As a seasoned researcher with over two decades of market analysis under my belt, I’ve seen enough cycles to recognize a trend when I see one. The recent surge in Bitcoin and altcoins seems to be fueled by the anticipation of interest rate cuts, as hinted by Jerome Powell. However, history has taught us that “buy the rumor, sell the news” is often a reality in the world of finance.

After a suggestion by Jerome Powell, the head of the Federal Reserve, that interest rates might decrease in September, both Bitcoin and other digital currencies showed signs of recovery.

On August 24th, Bitcoin (BTC) soared to reach approximately $64,000, while Ethereum (ETH) surged to hit about $2,765. The combined market value of all cryptocurrencies increased by nearly 5% to exceed $2.26 trillion in total.

In similar fashion, significant indices such as the Dow Jones, S&P 500, and the Nasdaq 100 have been nearing record levels within the stock market. However, it’s important to note that there’s a potential risk these market gains in both stocks and cryptocurrencies might be temporary.

Buy the rumor, sell the news

As an analyst, I’ve noticed that the market has been anticipating interest rate cuts for September, following the relatively weak employment data released by the U.S. Recently, the probability of such a move, as indicated by the Fed Rate Monitor tool, has consistently remained above 80% over the past three weeks.

From my perspective as a researcher, Powell’s statement served as a hint about the direction of our upcoming meeting on September 18th. Given that a rate cut has already been factored into market expectations, there’s a potential risk that stocks and cryptocurrencies may experience a pullback as investors begin to sell in anticipation of this anticipated news.

On numerous occasions, we’ve observed this pattern repeating. To give you an idea, Bitcoin plummeted nearly 10% following a halving event, whereas Ether saw a significant decline, in double digits, after the Securities and Exchange Commission gave the green light to ETFs.

Generally speaking, stocks tend to fall significantly once the Federal Reserve reduces interest rates. In fact, Geiger Capital, a traditionalist analyst on X.com, reminded us of the instances in 2001 and 2002 as precedents.

🔸Initial Interest Rate Reduction – January 3, 2001

— Geiger Capital (@Geiger_Capital) August 23, 2024

During times like those seen in 2020 with the onset of the Covid-19 pandemic, the stock market tends to perform favorably when the Federal Reserve reduces interest rates, as it did then.

A further advantage lies in the fact that these reductions occur concurrently with an upsurge in robust earnings growth for U.S. corporations.

Money markets are seeing inflows

One explanation for why cryptocurrencies might decline when the Fed reduces interest rates is because more money continues to flow into safer money market funds.

The data indicates that these funds experienced more than $90 billion in new investments during the initial part of August, despite growing anticipation for interest rate reductions. Currently, they manage assets worth over $6.2 trillion.

It’s been suggested that as money market investors withdraw or give up on their investments, there could be an increase in the investment into riskier assets such as cryptocurrencies and stocks.

It’s quite probable that this rotation will occur, but it may require some patience as any adjustments to interest rates are expected to be made gradually.

Bitcoin is still forming lower highs

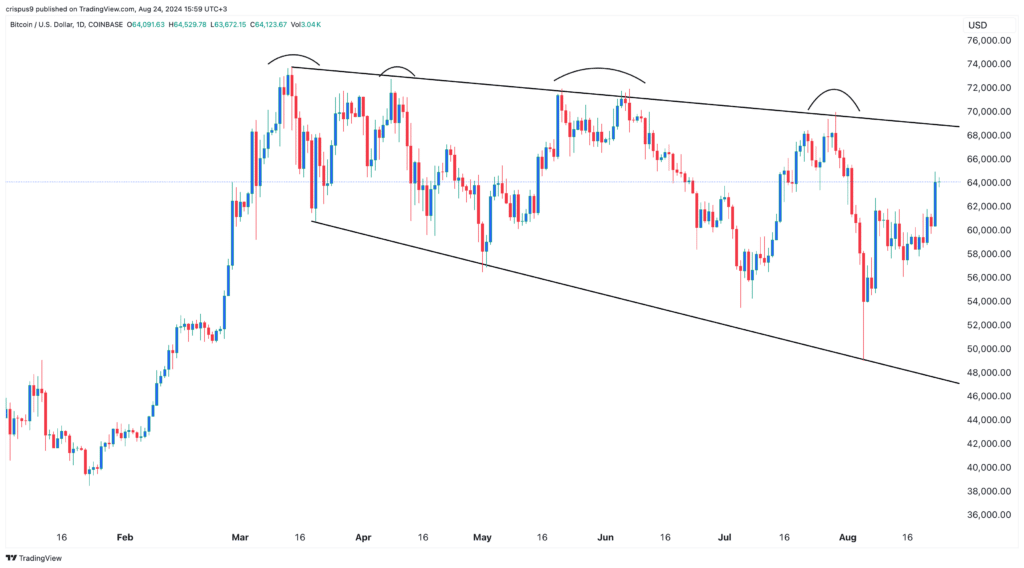

As a researcher observing the cryptocurrency market, I’ve noticed that Bitcoin has bounced back from its dip to $49,000 earlier this month, reaching $64,000. Yet, it’s essential to note that this price rise doesn’t necessarily signify a full breakout, as Bitcoin has oscillated within this range for the past few months.

Significantly, Bitcoin has been creating progressively lower peak prices since March, with peaks at $73,800, then $72,000 and $70,000 in succession. A clear breakout suggesting a bullish market would occur if the coin surpasses its initial peak price of $73,800. Until this happens, there’s a possibility that Bitcoin may revert to a downward trend.

From a favorable perspective, the repeated occurrence of lower peaks and troughs has shaped into a falling broadening wedge formation, which is often interpreted as a positive or bullish signal.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- USD CNY PREDICTION

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2024-08-24 21:34