As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of bull runs and bear markets. However, the current Bitcoin rally is something truly extraordinary. The consistent hitting of new all-time highs is reminiscent of the Dotcom boom, but with more stability and less hype.

Bitcoin has been consistently hitting new all-time highs over the past two weeks.

In the last 24 hours, Bitcoin (BTC) has increased by 5.8% and is presently being exchanged at an all-time high of approximately $97,750. Also known as “digital gold,” its current market capitalization stands at around $1.93 trillion, representing a 57.9% control over the entire crypto market.

Its daily trading volume also broke the $85 billion mark.

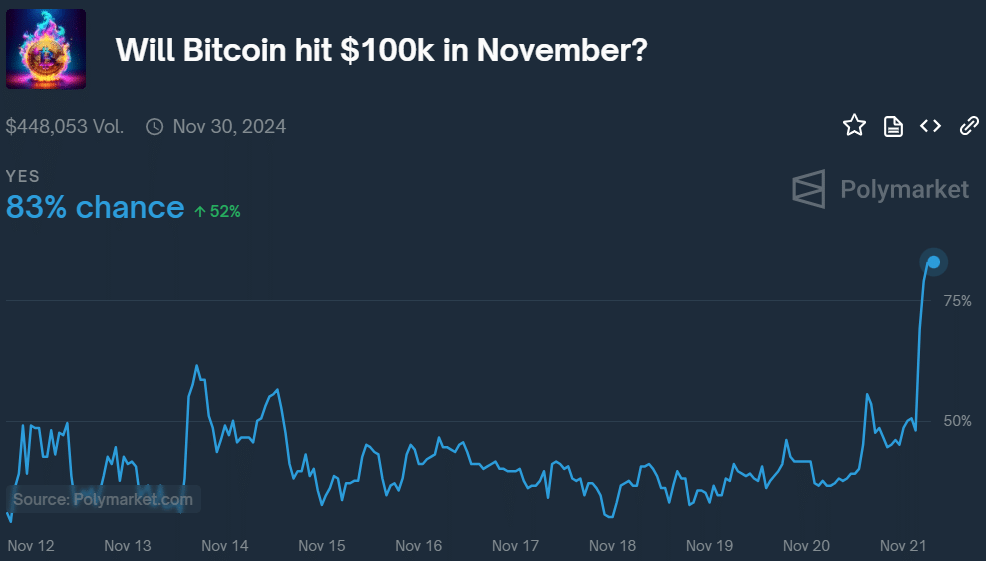

According to a survey conducted on the market forecasting platform Polymarket, there’s an approximately 83% likelihood that Bitcoin will surpass the $100,000 threshold by December, given its robust upward trend.

Reaching a new all-time high, the total market value of cryptocurrencies, including Bitcoin, soared to an impressive $3.33 trillion, as reported by CoinGecko’s latest data.

What’s driving the bulls?

Multiple elements have been contributing to the rising price of Bitcoin, with the significant surge starting after the victory of “Bitcoin-friendly” President Donald Trump in the U.S. presidential election on November 6th.

As a dedicated crypto investor, I find myself hopeful that pro-cryptocurrency politicians will continue to hold significant influence within the U.S. House of Representatives and the Senate. With President Trump’s potential second term on the horizon, these developments may pave the way for more crypto-friendly regulations.

Additionally, according to Ki Young Ju, Chief Executive Officer at market analysis platform CryptoQuant, the current bullish trend appears to share similarities with the bull run witnessed in 2020.

#Bitcoin bull market is starting, with data resembling 2020.

Thread 🧵

— Ki Young Ju (@ki_young_ju) November 21, 2024

According to Young Ju, one significant factor is the substantial buildup of whales (large institutional investors), which appears to have driven the increase in Bitcoin’s price due to numerous large over-the-counter transactions, more likely from institutions instead of individual traders.

On April 20th, the Bitcoin halving occurred, reducing the miner’s block reward by half. To maintain profitability for miners, this event called for an increase in Bitcoin’s price, as suggested by the CEO of CryptoQuant in a subsequent discussion.

The latest catalyst for the Bitcoin price is the launch of spot BTC exchange-traded fund options in the U.S. — the first investment product to get the green light from the U.S. Securities and Exchange Commission was BlackRock’s iShares Bitcoin Trust.

Significantly, options for Bitcoin Exchange-Traded Funds (ETFs) might lead to a rise in the popularity of Bitcoin, often referred to as “digital gold,” as these options provide investors with a way to mitigate their investment risks.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-11-21 10:19