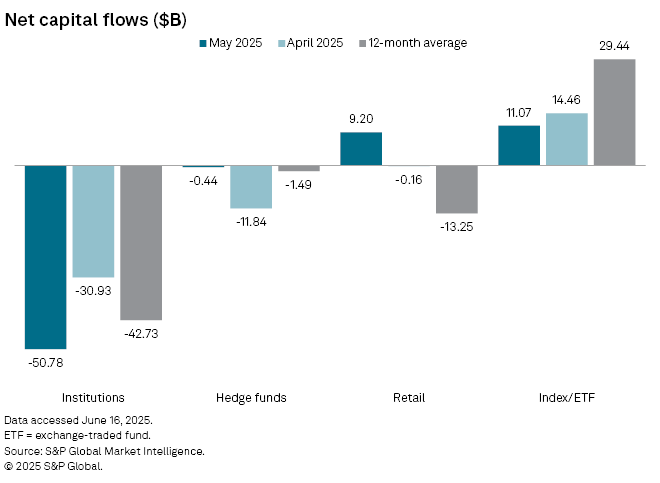

In what one might call a veritable orgy of divestment—had there been even a whiff of champagne—our beloved institutional investors have tossed a shocking $50.78 billion in equities out the proverbial window during May. Yes, it would seem even the cold, unfeeling heart of Wall Street can skip a beat, especially when S&P Global, that most distinguished of bean counters, is doing the counting.

April’s sell-off was but a mere $30.93 billion—a paltry sum, almost decent company for lunch. May, however, would not be outshone, not content with mediocrity, and soared well above last year’s mousy monthly average of $42.73 billion. One must admire the dedication to overachievement, tragic though it may be.

S&P Global, presumably between sips of weak tea and stronger spirits, blames the grim exodus on two modern classics: trade war anxiety and Moody’s unceremonious demotion of the United States from AAA to AA1. Well, every empire must have its day—preferably somewhere far from one’s portfolio.

Thomas McNamara, a director whose title promises wisdom, waves a genteel hand at the woods and the trees and the wolves therein,

“Institutions still don’t feel that we are out of the woods in relation to tariffs, recession and overall global uncertainty.”

Elsewhere, the sweet-toothed index and ETF crowd have been nibbling rather than feasting: only $11.07 billion snapped up in May, and $14.46 billion in April. These are the financial world’s equivalent of a salad at a steakhouse—eminently sensible, but hardly the main event. Let’s not speak of the 12-month $29.44 billion average, lest someone choke on a crouton.

McNamara, with a philosopher’s shrug, alludes to the cosmic complexity of stock sales,

“There are a lot of factors that go into this on a general basis, but this month, a main driver was share buybacks. This may also be a reason why the market rebounded like it did without any long-only conviction.”

And so the S&P 500 is up 0.25%—hardly a comet, but not a crash. The Nasdaq, clearly in possession of stronger coffee, is up nearly 1.6%. Meanwhile, the Dow, perhaps overcome by ennui, is down 1.4%.

Ah, the markets: if you can’t laugh, you must simply invest. 😂💸

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Maiden Academy tier list

- Castle Duels tier list – Best Legendary and Epic cards

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- The 15 Highest-Grossing Movies Of 2024

2025-06-19 17:41