As a seasoned researcher with years of experience in the volatile world of cryptocurrencies, I find myself both intrigued and cautious about the recent developments with Ai16z. The meteoric rise of over 20,500% since November was nothing short of breathtaking, reminding me of the exhilarating rollercoaster rides we all love.

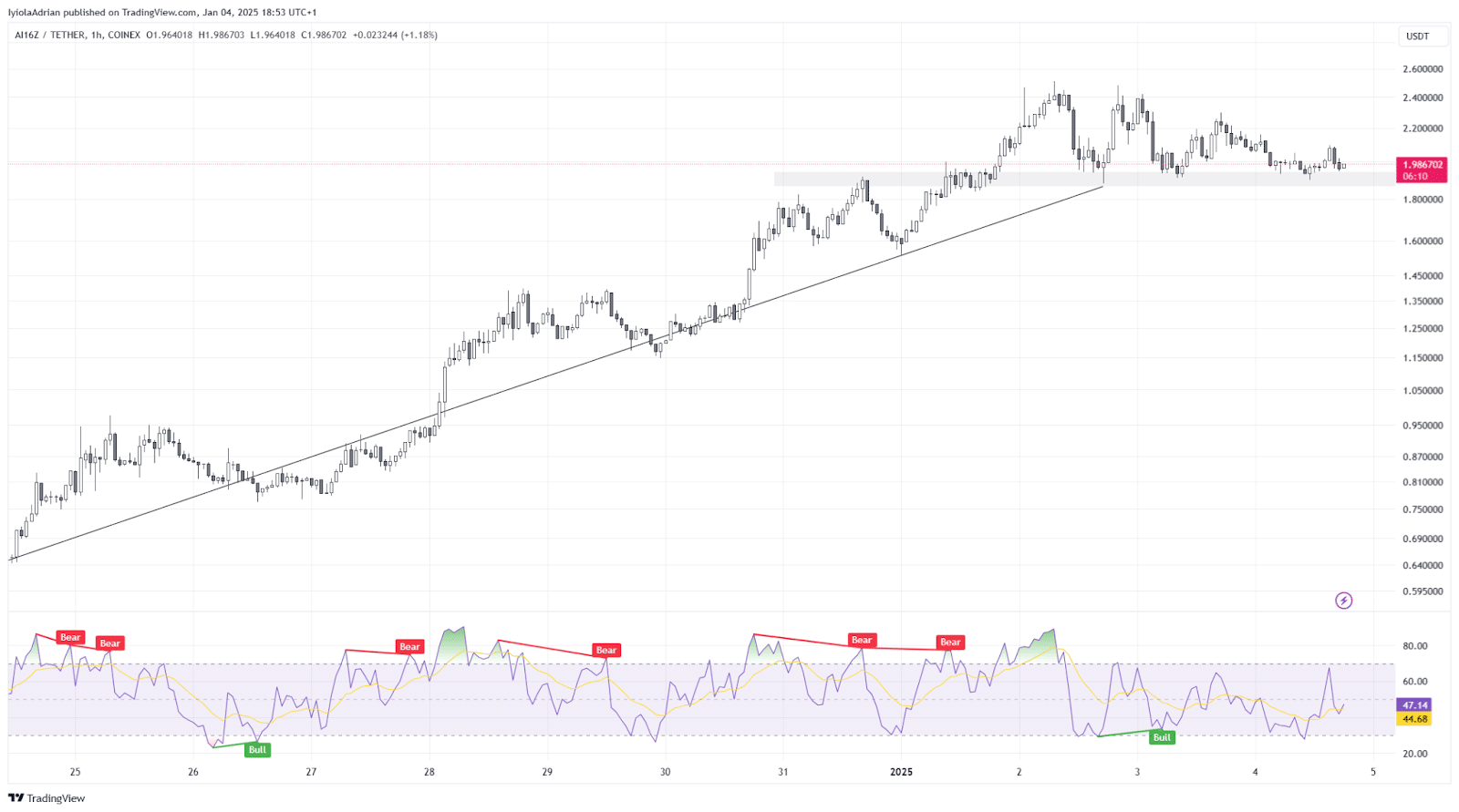

However, the sudden correction, entering what appears to be a local bear market, is not entirely surprising. The decrease in buying pressure and high RSI suggested that the memecoin had been overbought by traders, as I had predicted might happen.

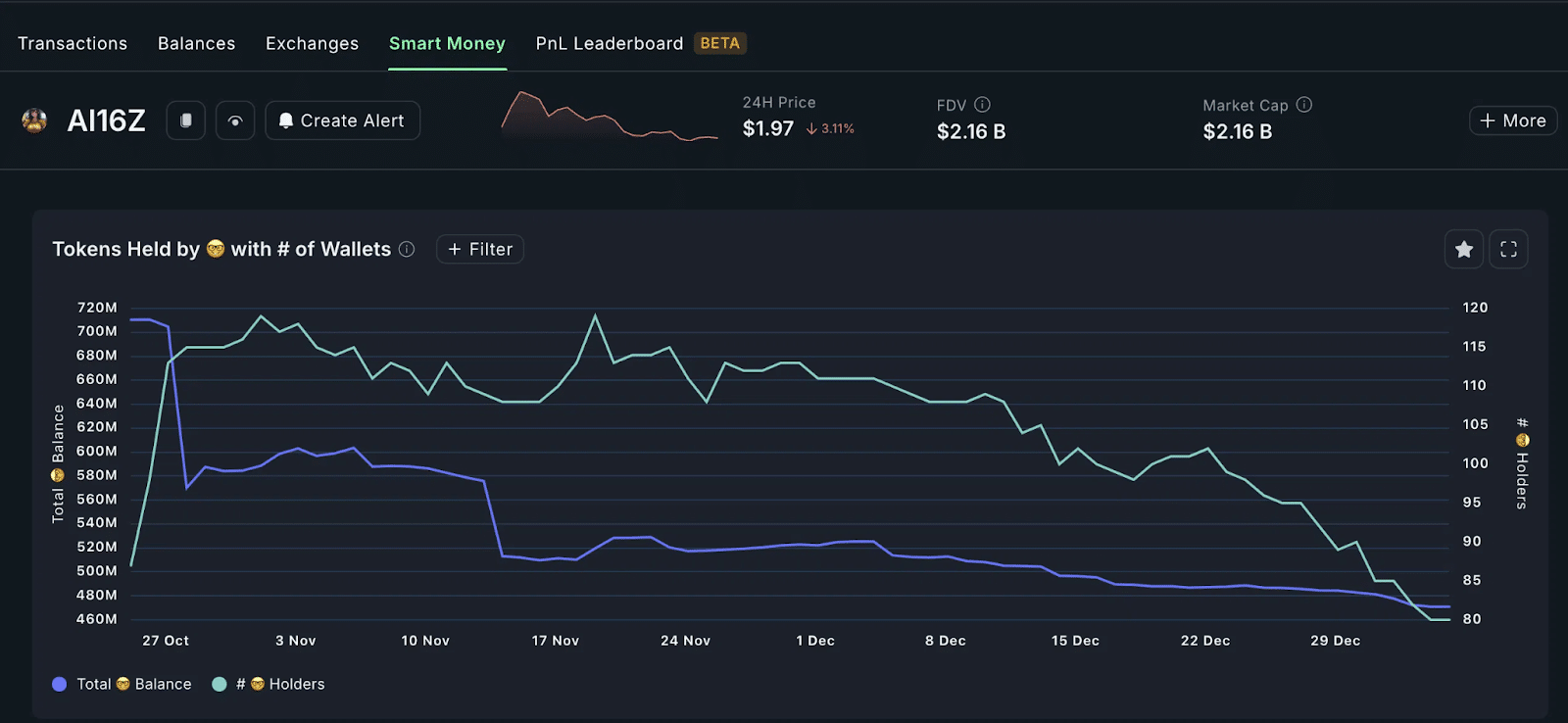

The sharp decline, with the price dropping from $2.50 to $2, is mainly due to profit-taking by investors, particularly the “smart money” who tend to sell their holdings before the market enters a downward phase. This trend isn’t unexpected, but it does serve as a reminder that even the most profitable investments can quickly turn into pumpkin soup.

The surge in Ai16z tokens on exchanges and the increase in selling rather than buying indicate that more tokens are being cashed out. It seems we might be witnessing a massive sell-off, with some traders deciding to hold onto their profits while others choose to sell a portion of their holdings.

In terms of individual investors, it’s fascinating to see the most profitable Ai16z trader has made $148 million in profits. However, as the wise old saying goes, “Don’t count your chickens before they hatch,” and I can’t help but wonder if this trader will end up with an empty nest after the dust settles.

Looking at the situation through the lens of the Wyckoff Method, Ai16z appears to be in the distribution phase, which is when more tokens are sold than bought. If this continues, the token could indeed fall further, with some speculating a drop to $1, which would be a 50% decrease from its current value.

In closing, I’d like to leave you all with a little joke: Why did the Ai16z cross the road? To get to the other side of the bear market! Keep your eyes on the chart and your fingers on the buy or sell button – may the best trader win!

AI16z, a cryptocurrency tied to artificial intelligence and built on the Solana blockchain, experienced a significant price decline recently, suggesting it might be in a temporary downturn or ‘local bear market.’ In just over three months since November, its value had surged by an impressive 20,500%, reaching a market capitalization high of $2.3 billion earlier this week.

By the 4th of January, the coin’s price had dropped to $2, marking a decline of over 21% from its peak of $2.50 this month. This decrease was anticipated due to reduced buying interest and a high RSI level, which indicated that traders had excessively bought the memecoin, causing it to reverse in price.

The significant drop primarily stems from investors cashing out their profits, often referred to as “smart money.” As per Nansen’s data, the number of these astute investors has decreased substantially, falling from 118 in November to only 80 on January 4.

Simultaneously, the total amount of their tokens has decreased from over 700 million to less than 500 million. It’s not surprising that savvy investors are selling off their holdings, given they typically do so before the market experiences a downturn.

As a crypto investor, I’ve noticed an intriguing trend lately: The number of AI16z tokens available on exchanges has significantly increased in recent times. Last week, there were approximately 12.32 million tokens on these platforms, but by January 4, that figure skyrocketed to over 43.65 million. Major trading hubs such as Gate, Raydium, MEXC, and Orca have witnessed the most significant growth. This surge suggests that more tokens are being offloaded rather than accumulated, hinting at holders cashing out.

The top AI16z investor, when it comes to individual profits, has pocketed an astounding $148 million. Despite selling tokens worth $4.6 million, this trader keeps 96% of their initial investment intact. Other successful traders, who earned $63 million, $57 million, and $44 million respectively, are maintaining their positions. On the other hand, many other profitable investors have opted to cash out a portion of their investments.

This decrease in price could also be associated with the Wyckoff Method, a widely-used market concept. This theory divides market trends into four phases: accumulation, when investors gather shares; markup, where prices rise as more buyers enter; distribution, when existing holders sell off their shares; and markdown, when prices fall due to selling pressure. Ai16z started its journey in the accumulation phase in November, then moved into the markup phase in December.

As a seasoned crypto investor with several years of experience under my belt, I can’t help but notice the recent trend in the market – tokens are being distributed at a faster rate than they’re being bought. This distribution phase has me feeling a bit uneasy, as it’s often a sign that the token could potentially drop further. In fact, some experts predict that if this trend continues, we might see the value of the token plummet to $1 – a 50% decrease from its current price. Given my past experiences in this volatile market, I know all too well how quickly things can change, but I’m keeping a close eye on this situation and will make adjustments to my portfolio accordingly.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- USD CNY PREDICTION

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2025-01-04 22:28