The cryptocurrency industry and the presidential election in the United States are interconnected in several ways. The possibility of the Securities and Exchange Commission (SEC) approving spot Ethereum Exchange Traded Funds (ETFs) is fueling optimism within the industry, as several companies have submitted updated documents to the SEC for approval. Additionally, former President Donald Trump’s decision to accept political donations in cryptocurrencies has added another layer of significance to the crypto community in the upcoming election.

With the U.S. elections drawing near, there are signs that Joe Biden’s stance on cryptocurrencies is becoming more lenient. What could be driving this shift, and what implications might it have for the crypto sector?

Events surrounding cryptocurrencies in the U.S. could indicate that President Joe Biden is looking to engage with the crypto sector. A shift in tone from his administration regarding cryptocurrencies might be imminent, moving away from their previously hostile stance. How will this impact the US crypto landscape?

Table of Contents

Voting to repeal SEC directive

Last week, I came across the news that the Senate passed a resolution repealing Staff Accounting Bulletin 121 (SAB 121) issued by the U.S. Securities and Exchange Commission (SEC). This SEC rule had significant implications for financial institutions dealing with cryptocurrency, as it provided guidelines on accounting standards.

One potential paraphrase for “SAB 121 establishes accounting guidelines for businesses managing clients’ cryptocurrencies; this legislation mandates that financial institutions categorize digital assets as liabilities and include them in their statement of financial position.”

According to the SEC, SAB 121 safeguards investors. Nevertheless, the crypto sector holds a contrasting perspective. In their viewpoint, these regulations might dissuade banks and financial institutions from collaborating with crypto businesses. Consequently, this could hinder the crypto industry’s expansion.

Supporters of the digital asset sector were thrilled with the outcome of the recent vote, going so far as to call it “breathtaking” or “impressive” according to the Blockchain Association’s representatives.

The Senate passed a bipartisan resolution with broad support today, aiming to rescind SAB121, an accounting directive issued by the Securities and Exchange Commission (SEC) in 2022 that has been criticized for stifling innovation.

— Blockchain Association (@BlockchainAssn) May 16, 2024

Notable is the connection the Blockchain Association has made between the Senate’s decision and the forthcoming US elections. It is speculated that this move by the current administration aims to garner support from the younger demographic.

As a crypto investor, I can’t help but feel frustrated when I hear about the potential for a presidential veto on legislation related to cryptocurrencies. However, this setback doesn’t negate the fact that there’s a rising consciousness among voters, particularly the younger generation, regarding the significance of cryptocurrencies in our modern economy. It’s essential that our elected officials pay attention and work towards creating regulations that protect investors while fostering innovation in this burgeoning industry.

Blockchain Association

FIT21

As a crypto investor, I’m keeping a close eye on the upcoming vote in the House of Representatives regarding the Financial Innovation and Technology for the 21st Century Act, or FIT21, also referred to as HR 4763. This legislation is designed to create a unified regulatory structure for digital assets within the US market.

One essential function of the law is to establish clear jurisdictions for the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). This differentiation is crucial since it decides whether digital assets fall under the category of securities or commodities.

Supporters of FIT21 contend that this legislation provides essential regulatory certainty, enabling the cryptocurrency sector to persistently function within the American market. By establishing clear regulations, they assert that trust from the public will be fostered, innovative products will be developed, and unacceptable practices will be held responsible.

Spot Ethereum ETFs

One potential reason for Biden adjusting his tone could be the persistent whispers regarding the imminent approval of Ethereum spot ETFs by the SEC. According to previous reports from Barron, unidentified sources suggest that the regulatory body is leaning towards approving these Ethereum ETFs.

The agency has asked potential issuers to update Form 19b-4 in filings to launch the funds.

As a researcher, I’ve come across an interesting development: According to my analysis of SEC filings, at least five companies have recently updated their documents with the regulatory body. Among these are Fidelity, VanEck, Invesco/Galaxy, ARK Invest/21Shares, and Franklin Templeton.

New development: Within the past quarter-hour, at least five Ethereum ETF applicants, including Fidelity, VanEck, Invesco/Galaxy, Ark/21Shares, and Franklin, have filed amended 19b-4 forms with CBOE.

— James Seyffart (@JSeyff) May 21, 2024

At the same time, the VanEck proposed Ethereum spot ETF named ETHV made it to the DTCC’s list of assets. Additionally, the Franklin Templeton ETF, referred to as EZET, was also included in the list.

According to Eric Balchunas, an analyst at Bloomberg for Exchange-Traded Funds (ETFs), he has revised his prediction concerning the potential approval of a spot Ethereum ETF. Now, he estimates the probability to be around 75%.

As a crypto investor, I’ve recently upgraded my confidence in the approval of the Ether ETF proposed by JSeyff and me. Previously, we had set the odds at 25%, but today I’ve picked up some encouraging signs. There are whispers circulating that the Securities and Exchange Commission (SEC) might be reconsidering their stance on this contentious issue, which had led many to assume a denial. Consequently, everyone, including us, is scrambling to keep up with the latest developments.

— Eric Balchunas (@EricBalchunas) May 20, 2024

It’s been rumored this afternoon that the Securities and Exchange Commission might change its stance on this contentious issue. As a result, many people, including us, who had presumed the outcome to be unfavorable are now scrambling to adjust our plans accordingly.

Eric Balchunas, Bloomberg ETF analyst

He and his colleague James Seyffart emerged as go-to authorities on Bitcoin ETFs that trade on the spot market, successfully forecasting their approval and debut in January. According to Seyffart, who endorses this perspective, the intelligence stems from multiple reliable sources.

The deadline for VanEck’s 19b-4 filing for an Ethereum ETF is May 23, while ARK Invest’s application, led by Cathie Wood, has a filing date of May 24. Notably, BlackRock’s submission process for an Ethereum ETF through Form 19b-4 begins on Aug. 7.

Biden’s main competitor began accepting payments in cryptocurrency

As an analyst, I’d rephrase it this way: A significant development in President Biden’s policy evolution could be the announcement by former Presidential Candidate Donald Trump that he will accept political donations in various cryptocurrencies, such as Bitcoin (BTC), Ethereum (ETH), Solana (SOL), USDC, XRP, Dogecoin (DOGE), Shiba Inu (SHIB), ApeCoin (APE), Bitcoin Cash (BCH), Dai (DAI), and Litecoin (LTC). This move could potentially influence Biden’s administration’s stance on cryptocurrencies.

Around two weeks ago, at a gathering for his NFT collection, I, as a crypto investor, heard the Republican candidate express his backing for our industry. He highlighted the contrast between his stance and that of the current Democratic administration led by President Joe Biden.

Trump has made another plea to the cryptocurrency world for their backing as he faces intense regulatory pressure from Biden’s supporters.

Elizabeth Warren, a surrogate for President Biden, has criticized cryptocurrencies, stating her intention to create a “counter-crypto movement” aimed at limiting the financial freedoms of Americans. In response, supporters of the MAGA (Make America Great Again) movement are developing their own crypto community, potentially tipping the scales in their favor come November 5th.

Donald Trump’s election website

Should the crypto community be taken into account?

As a cryptocurrency market analyst, I’ve observed an increasing trend in the number of Americans owning digital assets. The forthcoming presidential election, however, could bring about substantial changes to this sector.

Approximately one in five residents in various American states view cryptocurrency as a significant concern in the forthcoming US elections, according to a recent survey conducted by Digital Currency Group.

Based on the research findings, approximately forty percent of the surveyed individuals expressed a desire for increased dialogue from political candidates regarding digital assets. Around twenty to twenty-five percent of the respondents favored the idea of politicians focusing more on regulating the digital asset industry and safeguarding investors.

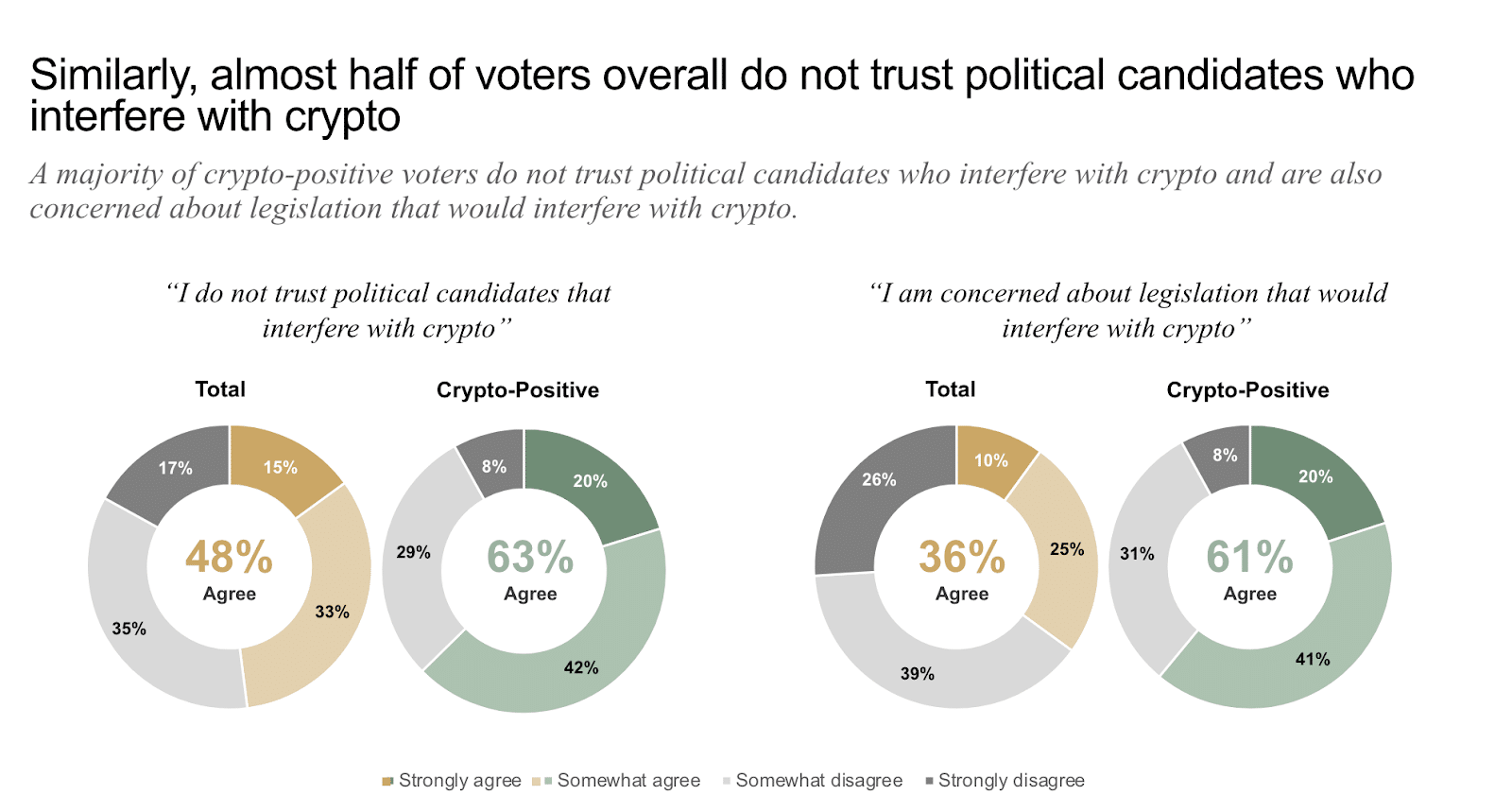

Approximately half of the population distrusts individuals involved in the digital asset sector, while around thirty percent is open to backing politicians who favor cryptocurrencies.

Among cryptocurrency owners, a Paradigm survey reveals a more pronounced distrust towards Joe Biden compared to before, as approximately 48% of this voting demographic intend to cast their ballots for Donald Trump in the forthcoming U.S. presidential election. Conversely, 38% lean towards Biden.

What is behind the softening of the American authorities’ policy?

The cryptocurrency sector is ramping up its presence in Washington with a view to shaping the outcome of the forthcoming US election. By investing record sums, they are backing pro-crypto politicians and educating legislators about digital currencies.

Previously, the crypto industry’s attempts to sway national elections have met with limited success and, in some cases, resulted in legal consequences for individuals like Sam Bankman-Fried. However, recent developments indicate that the industry’s political clout is gaining more traction and longevity.

The Biden administration could soon shift its tough stance on cryptocurrencies and adopt a more favorable approach, following in the footsteps of the previous administration under Trump, which effectively used cryptocurrencies as a political tool.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Gold Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-05-23 17:47