As a seasoned researcher with years of experience navigating the volatile world of cryptocurrencies, I find myself both intrigued and cautious when analyzing the recent market trends. Last week’s correction, resulting in a $190 billion loss, has certainly shaken the market but also provided us with some interesting insights into the performance of various assets.

Over the past week, the overall value of the cryptocurrency market dropped by approximately $190 billion due to a significant correction, leaving the total global cryptocurrency market capitalization at around $2.07 trillion by the close of trading on Friday.

Here are some standout traders from the previous week, highlighted by their impactful market movements and general investor interest.

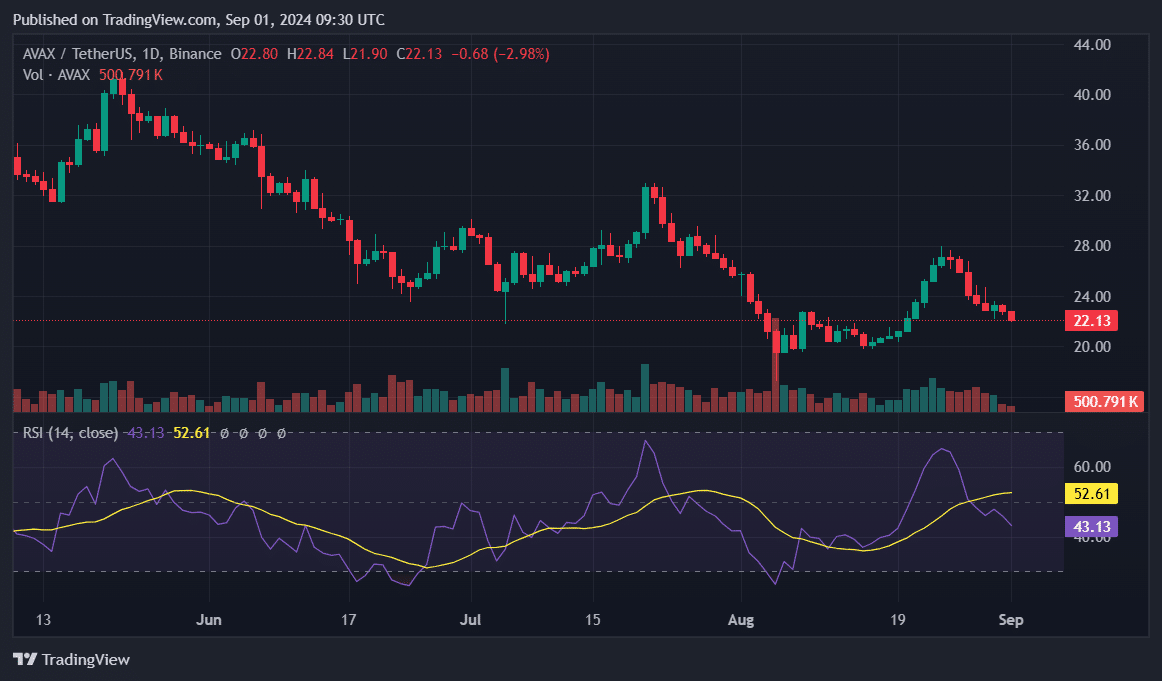

AVAX records six losing candles

Over the past week, Avalanche’s (AVAX) value saw a substantial drop, ending the week at $22.81 after shedding approximately 15.8%. For six out of the seven days, the asset exhibited a downward trend, resulting in losses on those days.

Although the overall trend appears to be declining, there’s been a minor upward shift in the RSI-driven moving average, hinting at potential stability. Additionally, the volume is slowly diminishing, which might suggest that the ongoing bearish phase may be nearing its end.

In the approaching days, it’s worthwhile keeping an eye on a few important aspects. Notably, the recent dip around $22 could potentially serve as a supportive level if the downward pressure on Avalanche persists.

Currently, if AVAX manages to rise above $24, it may indicate a change in investor sentiment. Yet, the direction of AVAX could significantly rely on the robustness of the overall cryptocurrency market, as its recent string of losses was influenced by market-wide trends.

MATIC collapses 26% in a week

Polygon (MATIC) fell sharply by 26.5%, closing last week at $0.4196.

Following a candlestick pattern known as a “bearish engulfing” on August 25, the disappointing performance can be interpreted as the sellers having gained significant control over the market. This type of candlestick indicates a potential shift in market sentiment towards bearishness.

Despite an increase in network activity, Polygon experienced seven consecutive losing days. On August 25, it dipped beneath the upper Bollinger Band, and by August 28, it had fallen below the middle band as well. Yet, it continues to stay above the lower band.

Based on my extensive experience in trading and technical analysis, I believe this pattern indicates that the asset is in a clear downtrend but hasn’t yet reached oversold levels. In the coming days, I would keep a close eye on the lower Bollinger Band around $0.3510 as it could potentially act as support if the bearish trend continues. This is a common occurrence in market trends, and I have found that understanding these patterns can help me make more informed trading decisions.

A break below this level could signal further declines.

However, a move above the middle band near $0.4568 might suggest a recovery.

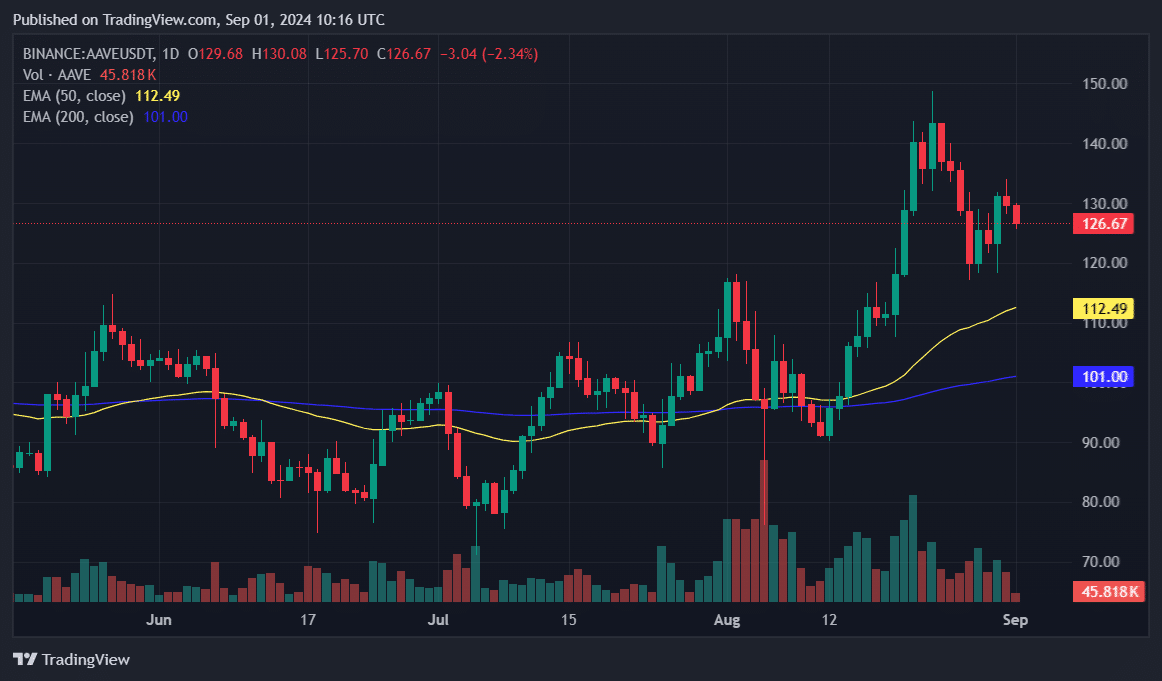

AAVE demonstrates resilience

Last week, Aave (AAVE) showed resilience, ending with a more moderate 5.37% decline to $129.71. In contrast to many other assets, Aave managed to steer clear of establishing new lows, thanks to two days marked by significant growth.

Regardless of the downward trend, the value stayed above its 50-day and 200-day moving averages at $112.50 and $101 respectively. This implies a generally optimistic perspective for the asset in the intermediate and long run.

This position indicates that AAVE is currently in a stronger technical position compared to many other assets. However, the 50-day EMA around $112.50 is worthy of note in the coming days.

Dropping below this point might indicate a change in attitudes. On the other hand, going beyond $130 may imply increased purchasing enthusiasm.

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Gold Rate Forecast

- Silver Rate Forecast

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- USD CNY PREDICTION

- Gods & Demons codes (January 2025)

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Every Upcoming Zac Efron Movie And TV Show

- Maiden Academy tier list

2024-09-01 18:06