As a seasoned researcher with a knack for deciphering cryptocurrency market trends and a not-so-secret obsession with Bitcoin, I find myself intrigued by the latest developments. The sideways movement of BTC might be causing some impatience among traders, but a closer look at the data paints a potentially bullish picture.

In recent times, Bitcoin appears to be holding steady rather than making significant gains or losses. However, a crucial sign points towards an imminent increase in its price.

Over the last 24 hours, Bitcoin’s price has hovered near the $59,000 level, briefly spiking to $60,680 before settling back. Currently, Bitcoin is experiencing a 0.6% increase and is being traded at approximately $58,900 as we speak.

Additionally, there was a significant surge in the daily trading volume of the leading cryptocurrency, reaching approximately $34.8 billion, which now remains stable at that level.

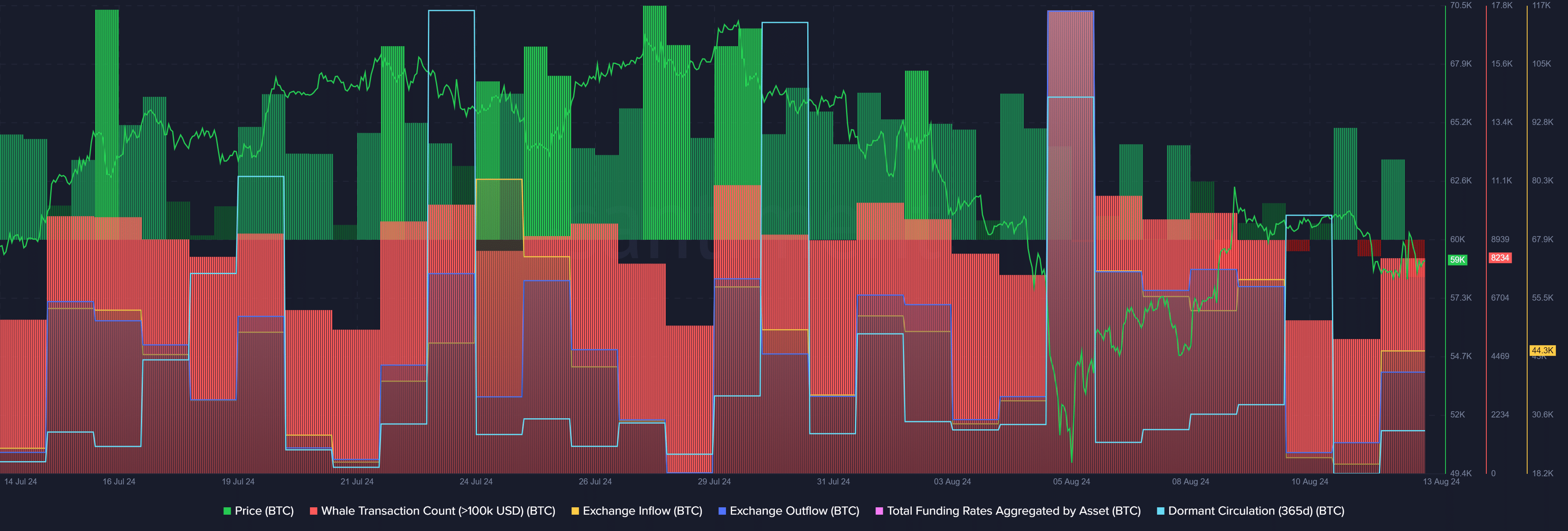

Based on Santiment’s data, the accumulated Bitcoin funding rate dipped to -0.0016%, indicating that traders anticipate a decrease in the asset’s value. Interestingly, though, Bitcoin has typically seen short-term price increases when the funding rate falls into the negative zone.

According to market intelligence data, there has been a rise in significant Bitcoin transactions. Specifically, Santiment reports that the number of such transactions, defined as those involving at least $100,000 worth of BTC, increased from 5,148 to 8,234 unique transactions within the last 24 hours. In simpler terms, more large-scale Bitcoin transactions are taking place.

At this point, whales are showing their readiness for short-term profit-taking.

Based on information provided by Santiment, there was a significant rise of approximately 119% in Bitcoin inflows to exchanges over the past day. This increase brought the number of BTC tokens entering exchanges from around 20,255 to about 44,323. In addition, the outflow of Bitcoins from exchanges also experienced a substantial surge during this period, with the amount going from approximately 24,911 to nearly 40,378 Bitcoins.

Significantly, the amount of Bitcoins not in active circulation for a year (365 days) has grown from 1,402 to 4,444 tokens within the past day, according to Santiment. This trend suggests that some long-term Bitcoin holders could be looking to cash out at these current prices.

On August 12th, U.S.-based Bitcoin exchange-traded funds attracted approximately $27.8 million, further boosting Bitcoin’s optimistic trend that had initially been dampened by a bearish beginning in August.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Gold Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-08-13 13:02