a single day, the market capitalization of these AI coins decreased by 14.6%. This decline appears to be linked to recent reports concerning China’s antitrust investigation into Nvidia, a leading company in the AI chip-making sector.

Today, the largest cryptocurrency tied to AI, Near Protocol (NEAR), experienced a dip of approximately 8.6%, currently valued at $6.65 per coin. In the same time frame, Render (RENDER) saw a decline of 9.7%, Akash Network (AKT) dropped by 9.6%, FET suffered an 8.6% loss, and The Graph (GRT) fell by 8%. These figures were ascertained at the press time.

As a crypto investor, I’ve noticed that other artificial intelligence tokens like Bittensor (TAO), Arkham (ARKM), Livepeer (LPT), and Flux (FLUX) have taken a significant hit, with losses ranging from 12-16% respectively. This has caused a 14.6% dip in the market cap of AI coins, lowering it to $40.56 billion at this moment.

After China initiated an examination into Nvidia for potential infractions of their anti-monopoly law, the AI sector experienced a decline. Additionally, the State Administration for Market Regulation alleged that the American semiconductor company failed to uphold its pledges following its 2020 acquisition of Mellanox Technologies, an Israeli chip designer.

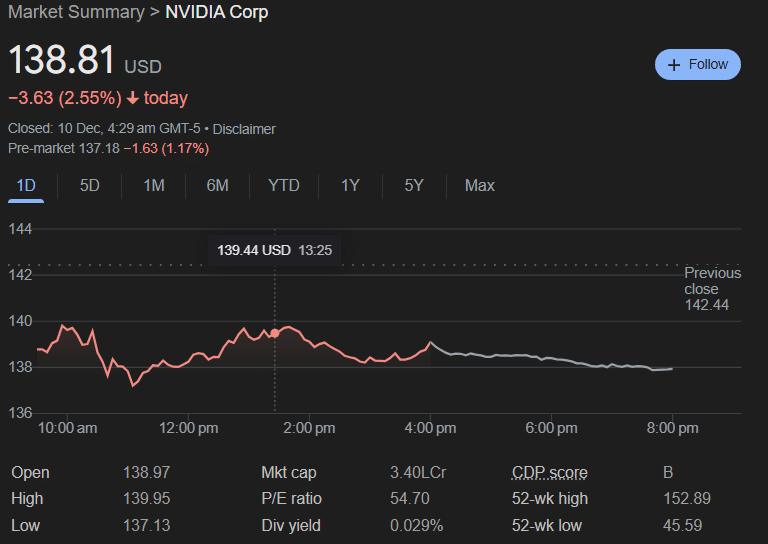

The latest financial report reveals that Nvidia, a company earning about 15% of its income from Chinese clients, experienced considerable influence from the report. Subsequently, Nvidia’s shares dropped by 2.55%, ending the day at $138.81 in New York stock markets on Tuesday.

AI-connected cryptocurrencies frequently react to news about Nvidia. For instance, as Crypto.news had earlier reported, multiple such tokens saw double-digit declines after Nvidia suffered its biggest single-day market value decrease on September 4, following a subpoena from the U.S. Department of Justice regarding antitrust matters.

In this instance, coins tied to artificial intelligence and other cryptocurrencies encountered difficulties as well, given that Bitcoin (BTC), often seen as a benchmark in the crypto market, experienced a sudden drop in value on December 10th. This decline saw Bitcoin dipping below $95,000 from its previous day’s peak of $100,200.

The incident set off a chain reaction throughout the wider cryptocurrency sector, causing it to drop by approximately 6.8% over the past 24 hours. This dramatic decline resulted in a substantial $1.7 billion worth of positions being terminated due to market movements.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Maiden Academy tier list

2024-12-10 14:40