As a seasoned crypto investor with a knack for spotting trends and navigating market volatility, I find Binance’s recent announcement to delist certain tokens a reminder of the dynamic nature of this space. While it’s always a bit disheartening to see my investments take a hit, especially when they plunge by around 30%, I’ve learned to ride these waves and not let temporary market fluctuations deter me from my long-term strategy.

As an analyst, I’d like to share that I recently received a notice from Binance about their intention to delist certain tokens due to compliance concerns. Not long after this announcement, these five tokens experienced a significant drop in value, approximately 30% each.

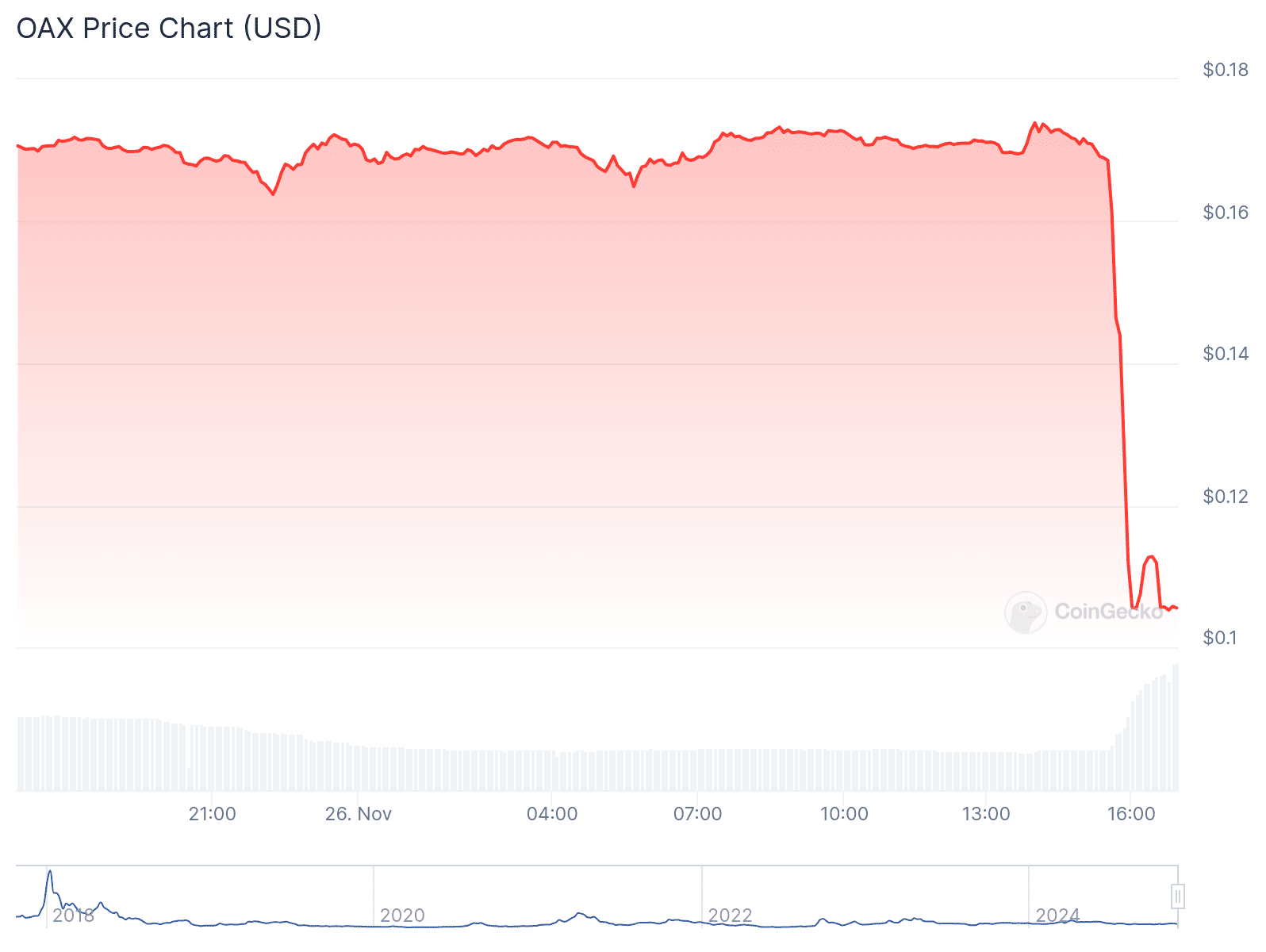

As a crypto investor, I received a notification on November 26th from the exchange stating that they will be removing five tokens from their platform: Gifto, IRISnet, SelfKey, OAX, and Ren. This decision follows Binance’s regular assessment of digital assets, as these tokens no longer meet their standards or the broader industry landscape has shifted.

On December 10th at 03:00 UTC, five specific tokens (GFT, IRIS, KEY, OAX, and REN) will be delisted from Binance. This means that any trading pairs associated with these tokens, such as GFT/USDT, IRIS/USDT, KEY/USDT, OAX/BTC, OAX/USDT, REN/BTC, and REN/USDT, will also no longer be available. Additionally, spot market trading for these tokens will cease on November 6th.

Based on CoinGecko’s figures, GFT dropped by about 30.6% almost instantly after Binance made its announcement. At the moment, it is being traded at approximately $0.01242. Similarly, KEY experienced a significant drop, declining by roughly 29.7% to reach $0.00262 around the same timeframe.

After Binance made an announcement, OAX suffered the most significant drop, decreasing by 37.2%. This was immediately followed by REN, which also declined significantly to $0.03716, representing a 36.1% fall. Subsequently, IRIS experienced a 34.8% decrease after Binance announced its intention to remove the token from its platform.

Binance clarified that the process of removing tokens from their platform depends on various aspects like the progress of the project, the reliability of their networks, and adherence to regulatory standards. They emphasized that such actions aim to safeguard users and maintain a thriving cryptocurrency marketplace.

Consequently, Binance advised its users to act promptly in the period before and after the delisting date. The announcement makes it clear that deposits for the token won’t be reflected in your account after December 12. Yet, support for withdrawals of these tokens will cease on February 12, 2025.

On December 3rd, Binance Futures will settle all positions on the KEYUSDT RENUSDT USDⓈ-M Perpetual Contracts automatically and close them. Consequently, users won’t be permitted to open any new positions on these contracts following this date.

binance has hinted at the potential for delisted tokens to be exchanged into stablecoins on users’ behalf after February 13, 2025, however, it should be noted that this is not a definite promise as of now.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Maiden Academy tier list

- Hero Tale best builds – One for melee, one for ranged characters

2024-11-26 14:54