As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of bull runs and bear markets. However, the recent surge of Algorand (ALGO) has caught my attention, not just because of its impressive 240% climb from its yearly low but also due to the optimistic forecasts from fellow analysts like Steph is Crypto.

On November 29, the value of Algorand significantly increased, indicating a robust upward movement in its price, as the overall trend for cryptocurrencies remained positive.

Recently, the Algorand (ALGO) cryptocurrency reached a peak of $0.40, which is its highest point since last November. For the past four weeks, ALGO has experienced consistent growth, increasing by more than 240% from its lowest point in 2022.

crypto experts remain hopeful regarding ALGO’s price, with well-known analyst Steph from X post – Crypto predicting a potential rise to $1.26. This optimism stems from a double-bottom pattern observed on the weekly chart, which could potentially cause a 300% increase in value if accurate.

$Algo is breaking out 👀

The technical target is at approximately $1,26#Algorand

— STEPH IS CRYPTO (@Steph_iscrypto) November 29, 2024

A different expert observed that the value of this digital currency could increase due to its robust token economics, widespread practical application, and superior technology. To illustrate, Algorand boasts a partnership with FIFA, leveraging their blockchain for the operation of its Non-Fungible Token (NFT) marketplace.

The worth of funds locked within Algorand’s DeFi system has climbed to a new high, reaching $170 million – the highest since February. Important applications within its ecosystem have experienced substantial growth, with Folks Finance witnessing a 200% increase in assets over the past month. Currently, Lofty holds approximately $45 million in assets, while Tinyman is managing around $34.6 million.

The surge in Algorand corresponds with the overall performance of the cryptocurrency market. On Friday, Bitcoin soared past $98,000, and the combined value of all digital currencies exceeded $3.4 trillion. Similarly, notable coins that emerged in 2021, including Theta Network, Stellar, and MultiversX (previously known as Elrond), also experienced considerable growth.

Algorand price analysis

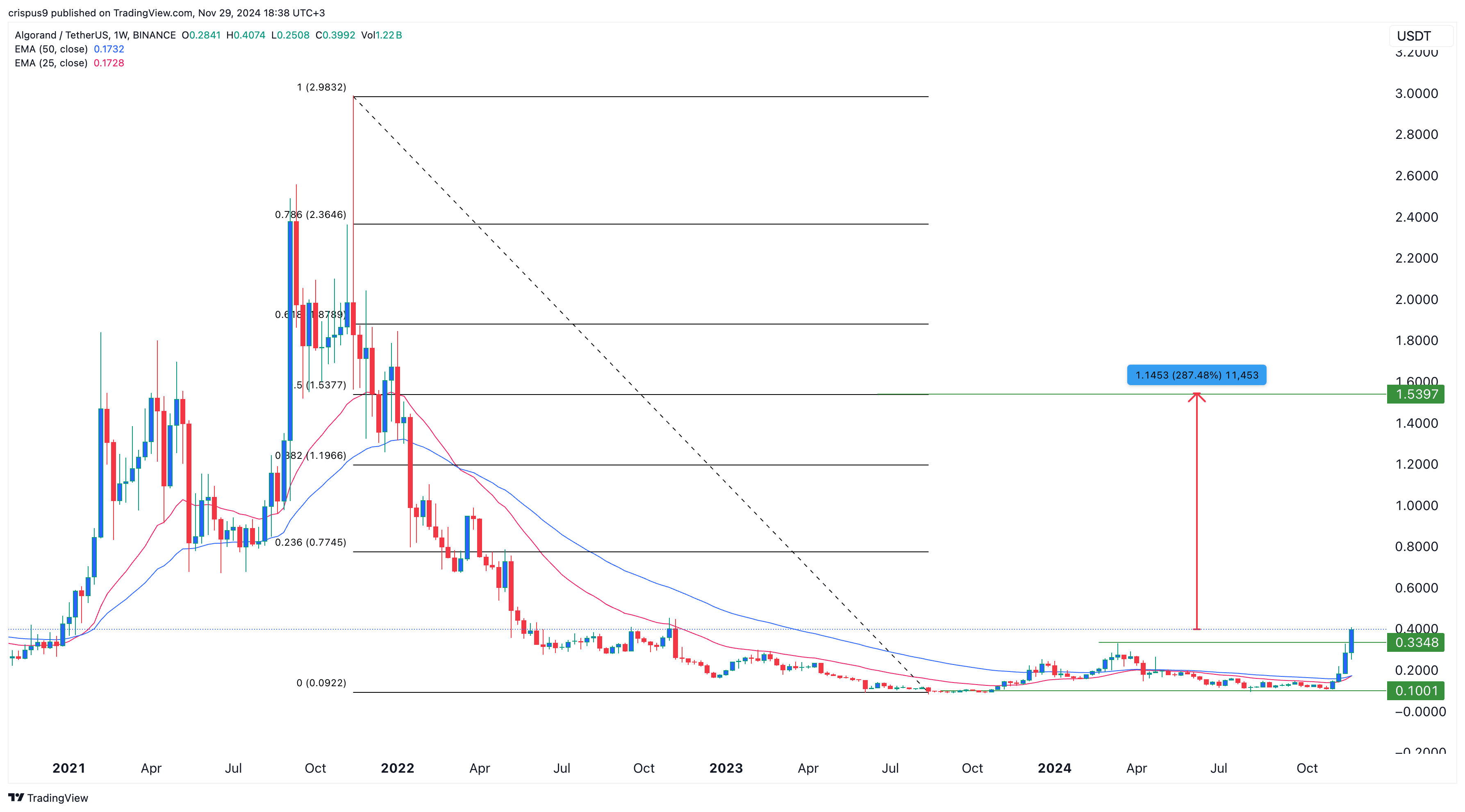

The trend for Algo looks positive as indicated by its weekly chart. This could mean that Algo might reach around $1.54 during the current price surge. Notably, Algo has formed a double-bottom pattern at $0.10, which it hasn’t exceeded since last year. Now, it has gone beyond the line that defines this pattern, or the neckline, at $0.3348, often a sign of a bullish trend.

If the current upward trend persists, ALGO might reach $1.54, which would be a substantial 287% rise from its current price and coincide with the 50% Fibonacci Retracement mark. To achieve this, the coin must initially surpass two resistance levels: first, the 23.6% Fibonacci Retracement point at $0.7745, followed by the 38.2% level at $1.20. Conversely, a decline below the support level at $0.20 could initiate a bearish trend.

Read More

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

2024-11-29 18:58