As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of bull and bear runs, especially in the volatile world of cryptocurrencies. The recent downturn in Coinbase’s stock price might seem daunting at first glance, but as they say, every cloud has a silver lining.

Over the past eight days, Coinbase’s stock has been steadily declining, but some financial experts predict it might recover and reach approximately $295 – a potential increase of around 40% compared to its price on Friday.

Coinbase pulled back its stance due to a sharp decline in Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and various alternative coins, resulting in reduced trading activity on both centralized and decentralized cryptocurrency platforms.

Coinbase earnings

Alongside fluctuations in the cryptocurrency market, the price of Coinbase’s shares also responded to their reported earnings, demonstrating the advantages of their diverse business portfolio.

In the second quarter of 2023, Coinbase earned approximately $1.3 billion as net revenue, marking a substantial rise compared to the $663 million generated during the same period the previous year. However, this figure fell slightly short of the $1.58 billion in revenue they reported for the first quarter.

In comparison to the $97 million loss from the same time last year, Coinbase recorded a net profit of $36 million this time around. Moreover, all their figures surpassed both their own projections and the predictions made by financial analysts.

To clarify, Coinbase’s strategies to expand its operations have shown success. Notably, its transaction income reached an impressive $780 million, with its subscription and service income surging up to $599 million.

The latter portion of its earnings, specifically from custodial fees, experienced a significant growth, reaching $34.5 million. This development makes Coinbase particularly thrilling because it now serves as the largest custodian for many Bitcoin and Ethereum Exchange-Traded Funds (ETFs). The company anticipates reduced volatility in its earnings as investors tend to hold their ETFs for extended periods.

Another aspect of Coinbase’s income from subscriptions and services involves their stablecoin earnings, blockchain rewards, interest, fees, and additional subscription-based offerings.

Analyst is bullish on Coinbase stock

A majority of financial analysts from Wall Street have a positive outlook towards COIN’s stock, with predictions pointing to an average price target of $265 – a 25% increase over the stock’s closing price on Friday. (Yahoo Finance)

In simple terms, Citigroup switched their stance on Coinbase, upgrading it from ‘hold’ to ‘buy’ in July. Analysts from firms like Needham, Goldman Sachs, and JMP Securities also show optimism towards the company’s stock.

Recently, an analyst from HC Wainwright revised their projected price for the stock, lowering it from $315 to $295. Despite this adjustment, they still anticipate a substantial potential increase of around 40% from the current price.

The analyst cited two key catalysts to drive shares higher. First, the crypto industry could get the regulatory clarity it has always wanted this year. Brian Armstrong, the company’s CEO has seen some bipartisan moves about crypto in Congress in the past few months.

After mentioning this, HC Wainwright pointed out that Coinbase has expanded its business scope, making it less reliant on income from transactions alone.

“Although there might be a period of stability in cryptocurrency prices and trading activity due to economic uncertainties in the near future, our optimism remains high regarding these significant factors impacting Coinbase. We anticipate this bullish trend in the crypto market to continue over the next 12-18 months as we move forward into a new phase of growth.”

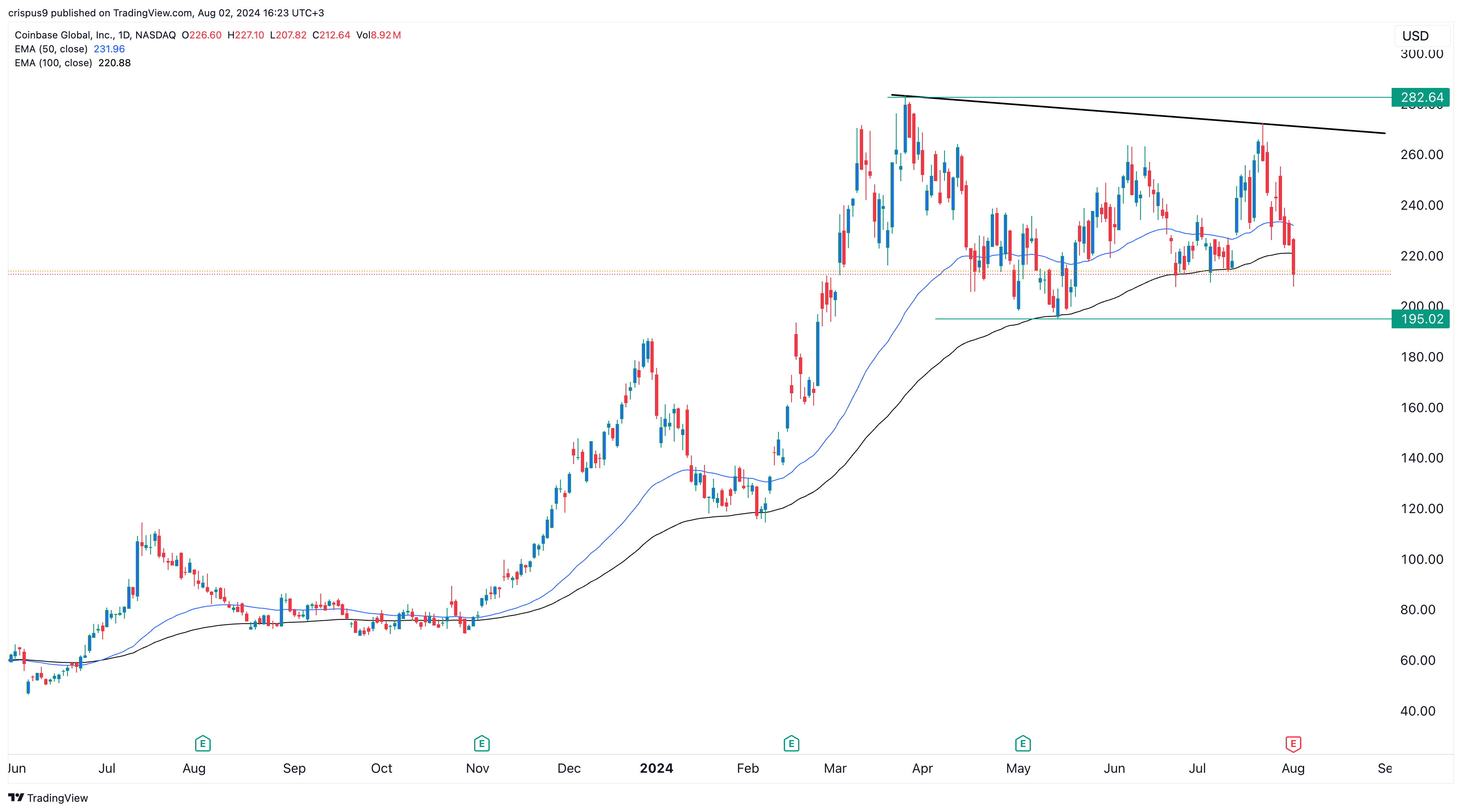

As I analyze the data, it’s evident that my ongoing study on this stock is encountering some technical challenges. On the daily chart, the stock appears to be slipping beneath both the 50-day and 100-day Exponential Moving Averages (EMA), suggesting a dominant bearish trend. Furthermore, it has developed a slightly inclined double-top pattern with a neckline at $195.02. Should the stock breach this level, it could indicate further price decreases.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-08-03 01:29