As a seasoned crypto investor with a decade of experience under my belt, witnessing Bitcoin touch $100,000 on CME Futures is nothing short of exhilarating. I remember when it was just a few dollars, and now here we are, watching it soar to new heights. The derivatives marketplace seems to be leading the charge, with open interest surging to unprecedented levels.

On the CME Futures exchange, Bitcoin briefly reached a value of $100,000 over the Thanksgiving holiday, although its actual token price hovered just under that mark.

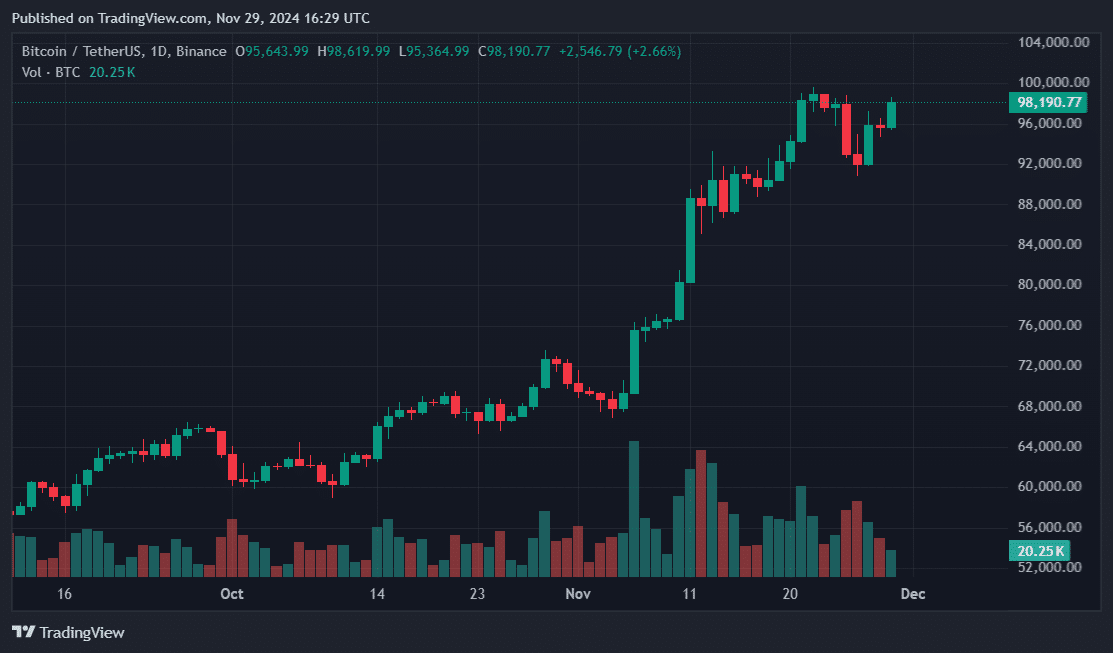

Tracking Bitcoin (BTC) on CME Futures through TradingView revealed that the leading cryptocurrency reached a high of approximately $100,085 in the derivatives market around mid-morning on November 29th.

Currently, the price of BTC is holding steady at approximately $98,285. This comes after it reached an all-time high of $99,645 on November 22nd. Following this peak, there was a slight dip to around $91,000, leading some experts to suggest that BTC might be experiencing a “cooling off” period.

According to CME Futures data, it seems that Bitcoin might hit record highs faster than previously thought. This viewpoint is supported by Coinglass’ analysis, which points out that the value for BTC Futures open interest recently spiked to a staggering $61 billion at the time of their report.

The increase in open interest soared by half within approximately a month’s time, sparking discussions about whether the market will experience a correction or continue its positive trajectory.

Regardless of the circumstances, various institutions and national bodies swiftly moved to stockpile Bitcoin for their corporate vaults and government reserves. MicroStrategy took the lead among private firms, holding approximately $35 billion in Bitcoin. Other companies such as SOS Limited and Metaplanet joined them, investing millions of dollars into purchasing Bitcoin.

During President Donald Trump’s tenure, the United States had the most significant holdings of Bitcoin (BTC) among sovereign nations. However, there was potential for this amount to grow even further. Trump’s transition team was considering appointing a crypto council to help maximize the country’s BTC reserves, in line with his pledge to amass a substantial digital currency stockpile.

Senator Cynthia Lummis from Wyoming introduced a proposal to acquire approximately one million Bitcoins over a five-year period, as Bitcoin has gained prominence in international political discussions. Countries like Brazil and regions such as Vancouver in Canada are considering following the lead set by El Salvador, which holds roughly $500 million worth of BTC since its initial purchase in 2020. Switzerland too, has legislated to explore how Bitcoin could enhance its power grid.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Gold Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Black Myth: Wukong minimum & recommended system requirements for PC

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-11-29 19:55