The current drop in AXL‘s value doesn’t seem to be slowing down, as data from the blockchain suggests tougher times may lie ahead for this cryptocurrency.

At the moment, Axelar – a versatile blockchain interoperability system identified by the symbol AXL – experienced a continuous decline over three days, ending at $0.6152. This drop in value has led to a decrease in its total market capitalization to approximately $552 million. Since December 16th, this digital currency has been on a downward trend, causing its price to plummet by around 40%. Over the past month, it has seen losses of about 27.8%.

Multiple indicators based on blockchain activity hint at potential further declines for the asset within the next few days.

Significantly, the total value locked in Axelar’s DeFi ecosystem has experienced a substantial decrease over the past month. Specifically, the TVL dropped from $367 million to $254 million as of today, according to data from DeFiLlama. This decline suggests less user engagement and potential waning investor trust.

Furthermore, it’s been observed that AXL traders have been transferring their assets to trading platforms more frequently over the last week, based on information from CoinGlass. This surge in exchange transfers might signal a potential price adjustment in the near future. The increased activity could be due to either declining faith in the project or a desire to invest in other ventures.

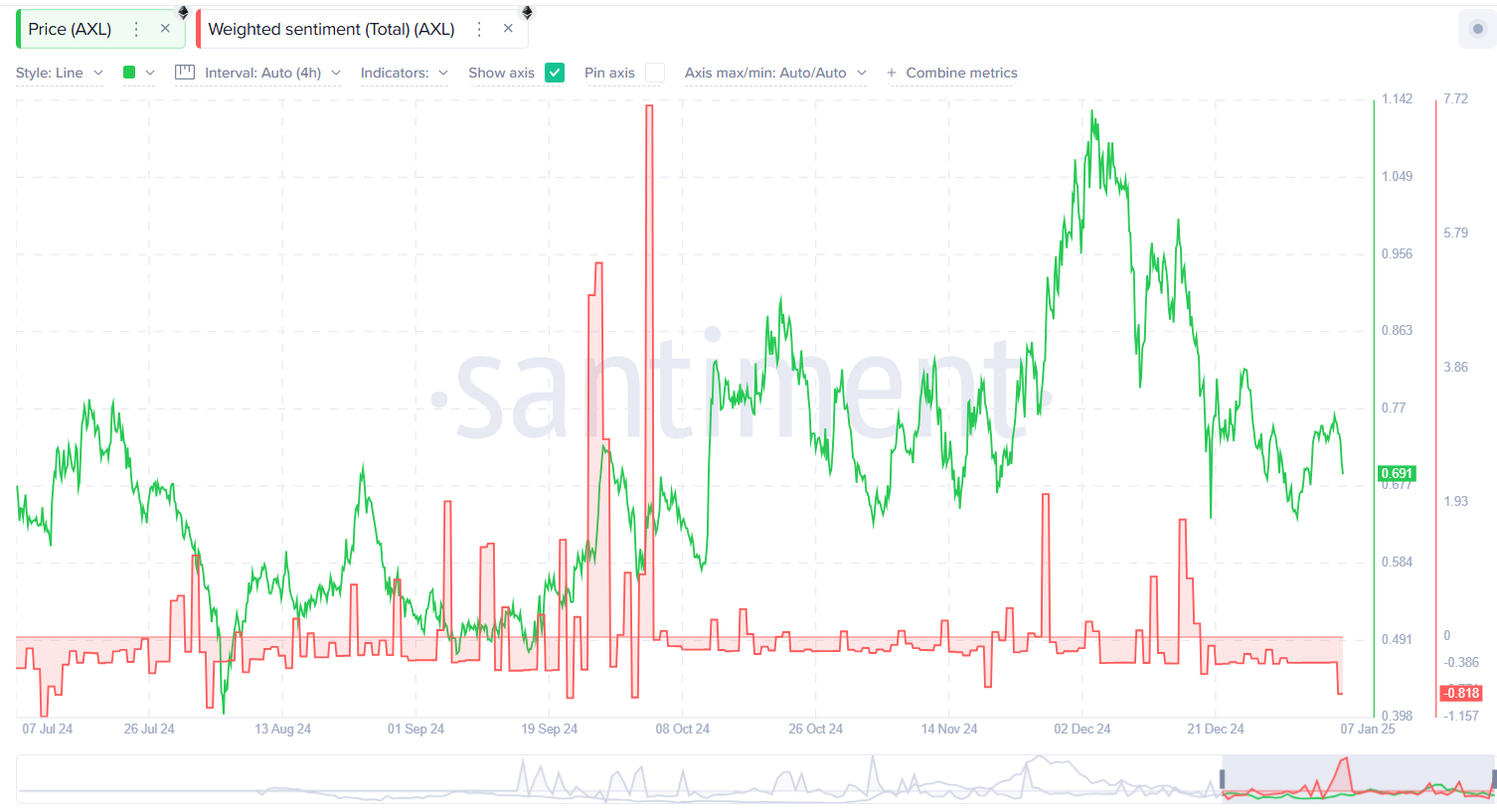

The general feeling towards the altcoin has become more negative, as indicated by a weighted sentiment of -0.818, suggesting that there is growing skepticism amongst traders.

Over the past five days, there’s been a significant decrease in demand for trading derivatives of altcoins, as indicated by CoinGlass data. The open interest in AXL futures, which stood at $19.9 million on Dec. 4, has now dropped to approximately $10.44 million as we speak.

A key reason for AXL’s current downturn is the widespread pessimistic attitude, fueled by the Federal Reserve’s aggressive stance on interest rate increases and the surge of U.S. bond yields. This uncertainty has affected both traditional and cryptocurrency markets. Additionally, Bitcoin‘s (BTC) recent dip below $100,000 has exacerbated losses in the altcoin market, where fluctuations and potential risks are often more significant.

Bearish technicals

Looking at the one-day AXL/USD price chart, the Moving Average Convergence Divergence (MACD) indicated a potential short-term bearish reversal. Specifically, the MACD line (blue) dropped beneath the signal line (orange). Additionally, the direction of both the oscillator’s lines was downwards, and at the current moment, the Supertrend line hovered above the price, supporting this bearish outlook.

Furthermore, the Chaikin Money Flow Index registered a value of -0.11, suggesting a moderate level of bearishness since transactions involving selling were somewhat more prevalent than those involving buying in the market.

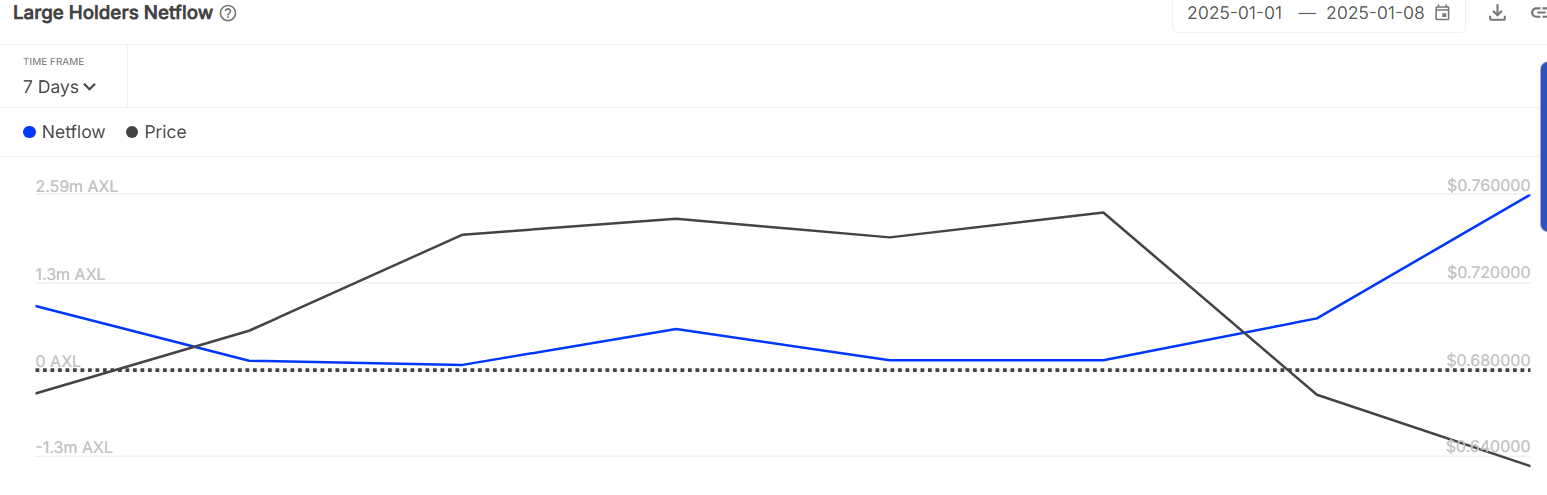

In a potential turn of events, the token might see some respite since there’s growing attention from whales towards AXL at its current price points. Over the period between January 6th and January 8th, the inflow of whale wallet tokens surged from 128,480 to a significant 2.59 million. Given that whale investments are frequently seen as a positive sign, retail investors might consider following this trend.

Furthermore, the value of the altcoin might increase if Bitcoin experiences a significant recovery from its recent declines prior to President-elect Donald Trump’s inauguration in late January.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-01-09 14:16