Uncover the five leading crypto Exchange-Traded Funds (ETFs) worth monitoring in the year 2024. Gain a comprehensive understanding of their track records, trading volumes, and shrewdly select among them in an ever-evolving market landscape.

Following the SEC’s approval of Bitcoin spot ETFs on January 10, 2024, the cryptocurrency market experienced a notable surge. Consequently, Bitcoin’s price reached an impressive 201% increase compared to the previous year, surpassing earlier record highs.

In the hunt for the most profitable cryptocurrency ETF to invest in during 2024, a significant query surfaces: Which of the leading crypto ETFs has delivered the strongest returns so far, and is there potential for it to maintain this impressive growth trajectory?

As a thorough analyst, I’d like to share with you my findings on the five leading crypto Exchange-Traded Funds (ETFs) currently available in the market. My intention is to help you navigate this dynamic landscape and identify the most promising and top-performing funds. However, it’s crucial to remember that this information should not be considered financial advice. I strongly encourage each investor to conduct their own research and consult with professionals before making any investment decisions related to crypto.

Table of Contents

What is a cryptocurrency ETF?

As a researcher studying investment vehicles, I can explain that a cryptocurrency Exchange-Traded Fund (ETF) functions as an investment instrument that mirrors the price movements of specific cryptographic assets. By investing in a cryptocurrency ETF, you’re essentially gaining exposure to the underlying digital currencies without having to directly manage or own them.

As a researcher investigating crypto Exchange-Traded Funds (ETFs), I would describe them as investment vehicles that function in a manner akin to traditional ETFs. Instead of owning shares of stocks or commodities directly, investors purchase units of these crypto ETFs. The value of these units is tied to the price movements within the cryptocurrency market. Essentially, an investor’s profit or loss depends on the performance of the underlying digital assets held by the fund.

Investor interest in the idea of blockchain Exchange-Traded Funds (ETFs) has surged, as they seek reliable and established investment options in the marketplace. These funds are instrumental in promoting the broader acceptance of cryptocurrencies by overcoming several obstacles that have hindered their mainstream adoption.

Bitcoin and Ethereum (ETH) are currently the most widely used cryptocurrencies in exchange-traded funds (ETFs). The Securities and Exchange Commission (SEC) granting approval for spot Bitcoin ETFs has expanded access to these digital assets, making them more accessible and adding legitimacy as valuable investment alternatives.

Top 5 crypto ETFs

As a crypto investor, I understand that choosing a cryptocurrency Exchange-Traded Fund (ETF) involves extra caution. I delve deep into chart analysis and apply elements of the CAN SLIM method created by William J. O’Neal to unearth the most promising tokens within the fund.

As an analyst, I would advise focusing on Exchange-Traded Funds (ETFs) with a substantial market capitalization and significant daily average trading volume. These characteristics suggest a healthy and liquid ETF. In the context of crypto investments, it is often suggested to consider well-established ETFs that track leading cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). Their consistent growth and adoption rates make them attractive options for potential investors.

The cost of a cryptocurrency ETF is influenced by numerous variables. These factors include changes in supply and the discovery of new applications, each affecting its returns uniquely. It’s essential for investors to assess market trends accurately since even top-performing stocks may underperform during a bearish market.

As a cryptocurrency market analyst, I want to share some insights with you. While the current market trend exhibits optimism, it’s crucial for investors not to overlook the ongoing concerns about potential recession risks and high inflation. Keeping these factors in mind, I’d like to draw your attention to some top-performing crypto ETFs that have been generating considerable interest among investors as we move through the year: [

ProShares Bitcoin Strategy ETF (BITO)

As a researcher studying the crypto exchange-traded fund (ETF) market, I would recommend considering the ProShares Bitcoin Strategy ETF (BITO) for investment. This particular ETF holds the distinction of being the first Bitcoin-based ETF available in the United States. Additionally, it boasts impressive liquidity within its category at the current moment.

With a higher expense ratio of 0.95% over the past quarter, BITO has averaged approximately 18 million in daily trading volume as reported by VettaFi, positioning it as an attractive option for crypto ETF investors looking for ample liquidity.

As an analyst, I’d highlight that BITO currently manages assets worth $2.04 billion and has achieved a remarkable YTD return of 51.66%. These impressive figures underscore its effectiveness in navigating the volatile crypto market. Given these attributes, it seems plausible for BITO to secure a position among the preferred crypto ETFs for numerous investors.

iShares Bitcoin Trust (IBIT)

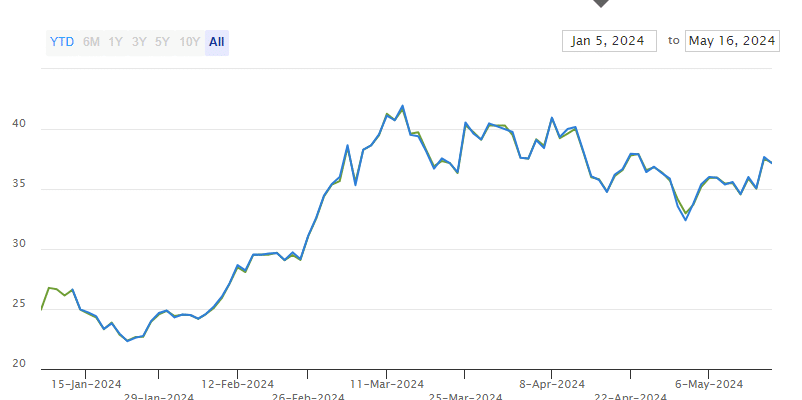

In 2024, the iShares Bitcoin Trust ETF managed by BlackRock (IBIT) has emerged as a noteworthy crypto ETF worth monitoring. Introduced at the beginning of the year, IBIT offers investors an opportunity to purchase Bitcoin (BTC) using standard brokerage accounts. This combination of cryptocurrency’s appeal and traditional investment vehicles makes IBIT an intriguing choice for those seeking to diversify their portfolios.

With an impressive asset under management (AUM) of $16.5 billion, this fund has experienced remarkable growth and established new records in the exchange-traded fund (ETF) sector in a brief period.

Within a few weeks of its launch, the asset base under management had already exceeded $10 billion, demonstrating strong demand and the robust growth of the cryptocurrency ETF sector.

As a researcher studying the financial performance of IBIT, I found a particularly noteworthy week in February. During this time, IBIT successfully attracted an impressive $3.3 billion in fund inflows. This surge was fueled by a concurrent increase in Bitcoin prices and heightened investor interest.

To begin with, BlackRock reduced its fees from 0.25% to 0.12% temporarily, making its expense ratio more attractive for investors. This fee reduction, combined with its vast assets under management (AUM), increases the case for including IBIT in the crypto ETF shortlist for 2024. By offering a combination of substantial growth prospects and cost savings, BlackRock’s move appeals to those considering crypto investments.

Grayscale Bitcoin Investment Trust (GBTC)

As a researcher studying the evolution of Bitcoin investments, I would describe the Grayscale Bitcoin Trust (GBTC), which debuted in 2013, as having pioneered a unique role in the Bitcoin investment landscape by providing investors with the chance to trade Bitcoin over-the-counter.

In January 2024, the transformation of this entity experienced a major milestone when it was endorsed by the SEC to be listed as a Bitcoin Exchange-Traded Fund (ETF). This pivotal event signified a substantial advancement in its development and fortified its role within the crypto investment sphere.

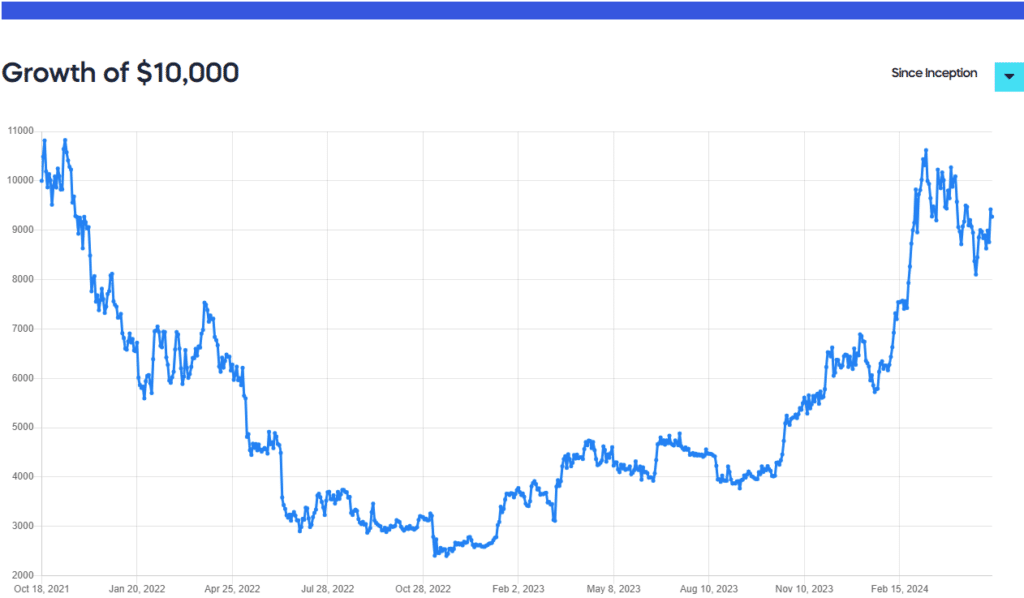

Significantly, the ETF stands out as one of the best-performing assets this year with a yield of 67.59% as of the latest data from Yahoo Finance, and an impressive one-year daily return of 317.61%.

As a researcher studying exchange-traded funds (ETFs), I’ve come across GBTC – a notable player in the market due to its impressive performance and high liquidity. With an average daily trading volume of approximately 16 million shares, this fund stands out from its peers. Additionally, GBTC manages an enormous asset under management (AUM) of over $18.82 billion, making it one of the largest in its class.

As an analyst, I would say: Although GBTC’s annual management fee of 1.5% is more than some other crypto ETFs on the market, its exceptional performance metrics and high liquidity position it as a top choice for buying a crypto ETF at this time.

As an analyst, I would express it this way: With its substantial assets under management (AUM) and impressive performance metrics, this trust clearly demonstrates its forward-thinking approach to facilitating Bitcoin investments. This commitment to providing a solid foundation for entering the crypto market instills confidence in investors looking for a reliable and established option.

Fidelity Wise Origin Bitcoin Fund (FBTC)

As a crypto investor, I’ve noticed that while some asset managers like Vanguard have been hesitant to jump into the crypto bandwagon, Fidelity Investments has boldly embraced the revolution. Instead of sitting on the sidelines, they took the lead by launching their own Bitcoin Exchange-Traded Fund (ETF), named FBTC. And what sets Fidelity apart is their commitment to making it easily accessible and tradable on their platform for investors like me.

This tactic closely resembled the triumph of BlackRock’s iShares Bitcoin Trust, resulting in substantial investments totaling over a billion dollars pouring into FBTC following its debut.

Fidelity’s announcement that it would lower the expense ratio to zero percent until August 1, 2024 was an attractive proposition for investors, given its current assets under management (AUM) totaling $9.71 billion.

The zero cost ratio and substantial assets it manages make FBTC an attractive choice and solidify its place on our top crypto ETF picks.

Bitwise Bitcoin Strategy Optimum Roll ETF (BITC)

In spite of having a smaller asset base and lower trading volume compared to other ETFs in its class, the Bitwise Bitcoin Strategy Optimum Roll ETF has been among the top performers in the alternative ETF segment during the year 2024, as indicated by VettaFi’s data.

Bitwise Asset Management’s crypto index fund, BITC, boasts a Year-to-Date (YTD) gain of 72.71%, placing it amongst the top performing crypto Exchange-Traded Funds (ETFs).

As a researcher studying exchange-traded funds (ETFs), I can tell you that one particular strategy I’ve come across focuses on capital appreciation in the Bitcoin market. This is achieved by managing exposure to Bitcoin futures contracts, which offer directional bets on the price of Bitcoin. Additionally, this strategy employs strategic analysis of the futures market to optimize potential roll returns – essentially seeking to maximize profits when rolling over expiring futures contracts with new ones.

As an analyst, I’ve observed that despite having a relatively small asset under management (AUM) of $4.5 million, BITC manages to generate impressive daily trading volumes averaging 13,144, and maintains a competitive expense ratio of 0.85%. These performance metrics underscore BITC’s ability to deliver solid results, making it an intriguing investment opportunity in my analysis.

How to find the best ETFs

As a diligent researcher seeking out the finest blockchain Exchange-Traded Funds (ETFs) for investors, I recommend focusing on several key factors. Firstly, evaluate strong performance and substantial trading volume to ensure ample liquidity and market interest. Secondly, consider whether you’d like exposure to the entire crypto market or specific digital coins. Lastly, don’t overlook the importance of low fees when selecting an ETF.

As a crypto investor, I would recommend focusing on Exchange-Traded Funds (ETFs) that exhibit substantial daily trading volumes, preferably over 50,000 shares, to ensure liquidity. Additionally, it’s essential to consider those ETFs with impressive historical performance in major cryptocurrencies such as Bitcoin and Ethereum, to increase the chances of profitable investments.

As a researcher investigating exchange-traded funds (ETFs) in the cryptocurrency space, I would recommend selecting ETFs offered by established providers with assets exceeding $10 million. This approach could potentially minimize risks associated with investing in this volatile market. Nevertheless, it’s crucial to keep in mind the high volatility inherent in the cryptocurrency sector, which might negatively affect returns. Furthermore, be aware of management fees that could erode overall gains and note that currently, there are limited blockchain ETF options available, primarily focusing on major cryptocurrencies.

FAQ

Are crypto ETFs safe?

Caution is advised when considering investments in crypto ETFs due to their inherent risks. Firstly, cryptocurrencies are known for their extreme price swings, which can significantly impact the returns of these ETFs. Secondly, the regulatory landscape for crypto ETFs continues to develop, introducing an element of unpredictability. Lastly, expenses such as management fees and trading costs can diminish potential gains. Prospective investors are encouraged to delve into extensive research and possibly consult a financial advisor before making any decisions. Remember that every investment involves risks, and it’s crucial to assess whether crypto ETFs align with your financial objectives.

Are crypto ETFs a good investment?

As a crypto investor, I understand that blockchain ETFs can be an intriguing investment opportunity. However, it’s crucial to recognize that what works best for me may not apply to everyone else. The decision to invest in a blockchain ETF involves weighing its benefits against potential limitations. Factors such as my market knowledge and risk tolerance play significant roles in this assessment.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-05-20 22:49