As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market cycles and trends. The recent rise in Avalanche (AVAX) has certainly caught my attention. While the token unlocks are generally negative for existing holders due to increased supply, it seems that some investors are taking advantage of this situation by exiting their stakes before the unlock, as evidenced by the surge in staking inflows after the recent unlock.

14th largest cryptocurrency, Avalanche, experienced a sixth straight daily increase following a substantial release of tokens.

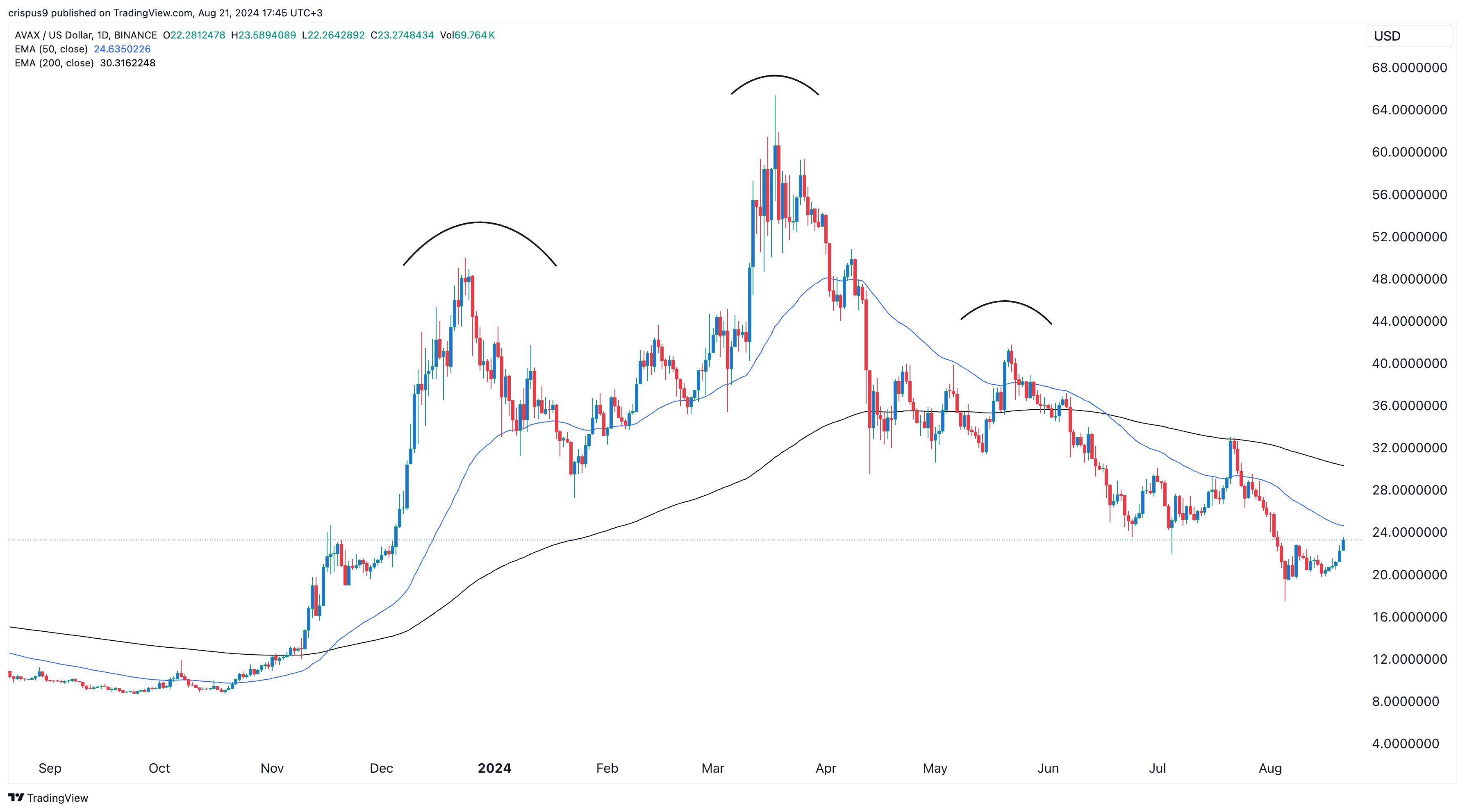

On August 21st, the AVAX token peaked at $23.25, marking its highest point since August 3rd, and representing a 32% increase from its lowest price recorded in August.

Avalanche’s staking yield retreats

The rise happened a day after the network unlocked 9.5 million AVAX tokens worth over $202 million. The next unlock will occur on Nov. 18 this year.

Users who possess Avalanche tokens can anticipate further releases over the coming years, given that only about 64% of the total supply has been released so far. By August 2029, an additional 255 million tokens are scheduled to be made available.

Token unlocks tend to be disadvantageous for current token holders as they boost the supply of coins in circulation. Additionally, they affect staking returns because some of these tokens are directed towards staking pools.

According to StakingRewards’ data, the return on staking AVAX has been decreasing over the past few weeks and is approaching a low not seen in months. On August 21st, it dropped to 7.93%, which was down from 7.97% on July 21st.

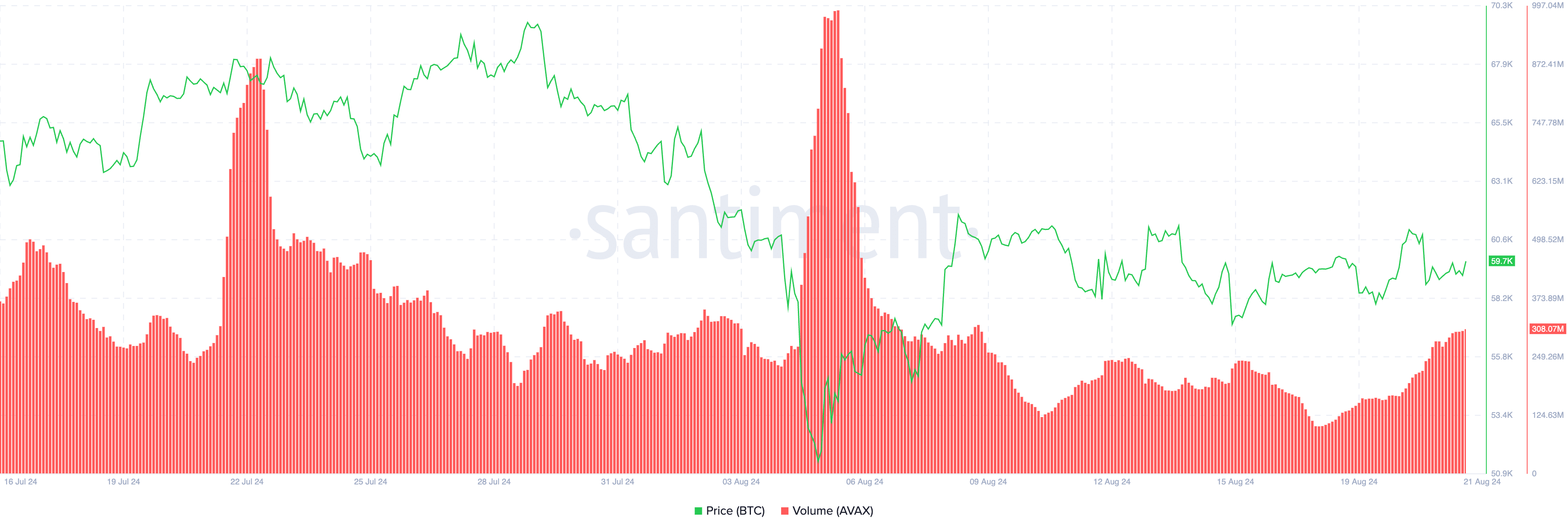

After the token unlock on August 20th, it appears that the number of staked assets increased, suggesting that some investors may have resumed their stake investments following the event. Prior to this, for six consecutive days, there had been a decrease in inflows, possibly indicating that certain investors chose to liquidate their stakes before the token unlock.

After Santiment’s data indicated a significant increase in day-to-day trading volume reaching approximately 309 million (highest since August 7), Avalanche’s token experienced an upward trend as well.

AVAX price formed a death cross and a head and shoulders pattern

As someone who has been actively monitoring the cryptocurrency market for several years now, I have to say that Avalanche has faced significant challenges this year. The token’s steep decline of over 64% from its peak in March is a stark reminder of the volatility that characterizes this rapidly evolving sector.

As an analyst, I’ve observed a persistent decline in Avalanche’s dominance within the Decentralized Finance (DeFi) sector. According to DefiLlama, the total value locked on the platform has diminished to approximately $882 million, positioning it as the ninth largest player in the industry.

Recently, emerging networks such as Basis and Arbitrum (ARB) have surpassed Avalanche in terms of their accumulated assets, with a total value of $1.49 billion for Basis and $2.68 billion for Arbitrum.

Other similar networks have surpassed it when it comes to trading volumes on decentralized exchanges. In the past week, its volume was approximately $421 million, but Arbitrum’s reached an impressive $3.7 billion, and Base recorded a weekly volume of around $3.18 billion.

One possible explanation for this could be that while meme coins such as Coq Inu (COQ), Kimbo, and Gecko Inu on Avalanche haven’t garnered significant popularity like Solana-based tokens such as Dogwifhat (WIF) and Bonk (BONK). The latter have managed to increase their market presence instead.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2024-08-21 18:41