As an experienced analyst, I’ve closely monitored the cryptocurrency market for years, and I’ve seen my fair share of ups and downs in various coins’ prices. The recent crash of Beercoin, a popular Solana meme coin, is concerning to me.

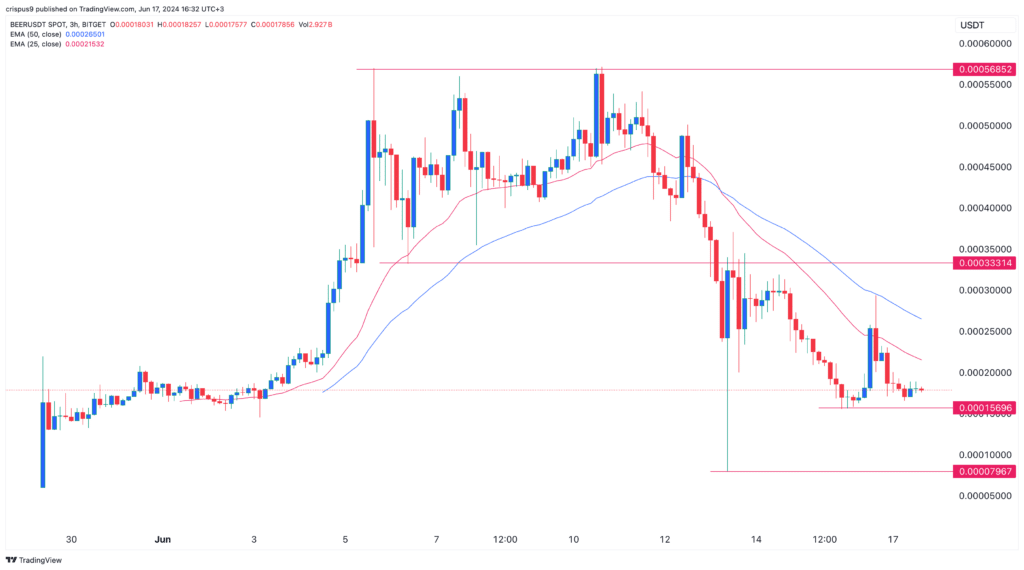

The well-liked meme coin based on the Solana blockchain, Beercoin, has experienced a significant decline in value lately. Following a high of $0.00057 this month, its price has dropped by more than 68%, now trading at $0.00018. Consequently, its market capitalization has fallen below $100 million, a substantial decrease from its peak value of $282 million.

As a crypto market analyst, I’ve observed that Beercoin’s token value decline aligns with the current downturn affecting the cryptocurrency sector. Yesterday, Bitcoin dipped below the $66,000 mark, while the majority of altcoins experienced a drop of more than 10% within the last 24 hours.

As a crypto investor, I’ve noticed a significant sell-off in the market lately. One possible explanation for this could be last week’s Federal Reserve decision. The officials there signaled that they only intend to make one interest rate cut this year. Given inflation’s persistent refusal to budge, many analysts now predict that the Fed won’t reduce rates at all in 2023. So, I believe that investors are responding to this news by selling off their crypto holdings, perhaps in anticipation of further market volatility.

It’s widely believed that meme cryptocurrencies such as Beercoin will perform poorly when the Federal Reserve takes a very aggressive stance, known as being “extremely hawkish.” Additionally, the value of Beercoin is currently declining due to large transactions by some of its major holders. According to data from LookOnChain, an insider disposed of over 5.4 billion tokens of this digital currency just last Sunday.

The “beercoin” team’s associated wallet sold a staggering $5.43 billion worth of $BEER tokens for approximately $1.13 million! We were able to track down that this wallet originally obtained the $BEER tokens from the team wallet with the addresses “7yfvQX…o9v394” and “8VY4LF…fDd5G2”.— Lookonchain (@lookonchain) June 16, 2024

As an analyst, I’ve uncovered some intriguing insights regarding recent transactions in the token market. On the same day, another insider joined me in selling a substantial amount of tokens worth approximately $5 billion, which equates to around $1.08 million. Simultaneously, on Friday, a pre-sale participant cashed out their profits from selling the $BEER token, amounting to a significant sum of $1.3 million. Notably, during this period, the official X account actively promoted the token on various platforms.

As an analyst, I would express it this way: Among the various warning signs in the investment world, insider sales stand out as particularly noteworthy. Given that insiders possess a deeper understanding of their companies, sales by them can signal potential concerns.

Beercoin price forecast

In my previous prediction, I maintained a balanced perspective regarding the BEER coin and issued a cautionary note, as some investors might consider cashing out their holdings, potentially leading to a price decline.

Three hours ago, the Beercoin token reached a peak price of $0.00056 on its chart. However, since then, it has experienced a substantial decline, dropping by more than 50% in value. This downturn became apparent following considerable insider selling activity last week.

The price of the coin has dipped below its crucial support level at $0.00033, marking its lowest point on June 6th. Additionally, it has stayed beneath both its 25-day and 50-day moving averages. The coin has, however, discovered a robust support at $0.000015.

Based on current market trends, it’s anticipated that Beercoin’s price may experience a bearish breakdown. Sellers are expected to push the price down towards the significant support level at $0.000080, which was the lowest point on June 13th.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-06-17 16:58