As a researcher with a background in blockchain technology and decentralized finance, I find BounceBit’s roadmap intriguing. The idea of merging centralized and decentralized finance to democratize high-yield opportunities in Bitcoin investing is an innovative approach that could potentially address the needs of both institutions and individual investors.

“Through its announced roadmap, BounceBit aims to make profitable Bitcoin investment opportunities accessible to all, blending the worlds of traditional finance and decentralized finance.”

In simple terms, BounceBit, a newly funded Bitcoin staking business with Binance‘s support, has revealed its plan of action for 2024, detailing major features they intend to introduce this year.

In a Medium article published on May 20th, BounceBit disclosed its plans to create a platform that merges the features of established exchanges such as Coinbase with decentralized infrastructure specifically for Bitcoin. The team emphasized that they will not be implementing sidechains or layer-2 solutions, expressing skepticism towards emerging trends like runes and BRC-20 tokens, which they believe are driven more by hype than addressing the long-term requirements of the Bitcoin ecosystem.

“Disagreement is possible, even from the market. But regardless, we’re moving forward with our plan.”

BounceBit

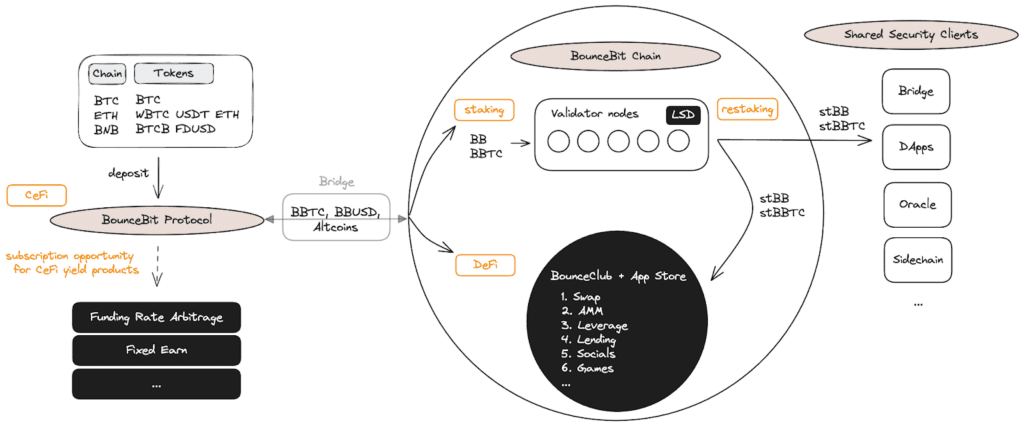

The 2024 plan for BounceBit doesn’t specify any particular dates, but it highlights several significant advancements for this year. BounceBit intends to fine-tune the BounceBit Chain, which is a proof-of-stake layer-1 blockchain fortified by validators who hold both Bitcoin and BB as stakes. To boost node performance, they plan to refine the Ethereum Virtual Machine (EVM) execution layer within the chain.

Planned enhancements include creating a common security client for the BounceBit BTC staking pool that other projects can leverage, building a novel mempool architecture to boost transaction processing capacity, and restructuring the interaction layer between Ethereum Virtual Machine (EVM) and Cosmos Software Development Kit (SDK), which is used for developing blockchain networks.

As a researcher studying BounceBit’s upcoming initiatives, I can share that they aim to go beyond infrastructure improvements. They intend to introduce a new product called Fixed Earn, which offers steady income for Bitcoin and dollar assets, reminiscent of traditional crypto lending platforms. Additionally, they plan to launch BounceClub, allowing users to develop their custom centralized-decentralized finance (cedefi) products using BounceBit’s widget. Regarding contract deployment, it is known that BounceBit will manage a special whitelist; however, the specific verification method remains undisclosed at this time.

In the beginning of April, Binance Labs, which is the investment wing of Binance, revealed their financial commitment to BounceBit. The specifics of the transaction, such as the amount invested, have yet to be made public. However, Yi He from Binance Labs expressed that this emerging company “opens up fresh possibilities for Bitcoin usage by combining CeFi and DeFi.”

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2024-05-20 10:40