As a seasoned researcher with over two decades of experience in the financial markets, I have seen my fair share of market cycles and trends. However, the current bull run of Bitcoin (BTC) is something that has caught my attention like no other.

Bitcoin price pulled back slightly after nearly retesting its all-time high of $73,800 on Oct. 29.

Currently, Bitcoin (BTC) is priced at approximately $71,800, with financial experts anticipating a potential bullish surge in the near future.

In a recent post on X, Mando CT, a well-known cryptocurrency trader with more than 600,000 followers on X and 300,000 subscribers on YouTube, suggested that the bull run was picking up speed. Moreover, he pointed out that optimism within the crypto sector was overwhelmingly evident.

$BTC bull run kicks into high gear, gaining momentum faster than light.

This cycle will bring us to ATH and beyond. The bullish sentiments are loud and clear!

Higher is the only option in my opinion! 👀 🔥

— MANDO CT (@XMaximist) October 30, 2024

Other experts are hopeful that the currency will maintain its robust upward trend. On a recent X post, well-known trader Peter Brandt pointed out that the currency might be on the verge of bursting through, which would become clear if the price surpasses the significant resistance level at around $76,000.

It appears that there is growing optimism among institutional investors towards Bitcoin ETFs, as demonstrated by a significant surge in investments. The data reveals that total inflows have reached $23.2 billion, with an additional $870 million invested on Tuesday, representing the fifth consecutive day of growth.

If Bitcoin keeps rising, it might persist that this surge encourages more people to jump on the bandwagon due to the growing fear of missing out on potential profits.

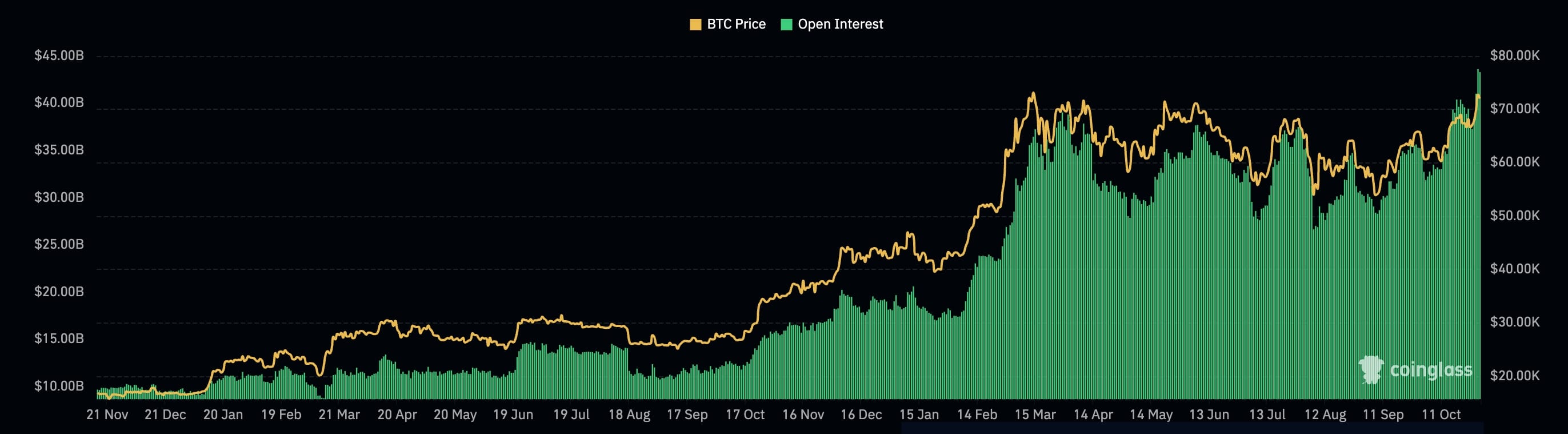

Currently, Bitcoin’s surge in value is coinciding with an increase in futures contracts open interest, peaking at a historic high of $44 billion. Moreover, the Crypto Fear & Greed Index has spiked to 67, suggesting that investors are feeling more optimistic or “greedy” about the market.

Historically speaking, Bitcoin tends to perform well during the months of October and November, as suggested by data from CoinGlass.

The U.S. election coming up is another factor that could serve as a catalyst. According to prediction markets like Polymarket, there’s a roughly 70% chance that Donald Trump will emerge victorious in this election.

Should he emerge victorious, it seems the coin might further increase in the short run. Yet, as per Brad Garlinghouse, Ripple‘s (XRP) CEO, speaking to Bloomberg, it’s expected that cryptocurrencies will continue to prosper irrespective of who wins the presidency.

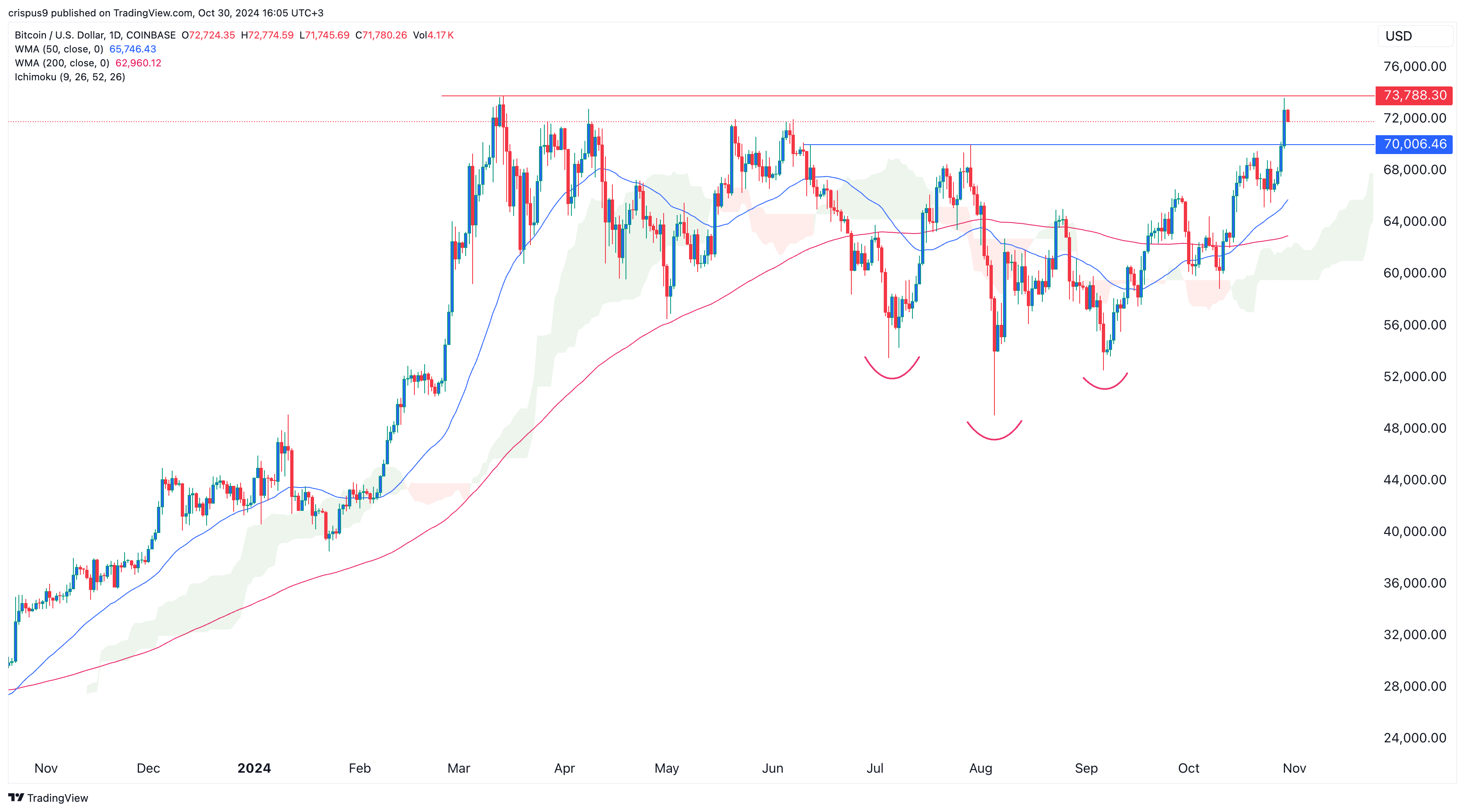

Bitcoin price is ripe for more gains

In simpler terms, the technical analysis for Bitcoin looks quite optimistic. On a day-to-day graph, it appears to have developed an inverted head and shoulders formation, which is typically viewed as a favorable signal.

It has also formed a golden cross pattern as the 200-day and 50-day moving averages crossed.

Currently, Bitcoin hovers above the Ichimoku cloud, suggesting a favorable trend. This could potentially lead to a robust surge beyond its record peak. Should that occur, the significant resistance level to keep an eye on would be around $80,000.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Maiden Academy tier list

- Hero Tale best builds – One for melee, one for ranged characters

2024-10-30 16:35