As a seasoned crypto investor with over a decade of experience in this volatile market, I must admit that the recent decline in Binance’s market share has caught my attention. Having ridden the crypto rollercoaster through numerous bull and bear markets, I’ve learned to read between the lines when it comes to exchange performance.

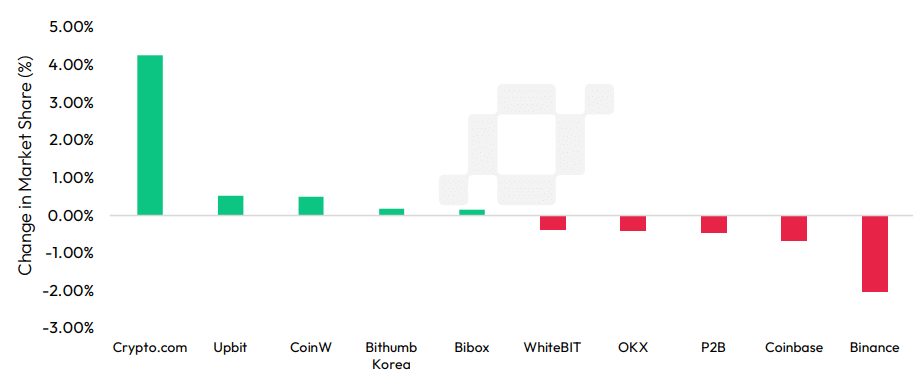

During the event known as “Red September,” Binance, the leading cryptocurrency exchange, saw a decrease in its market share as rival platforms managed to attract a higher volume of user trades.

Based on findings from a report published on October 3rd by CCData, the trading volume on Binance’s spot and derivatives markets saw a decrease of 23% and 21% respectively last month. This drop appears to be part of a broader trend as activity on centralized cryptocurrency exchanges (CEX) in general has decreased. CCData analysts noted that CEX volumes fell by 17% during September, which is typically a challenging month for digital assets.

In 2020, four years ago, the digital trading platform spearheaded by Changpeng Zhao commanded a 27% share in the spot market sector and accounted for 40% of the total volume in the derivatives market following a decline. This prominent position in both the spot and derivative markets was last held by Binance four years ago.

As a crypto investor, I’ve noticed that the exchange, now under the leadership of Richard Teng following CZ’s departure, has shown remarkable resilience amidst the intense storm of U.S. regulatory challenges that hit us since a June 2023 Securities and Exchange Commission lawsuit.

SEC authorities have expressed disapproval of Binance’s approach to listing in revised submission documents, alleging that Binance violated securities regulations by operating an unlicensed brokerage and facilitating illegal securities transactions, as reported by the federal regulator.

As I delve into market trends, it’s evident that while my main focus has been losing some ground, other exchanges like Crypto.com are thriving. Interestingly, CCData reveals that Crypto.com experienced a significant 40% increase across both spot and derivatives markets last month.

As a researcher examining the cryptocurrency market’s development over the course of the year, it’s evident that Crypto.com has experienced the most significant growth so far, boosting its market share by a noteworthy 8.08% to reach 10.5%. Meanwhile, Bybit and Bitget have also demonstrated impressive progress. Bybit has increased its market share by 3.48%, now standing at 9.60%, while Bitget has seen an uptick of 1.59%, bringing its market share to 3.34%.

Among the major cryptocurrency exchanges, Binance, Upbit, and OKX have experienced significant drops in their market share. Specifically, Binance’s market share decreased by 5.34%, dropping to 27.0%; Upbit saw a decline of 4.60%, resulting in a 2.50% market share; and OKX suffered a decrease of 4.04%, leaving them with a 3.91% market share.

CCData report

In the final quarter of the year (Q4), experts predict an increase in the value of assets and improved market liquidity, as there’s a likelihood of more Federal Reserve interest rate reductions and a resolution in the U.S. presidential election. However, crypto markets have seen a dip due to global economic uncertainties caused by conflicts in various parts of the world, particularly the Middle East.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-10-03 23:52