As a seasoned crypto investor with a decade of experience navigating the volatile waters of this digital frontier, I find myself standing at the crossroads once again, faced with the familiar yet ever-changing landscape of Bitcoin’s price action.

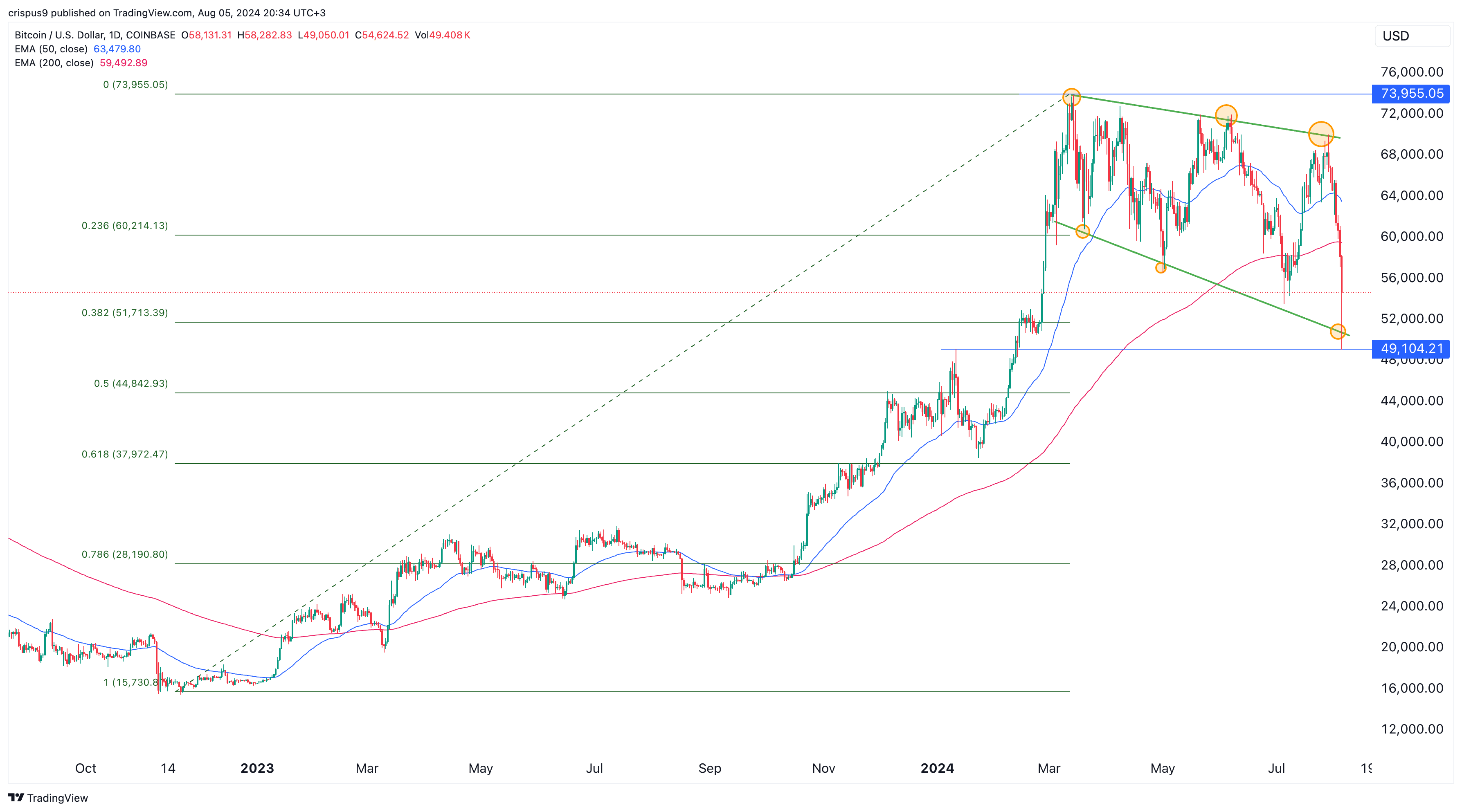

Bitcoin price dropped to a multi-month-low of $49,105 on Aug. 5 as the crypto sell-off continued.

On August 5th, Bitcoin (BTC) hit a record low, having dropped by more than 33% from its highest point this year. Although it has since recovered from a dip below $50,000 to challenge the $55,000 mark, it continues to be in the grip of a severe downtrend.

As a seasoned investor with years of experience under my belt, I have seen the highs and lows of various markets. Based on my observations and analysis, I find it intriguing to note that there seems to be a significant split in opinions about Bitcoin’s future price movement this year. According to Kalshi, a rapidly expanding prediction platform with notable backers such as Charles Schwab, Sequoia, and Henry Kravis, an impressive 76% of the polled participants anticipate that the Bitcoin price will close below $50,000 by the end of the year. While I always encourage diversification in investment portfolios, this forecast has piqued my curiosity, and I am keeping a close eye on the market developments to make an informed decision.

Approximately half of the people surveyed (54%) anticipate that the price of the coin will dip below $40,000, and about one-fifth (20%) believe it will fall even lower, under $30,000.

Currently, as per Polymarket’s data, there’s been a significant decrease in the number of traders anticipating Bitcoin will reach $100,000 this year. Initially, about 64% of poll participants thought so, but on Monday, that percentage dropped to only 22%.

Cryptocurrencies like Bitcoin are experiencing a drop due to challenges within the sector. For instance, investment products tied to Bitcoin, such as exchange-traded funds (ETFs), have seen a significant decrease in assets, totaling approximately $65.4 million.

The value of outstanding contracts for future Bitcoin transactions dropped to more than 6.2 billion US dollars compared to last month’s peak of over 8.8 billion US dollars. Moreover, it was reported that Bitcoin experienced liquidations worth approximately 444 million US dollars on Monday, while the overall sector saw over 1.14 billion US dollars in such events.

As a crypto investor, it’s reassuring to see that heavyweight players in the market, such as Blackrock, Fidelity, and MicroStrategy, aren’t unloading their digital assets. In fact, MicroStrategy is actively seeking funds to acquire even more coins.

Moreover, similar to what occurred in March 2020, it’s possible that the Federal Reserve might reduce interest rates prior to their September meeting. Currently, inflation is declining, while the jobless rate has climbed up to 4.3%.

Bitcoin price technicals are sending mixed data

Looking at the daily graph, we notice that Bitcoin reached a high of $73,955 and subsequently dipped to $49,104 on August 5th. This low point is significant because it aligns with Bitcoin’s highest point from January 11th. Furthermore, Bitcoin has fallen below its 200-day moving average, indicating that bears currently dominate the market.

As a researcher studying the trends of Bitcoin, I’ve noticed an intriguing pattern: The digital currency has been consistently setting lower highs at $73,900, $72,000, and $70,000. Moreover, it has also been forming lower lows at $60,730, $56,900, and $50,775. Typically, such a price pattern suggests further potential for downward movement.

From a favorable perspective, Bitcoin appears to have created a falling broadening wedge formation, which is generally considered a bullish indicator. If Bitcoin surpasses its 200-day moving average and breaks through the upper boundary of the downward sloping trendline, it would suggest further price increases lie ahead.

Instead, if the price falls below Monday’s minimum, it would contradict the wedge pattern and suggest a further decline, with traders aiming for the 50% retracement level at $44,840.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2024-08-05 21:24