As a seasoned crypto investor with several years of experience under my belt, I find the recent analysis from CryptoQuant and Kaiko both intriguing and concerning. The recovering Bitcoin price following the U.S. inflation news was a welcome sight, but the fact that short-term holders are experiencing unrealized losses and miners’ profitability is at an all-time low is a cause for caution.

According to analysts at CryptoQuant, Bitcoin‘s expansion among large investors is noticeable but the expansion rate needs to increase for a durable and sustained rally.

Late on Wednesday, the cost of Bitcoin bounced back up to $66,000 after American inflation data came in lower than anticipated. This meant meager or no gains for Bitcoin traders looking to make a quick profit by selling.

As a researcher studying cryptocurrency trends, I recently came across an intriguing finding from blockchain analytics firm CryptoQuant. They reported that short-term Bitcoin holders are currently selling their Bitcoins with minimal or even no profit gained. However, it’s essential to note that this growth hasn’t intensified enough yet for the rally to become sustainable.

Traders currently face unrecovered losses on their holdings. Historically, such instances have preceded price bottoms in the market.

CryptoQuant

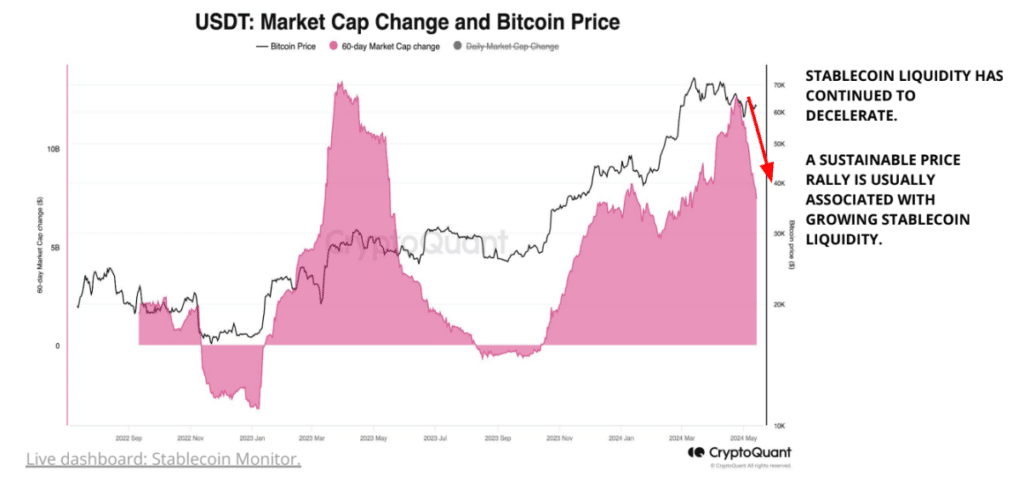

The report indicates that the Bitcoin inventory held by over-the-counter desks has remained constant since late April, implying a reduction in the amount of Bitcoin being introduced to the market via these platforms. Nevertheless, analysts issue a warning that despite this equilibrium, the expansion of stablecoin liquidity – a factor typically linked to robust Bitcoin price increases – is “slowing down” from a broader market standpoint.

As a researcher studying Bitcoin’s market dynamics, I’ve noticed an intriguing observation. Bitcoin’s current price seems relatively undervalued when considering miner profitability.

As a Bitcoin market analyst, I’ve noticed that current Bitcoin miners are experiencing significantly lower profits than before. In fact, their earnings have reached their lowest point since the market downturn in March 2020 – just after the initial shock of the COVID-19 pandemic.

CryptoQuant

Analysts at blockchain company Kaiko propose that Bitcoin’s recent halving could lead miners to sell their Bitcoins if prices don’t bounce back swiftly. The reason being, daily average transaction fees on the network, which surged post-halving, are now declining. Initially, these fees provided some respite for miners, according to Kaiko, but they’re decreasing once more as the initial fervor surrounding the Runes protocol has waned.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

2024-05-16 11:28