As a seasoned analyst with over two decades of experience in financial markets, I must say that Beam’s performance over the past few days has caught my attention. Having witnessed numerous market cycles and trends, I can confidently say that Beam’s rise is reminiscent of some bullish runs we’ve seen in traditional stocks.

On October 23rd, while other cryptocurrencies in the top 100 were experiencing a downturn, BEAM stood out with a 7.4% increase, making it the top performer of the day.

For five straight days, BEAM’s price surged to reach an intraday high of $0.0198, representing a 27% increase from its week’s lowest point. This significant rise propelled the cryptocurrency’s market capitalization above the $1 billion threshold. Furthermore, its daily trading volume soared over $101.8 million, marking a substantial 161% increase compared to the previous day’s figures.

As Beam’s popularity grew, so did the number of future contracts being held open by traders on various platforms, reaching a three-month peak of $11.87 million on CoinGlass – an increase from the $3.54 million low seen on September 8th. This surge in open interest indicates heightened trader engagement and could potentially strengthen the existing upward trend, which is generally considered positive or bullish in financial terms.

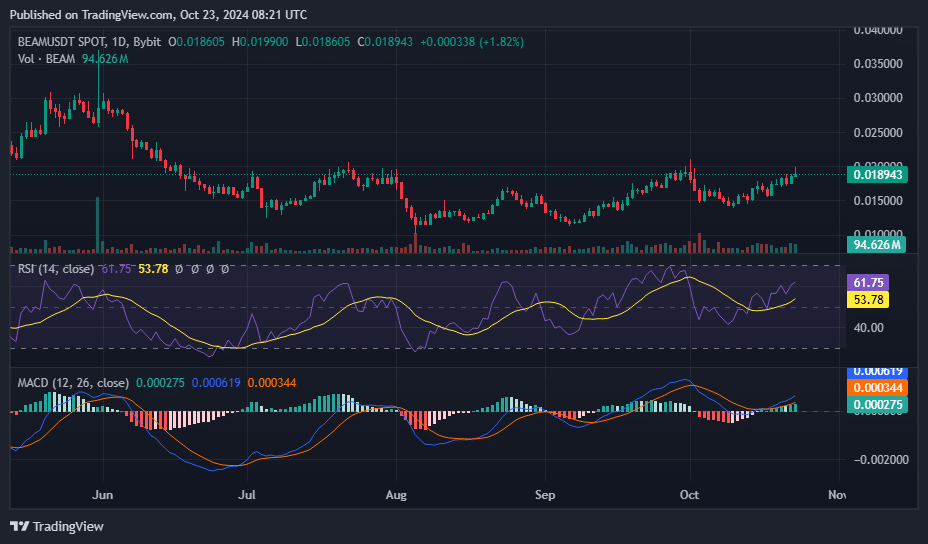

On the Beam (BEAM) to Tether (USDT) price graph, Beam was trading above both its 50-day and 100-day Exponential Moving Averages, suggesting that a brief period of upward price movement, or a short-term bullish phase, is likely to persist.

The Line for Relative Strength Index (RSI) has significantly increased to around 62, suggesting robust bullish energy. A favorable difference between the RSI’s pattern and price movements implies that the market might be witnessing an intensifying uptrend, potentially leading to more gains ahead.

At the same time, the Moving Average Convergence Divergence (MACD) is showing positive bars and its line has crossed above the signal line. This suggests a strong buying trend, implying that buyers are accumulating stocks, which increases the possibility of continuous price growth in the near and mid-term.

Although the exact reason behind Beam’s recent surge remains unclear, an analyst pointed out that the cryptocurrency has broken free from a downward accumulation channel it had been stuck in since March. In terms of technical analysis, this breakout could indicate a potential shift in trend, lending support to the optimistic outlook for Beam.

If BEAM can successfully breach its resistance point at $0.020, a point it’s previously been unable to overcome since July, this could initiate a robust uptrend, potentially resulting in a significant price rise, or as Mister Crypto puts it, a potential “price surge.

It seems that significant investors of BEAM cryptocurrency are reducing their positions. As per IntoTheBlock’s data, they accumulated approximately 3.49 billion tokens valued at $63.5 million on June 18. However, the current value has dropped significantly to around $1 million. Since whales own over 73.9% of the total BEAM supply, this substantial decrease in purchases might amplify downward trends if these investors opt to offload their assets.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2024-10-23 13:04