As a seasoned analyst with over two decades of experience in tech and finance, I find myself intrigued by the surge in AI-focused cryptocurrencies ahead of Nvidia’s quarterly results. The recent rise in Akash Network (AKT), Bittensor (TAO), Render Token (RNDR), Artificial Superintelligence Alliance (FET), and others, is reminiscent of a gold rush, albeit in the digital realm.

Next week, the focus will shift towards AI-related cryptocurrencies and stocks, with anticipation building as Nvidia is set to release its Q3 earnings report after market close on August 28th.

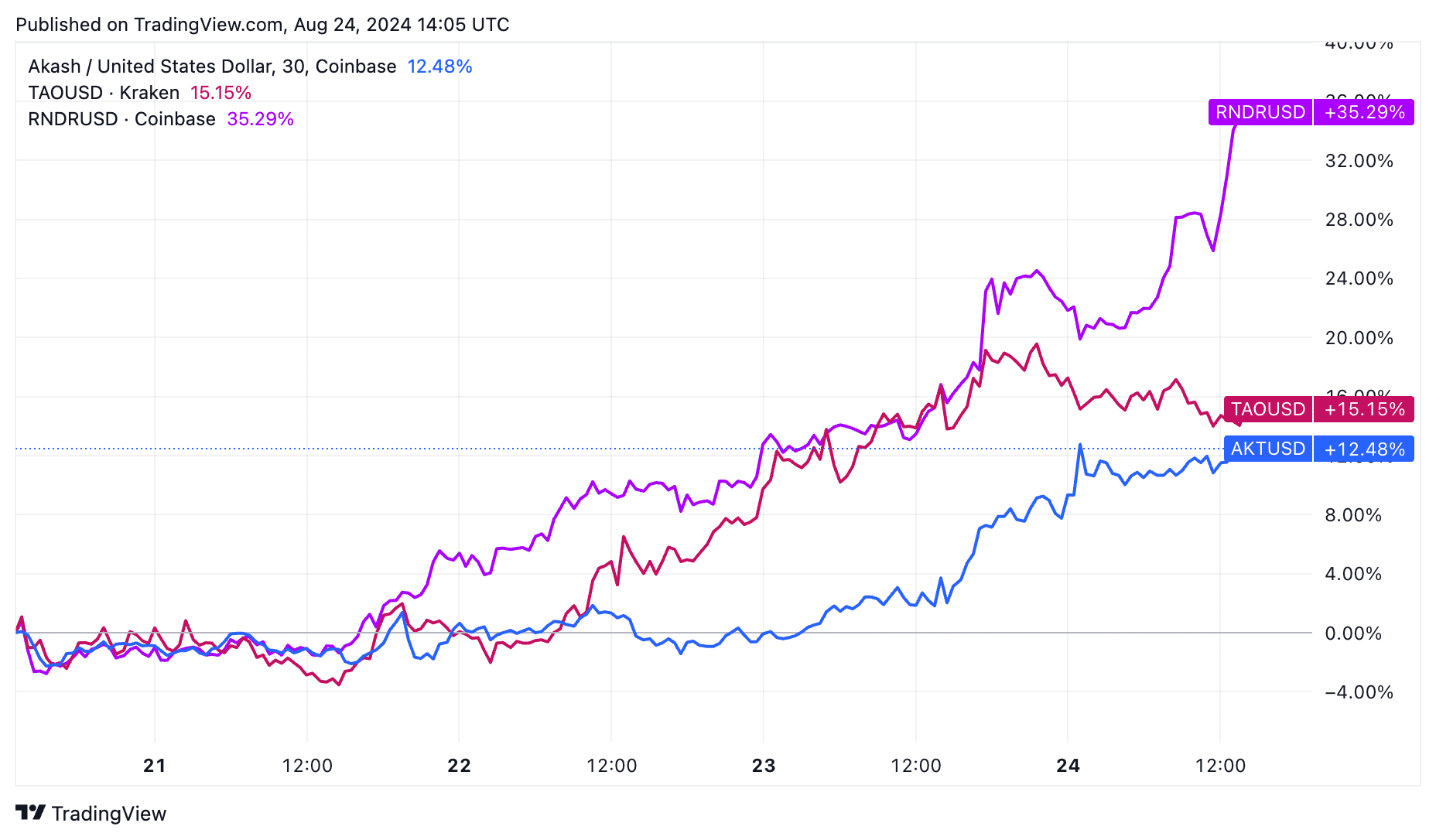

Prior to the event, Akash Network (AKT) experienced a 10% increase over the last seven days. Likewise, Bittensor (TAO), Render Token (RNDR), and Artificial Superintelligence Alliance (FET) have all surged by more than 30% during this timeframe.

On August 24th, I observed an impressive surge in the market capitalization of Artificial Intelligence (AI) tokens, as reported by CoinGecko, with a notable increase of more than 13.7%. Moreover, the trading volume soared significantly to reach approximately $1.7 billion on that day.

Following the latest remarks from Federal Reserve Chair Jerome Powell suggesting potential interest rate cuts in September, these positive returns appeared to materialize.

As a long-time tech enthusiast and investor, I’ve been closely watching Nvidia’s impressive growth this year. With its stock soaring by more than 161%, it has become one of the top three largest companies globally with a staggering market cap of over $3.1 trillion. This rapid expansion has been truly remarkable and is a testament to their innovative technology, strong leadership, and forward-thinking business strategy. I’ve personally witnessed firsthand how Nvidia’s advancements have revolutionized industries such as gaming, artificial intelligence, and autonomous vehicles, making it an indispensable player in today’s tech landscape. It’s truly inspiring to see a company with such potential reach new heights and set the bar for future innovation.

The company’s initial-quarter earnings reveal a significant surge in revenue, approximately 240%, reaching around $26 billion. These numbers suggest an increase in demand for AI, and analysts anticipate further growth to $28.6 billion in the subsequent quarter.

As a researcher, I recently had the opportunity to converse with a former NVIDIA (NVDA) colleague. Here’s a glimpse of his perspective:

— AlphaSense (@AlphaSenseInc) August 23, 2024

A robust income flow and positive future predictions suggest a promising outlook for the sector, likely causing increased values for related investments.

Results that come below estimates could lead to a sharp reversal.

Akash Network and Render share a connection with Nvidia’s business as they operate where blockchain technology and the semiconductor sector intersect. They provide distributed graphics processing unit (GPU) rendering services within their respective blockchain networks.

According to information displayed on the Akash Network’s site, it is possible to rent Nvidia’s H100 GPU for under an hourly rate of $1. This cost makes it a budget-friendly option considering it retails at more than $30,000.

Bittensor operates on a comparable distributed structure, providing a decentralized platform for developing machine intelligence solutions.

Its token has risen by 106% from its lowest point in August. The other top AI tokens to watch as Nvidia publishes its earnings are AIOZ Network (AIOZ), Arkham (ARKM), The Graph (GRT), and Internet Computer (ICP)

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- USD MXN PREDICTION

2024-08-24 21:49