As an analyst with over two decades of experience in the financial markets, I’ve seen my fair share of ups and downs, bull runs, and bear markets. The recent turn of events in the Bitcoin market, with its six-day winning streak coming to a halt, is not entirely unexpected.

On a surprising note, Bitcoin (BTC) broke its six-day victorious run on Monday, dropping by 0.37% to finish at $63,349. This change occurred even as the overall cryptocurrency market experienced a 0.51% growth, boosting the total market capitalization to an impressive $2.177 trillion.

Enhancing the excitement, BlackRock mandated Coinbase to complete Bitcoin withdrawals within 12 hours as part of its latest SEC amendment request. This action underscores their dedication to streamlined digital asset management, and it follows speculation about potential acquisition of physical Bitcoins by the company.

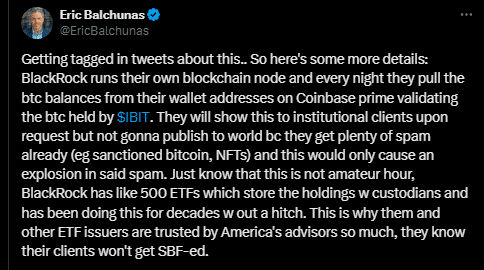

Eric Balchunas of Bloomberg Intelligence clarified that BlackRock diligently handles its investments, maintaining openness and dependability throughout their business practices. He underlined the fact that their Exchange-Traded Funds (ETFs) are widely trusted and consistently demonstrate a robust performance history.

As a researcher studying the US Bitcoin-spot ETF market, I’ve observed some notable trends recently. Specifically, Grayscale Bitcoin Trust reported a significant outflow of approximately $40.3 million, while Fidelity’s Bitcoin Fund managed to attract modest inflows worth around $24.9 million. The overall picture suggests a dip in the ETF market, with several issuers reporting zero net flows.

In terms of regulations, all five members of the Securities and Exchange Commission (SEC) will appear at a hearing scheduled for September 24th. Lawmakers are keen to engage in discussions about the future of digital assets. Any potential change in the SEC’s position might substantially influence the demand for Bitcoin.

From my perspective as an analyst, I’m keeping a close eye on the upcoming U.S. economic data, particularly the CB Consumer Confidence Index. This index might have a subtle impact on Bitcoin demand since it could suggest increased consumer spending. If economists are correct and the index shows growth, it may indicate that consumers are feeling more optimistic about their financial situations, potentially leading to higher overall spending. This increased spending could, in turn, influence the demand for Bitcoin as consumers may be more willing to invest or spend on digital assets.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Every Upcoming Zac Efron Movie And TV Show

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-09-24 15:01