Considering a long-term investment in cryptocurrencies? Explore our curated selection featuring top performers such as Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

Meme coins have gained significant traction and sparked interest in brief crypto investment opportunities, particularly among those seeking immediate returns. A recent analysis by CoinGecko revealed that meme coins led the way in profitability within the cryptocurrency market during Q1 of 2024. Notably, some well-known meme coins reportedly delivered impressive average gains surpassing 1312%.

While these cryptocurrencies carry a high risk of price fluctuations, potentially resulting in substantial losses, some cautious investors prefer to put their faith in comparatively stable digital assets for longer-term gains.

As an analyst, I would advise that not every cryptocurrency is destined for a long-term successful journey. To identify the most promising ones to invest in and hold, it’s essential to conduct thorough research on their fundamental aspects. This includes examining their underlying technology, the size of their developer and user communities, and evaluating their real-world applications or use cases within and beyond their respective ecosystems.

Furthermore, it’s essential to evaluate each crypto’s unique selling point and potential for sustained expansion and acceptance in the market. In this piece, we have carefully selected the top 5 cryptocurrencies based on these factors. Continue reading to discover which ones made our list.

Table of Contents

Bitcoin (BTC)

As a seasoned crypto investor, I can confidently affirm that including Bitcoin in your long-term investment portfolio is an intuitive decision. Being the first cryptocurrency to emerge on the scene, it boasts a rich history and a substantial market capitalization of over $1.3 trillion as of now. This represents approximately 53% of the total value of the crypto market.

According to the financial data from Curvo, Bitcoin has yielded more than 100% annual growth for over a decade. This asset stood out as one of the top performers worldwide between the years 2011 and 2023 based on market analyst Charlie Bilello’s findings.

Asset Class Returns since 2011…

— Charlie Bilello (@charliebilello) January 1, 2024

In January 2024, approval for bitcoin spot ETFs was granted, granting institutional investors entry into the cryptocurrency market and enhancing its reputation as a legitimate investment option.

An examination of Bitcoin’s historic price graph reveals that, amidst occasional declines, the digital currency’s worth has generally risen and presently trades at among the most elevated levels since its debut in 2009.

Bitcoin’s scarcity makes it an attractive option for investors aiming to buy and hold. The limited supply of only 21 million Bitcoins that will ever be in circulation increases its value. Scarcity often leads to higher prices, and with the potential for Bitcoin’s price to continue rising, some experts predict it could reach up to $1.5 million by 2030. (ARK Invest CEO Cathie Wood among them.)

The primary drawback of Bitcoin is that its blockchain isn’t designed to accommodate decentralized applications (dapps) or non-fungible tokens (NFTs). Consequently, this could hinder its versatility and potential applications, making it less competitive compared to other blockchains and digital currencies.

Ethereum (ETH)

As a crypto market analyst, I would emphasize that Ethereum ranks second in terms of market capitalization among cryptocurrencies, making it one of the five most significant assets to consider for long-term investment. Its potential lies in its versatile applications, a robust use case, and continuous advancements.

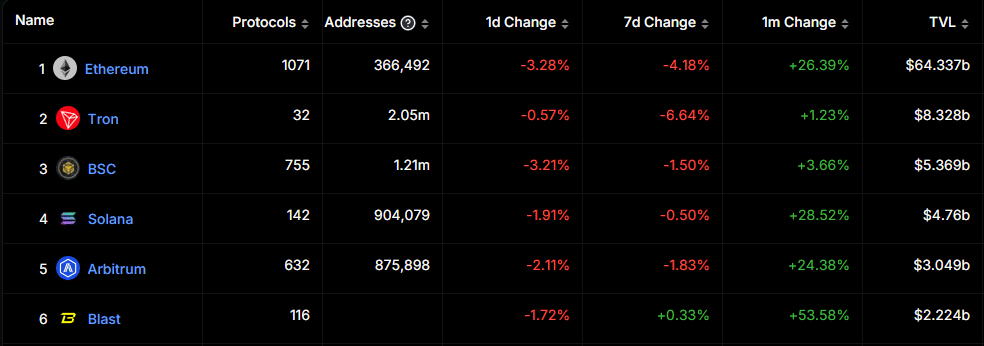

The current value of all assets secured on the blockchain surpasses $64 billion, which is almost triple the combined worth of its top five rivals.

Since its debut in 2014 at a meager price of $0.31, Ethereum’s value has experienced remarkable expansion. It reached an unprecedented peak in 2021, only to succumb to the crypto winter of 2022. However, the token regained momentum in 2023, achieving a yearly high of $2,120 in April.

The year 2024 has been quite robust, with Ether’s value approaching its record peak once more in March, hitting an impressive price of $4,067.

Based on information from CoinGecko, purchasing Ethereum one year ago and keeping it would have resulted in a roughly 100% return on your investment at present.

When pondering over the purchase and holding of Ethereum (ETH), it’s essential to take into account its long-term value proposition, which stands out in the cryptocurrency market. Ethereum plays a significant role in accommodating a substantial portion of the decentralized application (dApp) and decentralized finance (DeFi) domains. Moreover, some of the most intriguing crypto projects, such as Pepe (PEPE), Shiba Inu (SHIB), and Floki (FLOKI), utilize Ethereum’s ERC20 standard, making it an integral component within this dynamic ecosystem.

As a crypto investor, I believe Ethereum is a solid choice worth considering based on several reasons. Firstly, its decentralized nature and robust blockchain technology make it an attractive investment. Furthermore, the recent green light given by the SEC for Ethereum ETFs is a positive sign for the digital asset’s future growth. Taking all these factors into account, I think holding Ethereum in your portfolio could be a wise decision.

Best altcoins to hold

Solana (SOL)

Among the notable cryptocurrencies beyond Bitcoin and Ethereum, Solana is a strong contender worth considering. In the initial three months of 2024, this coin experienced remarkable expansion. Its value ranged from around $83 in January to surpassing $202 by April.

Having a market value exceeding $76 billion and averaging over $2 billion in daily trades, according to CoinGecko’s statistics, signifies robust investor faith in Solana.

With its capability to handle vast numbers of transactions at comparatively low costs and high speeds, reaching up to tens of thousands per second, the blockchain emerges as a formidable competitor in the realm of decentralized applications (dapps), decentralized finance protocols, and non-fungible tokens. It poses a significant challenge to Ethereum in these areas.

The increasing need for quicker and less costly transactions is fueling Solana’s popularity, with its user base anticipated to keep growing as new applications surface.

Although striving for top-notch security and transparency, Solana has experienced numerous network interruptions and performance complications, igniting doubts about its dependability. Furthermore, its link to Sam Bankman-Fried, the controversial founder of FTX, has tarnished its reputation and triggered a decline in its value.

Despite this, the value of the coin increased significantly over the past year. According to CoinGecko’s figures, an investor who purchased Solana (SOL) twelve months ago would have seen their investment grow by almost sevenfold at present.

Amongst all the blockchains, Solana holds the fourth-largest total value locked (TVL) with a thriving ecosystem worth approximately $230 billion, according to CoinMarketCap’s data. Moreover, Solana has brought forth innovative use cases like Solana Pay. This feature enables seamless connections between consumers and merchants directly on the blockchain, processing transactions using SOL or stablecoins, and delivering instant settlement with almost no fees.

As a blockchain analyst, I can tell you that the blockchain industry is expanding its presence in the mobile sector. In fact, last year saw the launch of the Saga, a revolutionary smartphone equipped with web3 technology. This innovation is designed to simplify user experience and provide easier access to decentralized applications, thereby attracting more individuals to the crypto world.

As a crypto investor, I’m excited about Solana’s current fundamentals and ongoing developments. Many experts, including those at VanEck, believe that Solana is one of the best coins to hold based on these factors. In fact, a report from October 2033 predicted an astonishing price rally of up to 10,600% for Solana by 2030. If this prediction comes true, we could see Solana’s price reaching around $3,200.

Chainlink (LINK)

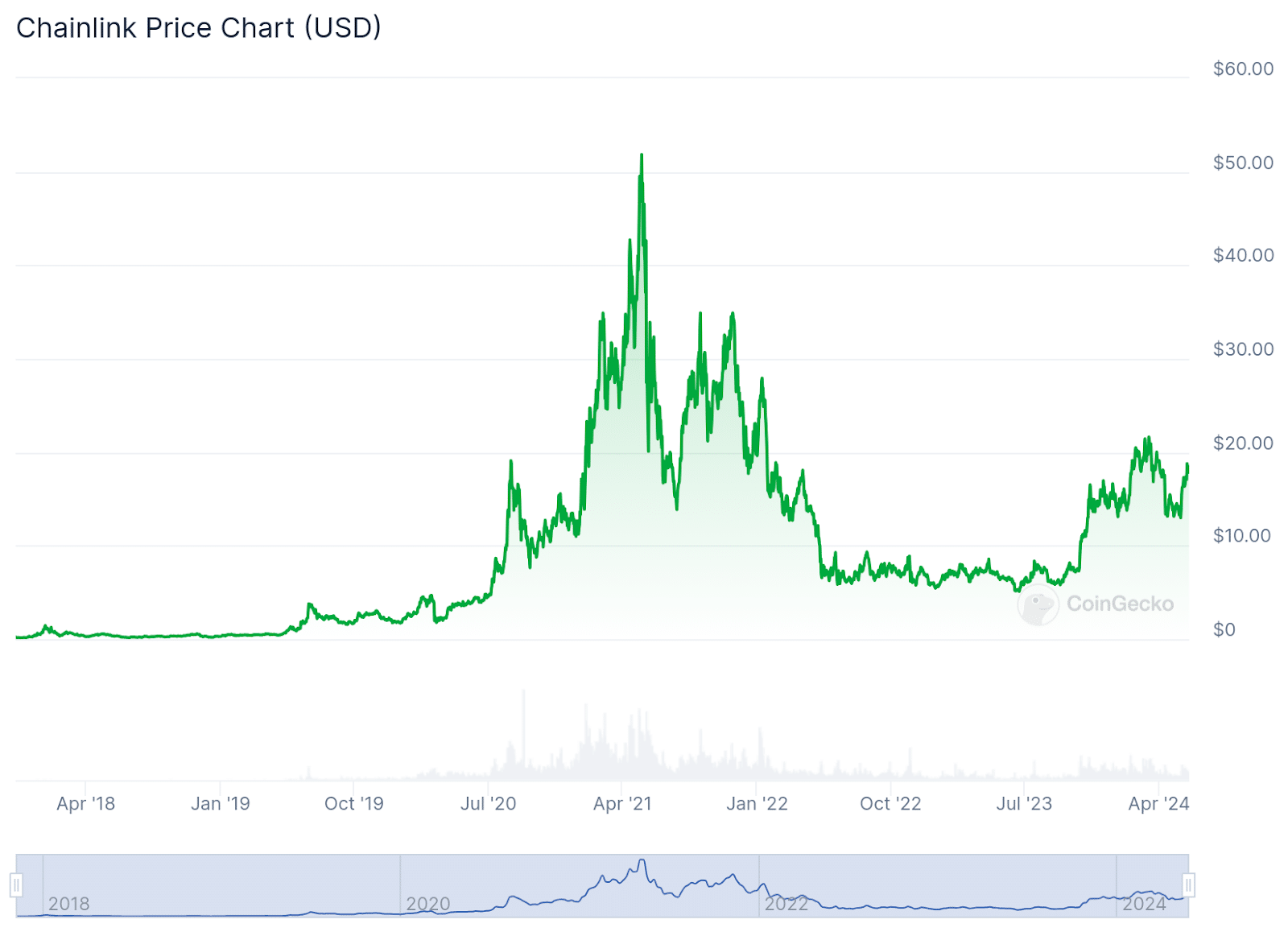

One potential cryptocurrency investment with long-term potential is Chainlink (LINK). This altcoin has experienced a remarkable surge since its humble start at $0.29, leading to a gain of approximately 4,790% from 2018 to 2023. To put it into perspective, the peak price of Chainlink reached an astounding $52.88, resulting in a mind-blowing increase of around 18,134%.

As I pen this down, the value of LINK stood at $17.99, accompanied by a noteworthy trading volume of $558.4 million per day. Despite being 65% below its all-time high price, it showcases a remarkable year-to-date growth of 178%, and a substantial gain of 38.7% over the past 30 days, as observed on May 31, 2024.

With a market capitalization of $10.7 billion, Chainlink showcases significant growth prospects. This may seem small next to Bitcoin’s towering $1.3 trillion valuation, but some believe that LINK‘s capabilities and uses could eventually surpass Bitcoin, which mainly serves as a decentralized asset for storage.

Although it can be difficult to foresee market trends given its unpredictability, Chainlink offers several significant advantages and groundbreaking features that may secure its role as a key player in the blockchain and DeFi sectors for the long term.

This network provides a connection between smart contracts on various blockchain systems and authentic, real-life data sources. Decentralizing the oracle function eradicates singular vulnerabilities, fortifying security through a dispersed system of nodes managed by multiple operators.

In the world of Decentralized Finance (DeFi), this platform plays a pivotal role by bringing real-world data into play for decentralized applications and smart contracts. Its usage is widespread and indispensable, contributing significantly to price feeds, lending systems, insurance solutions, among other essential elements within the DeFi landscape.

Furthermore, Chainlink has teamed up with Google Cloud, allowing for the integration of decentralized oracle services into Google’s cloud platform. This empowers smart contract creators to effortlessly add real-world data into their contracts.

Chainlink functions seamlessly with both the Tezos and Binance Smart Chains. On Tezos, Chainlink plays a crucial role by strengthening Tezos-built smart contracts through secure and dependable off-chain data and offering decentralized oracle solutions for projects within the BSC ecosystem.

“Another significant partnership for Chainlink that could strengthen its presence in mainstream financial services and shape its long-term future is the one it has with SWIFT. Their collaboration aims to link traditional banking systems with smart contracts via secure and dependable data feeds.”

Based on the information provided, it’s reasonable to believe that Chainlink has a solid foundation for a secure long-term future and could potentially be among the top altcoins to invest in.

Avalanche (AVAX)

Launched in 2020, Avalanche (AVAX) is a decentralized blockchain platform brought to life by software engineering pioneers Emin Gun Sirer, Kevin Sekniqi, and Maofan Yin. Equipped with the ability to support smart contracts, this innovative solution poses a significant competition to Ethereum.

In the last twelve months, AVAX has experienced a significant increase of more than 156%. This growth can be attributed to its strong market standing, sound foundational attributes, and impressive network performance, which frequently matches Ethereum’s top benchmarks.

As a researcher examining the current trends in the cryptocurrency market, I’ve observed an impressive upswing that has significantly impacted prominent players such as Bitcoin (BTC) and Ethereum (ETH). This market surge has also propelled the growth of lesser-known coins like Avalanche (AVAX).

In the thirteen-item ranking of cryptocurrencies based on market capitalization, AVAX stands out as a strong contender for investment. Various reasons support this viewpoint.

As an analyst, I’d rephrase it this way: I’ve noticed that this network has successfully formed alliances with well-known initiatives and businesses such as Chainlink, BiLira, and Biconomy. Consequently, the platform’s user base and developer community have grown significantly. Additionally, the blockchain is utilized in the burgeoning sector of GameFi, which combines online gaming with decentralized finance.

Collaborating with payment company Stripe, Avalanche aims to streamline the process of acquiring cryptocurrency for using dapps on their platform. This partnership, unveiled in April 2024, empowers users to purchase AVAX tokens directly via Stripe within the Core wallet – a native solution by Avalanche for wallet management and application portfolios. Industry experts believe this integration could significantly broaden Avalanche’s user base.

As a researcher examining the future developments of this network, I can see that it plans to roll out additional advancements and enhancements. These include increasing scalability by implementing subnets, broadening interoperability with various other blockchain platforms, and consistently refining user and developer experiences.

Although Ethereum is currently larger in scale, Avalanche’s potential for greater scalability could give it a competitive edge in the long run. If Ethereum were to postpone implementing speed and scaling improvements, then Avalanche might attract some business away from Ethereum, thereby expanding its own ecosystem.

As a crypto investor, I’ve closely observed the market trends and analyses of AVAX. Based on current predictions, this coin could potentially reach a price of up to $478 by 2030, making it an attractive choice for those seeking profitable long-term investments in cryptocurrencies.

Conclusion

The attraction of meme coins and their enormous price surges can be hard to resist. But, these investments carry significant risks and volatility. Therefore, for those looking for reliable long-term cryptocurrency holdings, it’s crucial to focus on coins with strong foundations, well-developed ecosystems, and clear applications.

Among the cryptocurrencies featured below, including trailblazers such as Bitcoin and Ethereum, as well as emerging contenders like Solana, Chainlink, and Avalanche, display noteworthy attributes that point towards substantial growth prospects in the long run.

As a researcher studying the cryptocurrency market, I strongly advise you to remember that my words should not be construed as financial guidance. Instead, I urge you to delve deeply into each crypto’s unique offerings and potential for growth before making an investment decision.

FAQ

What are the best crypto to hold for 5-10 years?

When pondering over long-term investments in cryptocurrencies, give preference to those boasting robust fundamentals and substantial use cases. Five noteworthy examples include Bitcoin, Ethereum, Solana, Chainlink, and Avalanche, which demonstrate the essential traits conducive to sustained growth and resilience. Nonetheless, it’s crucial to delve deeply into each option and assess your personal risk appetite before making an investment decision.

What is the best way to hold crypto?

Based on your preferences for security, convenience, and accessibility, the most effective method for managing crypto involves exploring different storage options. Some common choices include hardware wallets, software wallets, mobile wallets, paper wallets, and exchange wallets. For those prioritizing top-notch security, consider employing a combination of hardware wallets for long-term storage, and either software or mobile wallets for more frequent transactions.

Read More

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

2024-05-31 16:53