As a seasoned investor with over two decades of experience in the financial markets, I’ve seen my fair share of market fluctuations and trends. The current state of Bitcoin, as depicted by its recent performance and the predictions of analysts like Hayes and Madonna, seems to me reminiscent of the early days of the dot-com bubble.

It seems that conditions are favorable for Bitcoin to exceed its past record peak, according to many global financial analysts, largely due to an increase in global liquidity.

In the past few weeks, there have been indications that the global economic situation may be changing direction. This weekend, Goldman Sachs economists revealed they reduced their prediction for the likelihood of a U.S. recession in 2025 from 25% to 20%.

The shift occurred following the dissemination of recent U.S. retail sales and unemployment figures, indicating a possibility that the American economy could be more resilient than initially apprehended by some.

If the August jobs report, due for release on September 6th, aligns with current trends, it might lower the predicted probability of a recession to Goldman Sachs analysts’ earlier estimate of 15%.

As a crypto investor, I’m feeling optimistic about the potential for a rate cut by the U.S. Federal Reserve in September, potentially by 0.25%. This development could boost investment in cryptocurrencies and other riskier assets.

The anticipated interest rate reductions have already started influencing the financial markets, as US stock indices like the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average posted their highest weekly percentage growths of the year by August 16th.

In addition to the encouraging signs for the American economy, worldwide funds are starting to flow more freely. Typically, a surge in liquidity and decreased concerns about recession can spark optimistic movements within the cryptocurrency market.

Let’s delve deeper into global trends and examine how these economic changes might influence Bitcoin (BTC) and the broader cryptocurrency market over the next few weeks and months.

Liquidity surge across global markets

To predict where Bitcoin might go next, let’s explore the reasons for the recent increase in market liquidity and consider its potential effects on the wider financial landscape.

The U.S. liquidity flood

In the United States, it seems the Treasury is preparing to significantly increase the money supply within the economy. As articulated by Arthur Hayes, cofounder of BitMEX and a significant figure in the cryptocurrency sector, this influx of funds could potentially drive Bitcoin’s price beyond its previous record high of $73,700. However, one might wonder what has caused this sudden development?

One possible explanation is the upcoming presidential elections. Maintaining a strong economy is crucial, and this liquidity injection could be a way to ensure favorable conditions as the election approaches.

So, you’re asking about the specific methods for adding this liquidity? Well, the U.S. Treasury and the Federal Reserve possess a variety of potent instruments, as detailed by Hayes in his examination.

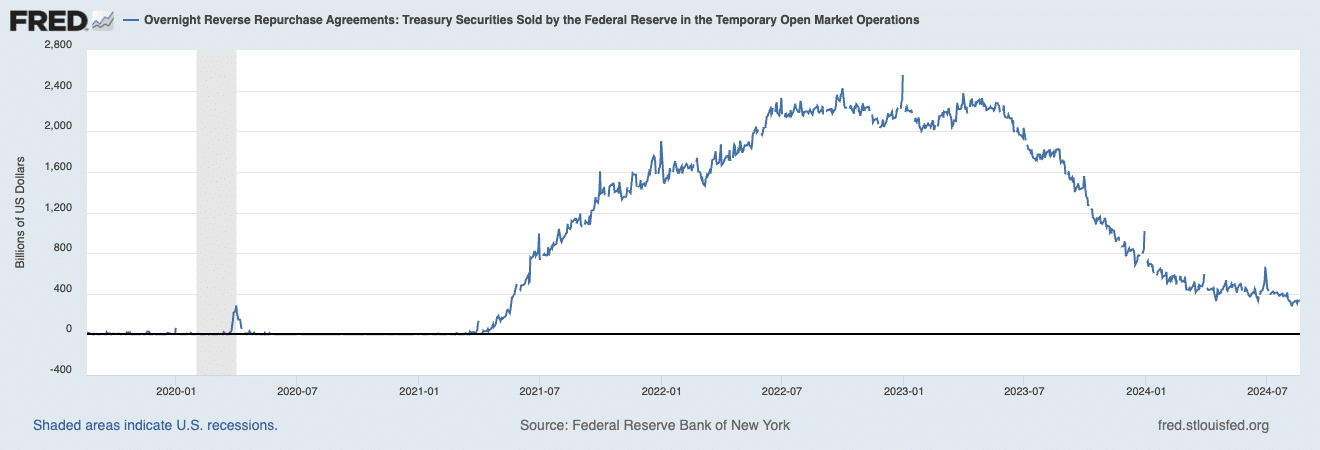

As an analyst, I’d rephrase that statement like this: As of August 19th, the overnight reverse repurchase agreement (RRP) balance I’m tracking has decreased substantially, from a high of over $2.5 trillion in December 2022, to now sitting at $333 billion.

Hayes clarifies that the Reverse Repurchase Agreement (RRP) is essentially a large reservoir of “sterilized funds” on the Federal Reserve’s balance sheet, which the U.S. Treasury appears to be aiming to move into the actual economy—in other words, increasing liquidity. The RRP refers to the value of Treasury securities that the Fed has sold with an arrangement for future repurchase. In this transaction, the purchasing entities—primarily money market funds—accumulate interest on their overnight deposits.

According to Hayes’ observation, the decrease in the overnight Repo Rate Pit (RRP) over the last year suggests that money market funds are shifting their cash into short-term Treasury bills rather than the RRP, as T-bills offer a slightly higher return. Hayes further explains that T-bills can be used strategically to increase liquidity and potentially stimulate credit and asset price growth in the marketplace. Essentially, this means that money is moving out of the Federal Reserve’s balance sheet, increasing liquidity within the markets.

The Treasury also recently announced plans to issue another $271 billion worth of T-bills before the end of December, Hayes noted.

Additionally, it’s worth noting that the U.S. Treasury has another option at its disposal. This is their General Account (TGA), often likened to a checking account for the government. With a balance of an impressive $750 billion, this account could potentially be utilized in various scenarios, such as averting a government shutdown or addressing other fiscal requirements. The TGA can even be employed to buy debt that isn’t Treasury bills. As Hayes points out: “By issuing more Treasury bills and reducing the amount of other types of debt, the Treasury effectively injects liquidity into the market.”

According to Hayes’ assertion, if these two methods are implemented, we might observe a range of investment – from approximately $301 billion (representing RRP funds) to as much as $1 trillion – being injected into the financial system by the end of this year.

As someone who closely follows the cryptocurrency market, I firmly believe that understanding the relationship between Bitcoin and liquidity is crucial for investors like myself. My personal experience has shown me that periods of increasing liquidity often coincide with significant price movements in Bitcoin. This correlation can provide valuable insights when making investment decisions. For instance, during the 2017 bull run, I noticed a surge in liquidity which was followed by a dramatic increase in the value of Bitcoin. Conversely, during times of economic uncertainty or market downturns, such as the COVID-19 pandemic, liquidity decreased, leading to a decline in Bitcoin’s price. Therefore, keeping an eye on liquidity trends is essential for anyone looking to navigate the ever-evolving world of cryptocurrencies.

As more wealth circulates within an economy, investors often become bolder in their investment choices. Since Bitcoin is considered a high-risk asset, with a limited supply, Hayes contends that this surge in funds might lead to a prosperous market for Bitcoin by the end of the year.

If the U.S. implements these cash infusions, there may be a significant rise in Bitcoin’s value due to an increase in investor interest in the cryptocurrency market, where they seek higher yields.

China’s liquidity moves

As the U.S. intensifies its monetary policies aimed at increasing liquidity, China too is taking action, albeit with distinct motivations.

Based on a recent discussion by financial analyst TomasOnMarkets, there are indications that the Chinese economy might be facing difficulties, as reported data suggests a decrease in bank loans for the first time in 19 years. This is significant because it hints that one of the world’s major economic growth engines, China, seems to be slowing down.

The People’s Bank of China (PBoC) is increasing its monetary stimulus, with the size of reverse repo operations growing significantly and exceeding a threshold that warrants closer observation ($65bn). However, it remains to be seen whether this trend will persist.

— Tomas (@TomasOnMarkets) August 15, 2024

To counteract this pressure, the People’s Bank of China has been quietly increasing its liquidity injections. Over the past month alone, the PBoC has injected $97 billion into the economy, primarily through the very same reverse repo operations.

Although these injections are currently smaller than previous instances, they’re significantly important during a period when China’s economy stands at a critical juncture.

As an analyst, I’ve noticed something more intriguing in the current economic situation. It appears that the Chinese Communist Party’s top brass is planning to introduce further policy initiatives aimed at bolstering the nation’s economy.

Additional infusions of liquidity may be considered, aiming to increase the money supply and possibly restore stability within the Chinese economy.

Recently, the Chinese yuan has become stronger compared to the US dollar. This development gives China’s central bank, the People’s Bank of China (PBoC), more flexibility to introduce further stimuli without inadvertently causing inflationary issues.

The big picture on global liquidity

It’s intriguing to note that these liquidity shifts aren’t occurring independently, but rather seem interconnected.

Jamie Coutts, the head crypto analyst at Real Vision, pointed out recently that major central banks such as the Bank of Japan have pumped significant sums into the world’s monetary reserves over the past month. Specifically, the Bank of Japan has infused approximately $400 billion.

In simpler terms, central banks are releasing more money into the economy, which could lead to a significant increase in the price of Bitcoin. My global liquidity model, last showing a bullish trend in November 2023, indicates this might be the case again. As you may remember, Bitcoin surged by 75% between November and…

— Jamie Coutts CMT (@Jamie1Coutts) August 15, 2024

When you add the $97 billion from the PBoC and an additional $1.2 trillion in broadened global money supply growth, it seems like a deliberate initiative to inject the world economy with liquidity.

A key point backing up this concept of cooperation is the current drop in the value of the U.S. dollar. This weakness implies a potential, unspoken approval from the Federal Reserve towards these liquidity strategies, leading to a harmonious strategy for stimulating the worldwide economy.

Jamie mentioned that considering past trends, the likelihood of Bitcoin experiencing a significant surge could be quite high. For instance, during comparable periods of increased liquidity in 2017, Bitcoin skyrocketed nearly 19 times its initial value. Similarly, in 2020, it multiplied by approximately 6 times.

It’s considered improbable that Bitcoin’s history will reoccur identically, but an analyst suggests a compelling argument for a potential 2-3 times rise in its value during this cycle – as long as the global money supply grows and the U.S. dollar index (DXY) falls below 101.

Where could the BTC price go?

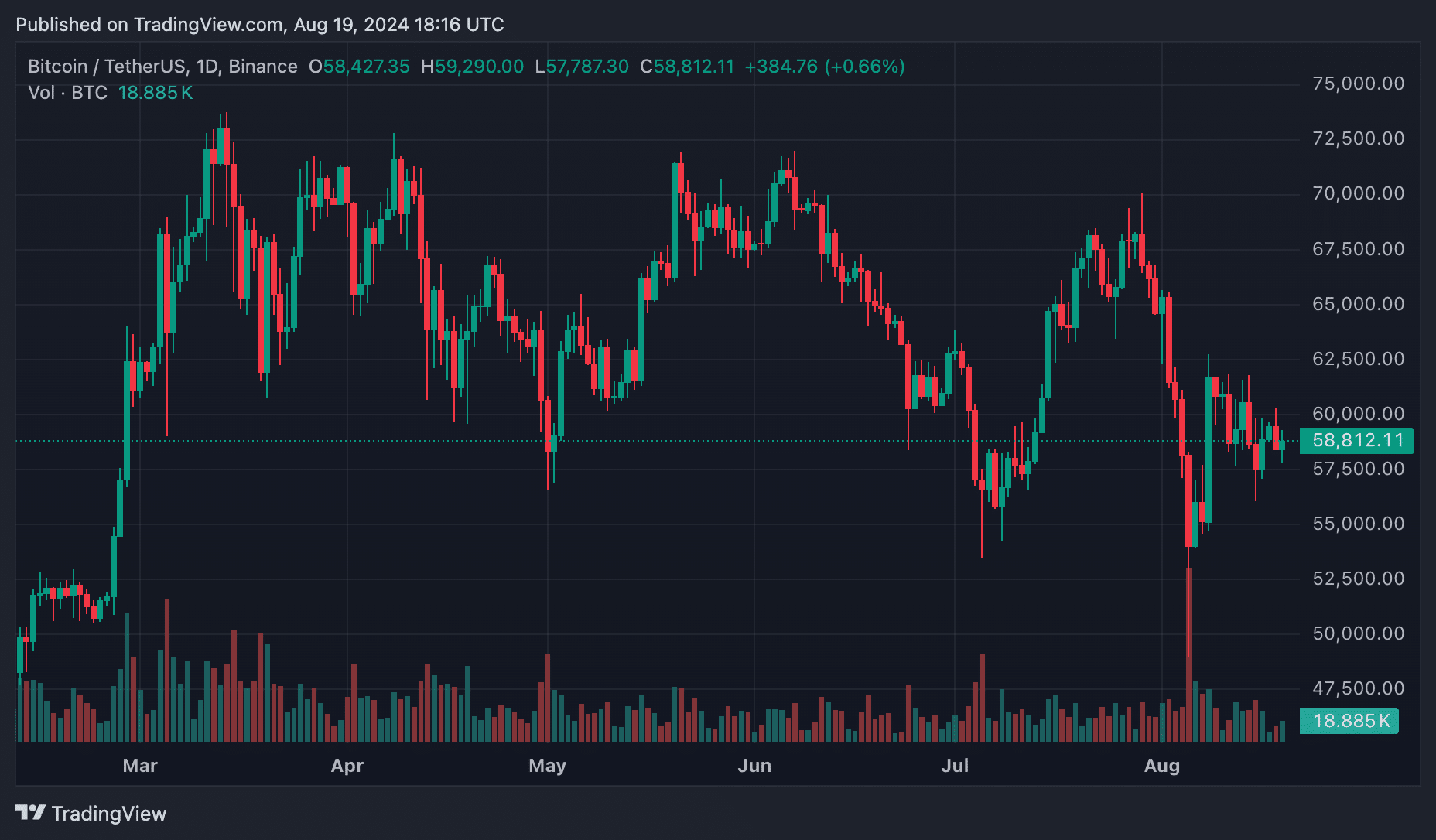

On August 5th, Bitcoin and other cryptocurrencies experienced a significant drop following a market crash. This decline was caused by increasing worries about a recession, along with the rapid reversal of the yen carry trade. The consequences were dramatic: Bitcoin fell to around $49,000 and struggled to rebound.

Currently, as of August 19th, Bitcoin is hovering near the $59,000 level. It’s encountering significant obstacles between $60,000 and $62,000. The crucial point now is: what direction will Bitcoin take moving forward?

As per Hayes’s perspective, Bitcoin requires a significant leap beyond the $70,000 mark to initiate its next bull run. Similarly, Ethereum (ETH) is expected to surpass the $4,000 barrier. Remaining hopeful, Hayes suggests that Bitcoin could potentially reach $100,000 in the future.

He believes that as Bitcoin rises, other major crypto assets will follow suit. Hayes specifically mentioned Solana (SOL), predicting it could soar 75% to reach $250, just shy of its all-time high.

According to Francesco Madonna, CEO of BitVaulty, he shares the belief that the present market conditions are indicative of a forthcoming extended period of growth or bull market.

Over the last ten years, Madonna noticed a recurring trend: when there’s an atmosphere of doubt or sudden cash infusions, gold often takes the lead because it is considered a secure investment.

Lately, gold has hit an unprecedented peak, and Madonna sees this as a sign that the bull phase for risky investments like Bitcoin might be getting underway.

2/3 Gold, symbolized as #Gld, has recently hit a new all-time high (ATH). Over the past decade, it’s been observed that gold tends to advance ahead in times of uncertainty or immediate liquidity infusions, given its reputation as a safe haven asset.

— Francesco Madonna (@CiccioMadonna) August 17, 2024

Madonna notes that when gold reaches its maximum, it’s often followed by a rise in the Nasdaq and Bitcoin, particularly when market liquidity becomes steady and investors look for greater yields from growth-oriented assets.

Since gold has reached its maximum value, Madonna speculates that Bitcoin’s current stabilization near $60,000 might be a prelude to a more significant surge, with $74,000 serving as a teaser and $250,000 being a possible future attainment.

For the past ten years or so, the pattern of gold serving as a precursor to shifts in liquidity has persisted. The recent all-time high that gold reached suggests that a bull market is now underway. Reaching 74k was merely a starter, with Bitcoin potentially reaching 250k!

— Francesco Madonna (@CiccioMadonna) August 17, 2024

According to Coutts’ latest statement, our credit-driven banking system operates on the principle that increasing the money supply is an inherent part of its functioning.

If this enlargement doesn’t occur, the system might face a breakdown. The analyst proposes that this continuous expansion in the money supply could serve as the trigger for Bitcoin, along with other rising and high-risk assets, to enter their next significant growth phase – a new major bull market.

Due to significant amounts of money being pumped into the economy by countries like the U.S. and China, along with other major economies, there’s a strong possibility that the desire for Bitcoin will grow as investors look for investment options that surpass conventional returns.

If the current trends in market liquidity persist, there’s a strong possibility that Bitcoin may soon experience another significant surge. This upward movement might even propel it beyond its former record high, establishing new milestones.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2024-08-20 03:29