As a seasoned researcher with over a decade of experience in the volatile world of finance and cryptocurrencies, I find myself constantly intrigued by the rollercoaster ride that is the crypto market. The latest dip in Bitcoin‘s price, following Powell’s rejection of a national Bitcoin reserve, serves as another reminder of the unpredictable nature of this digital gold rush.

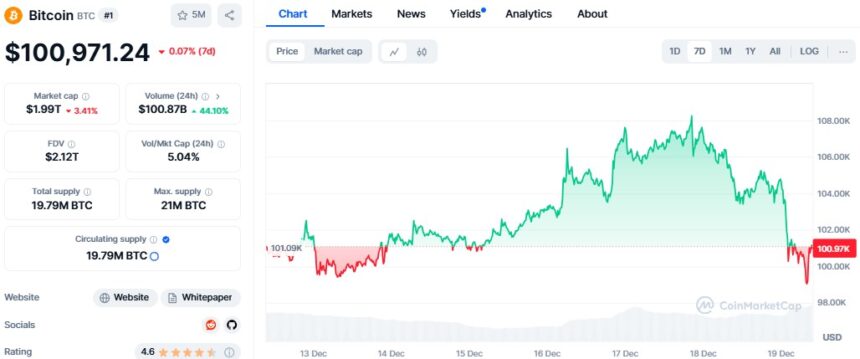

On Wednesday evening, the value of Bitcoin dropped beneath $100,000 and dipped by about 6% within a 24-hour period, closing at $99,047.70. This downward trend came in response to remarks made by Jerome Powell, the Chair of the U.S. Federal Reserve.

As an analyst, I can say that I recently observed Powell, the Federal Reserve Chair, dismissing the concept of establishing a national Bitcoin reserve for the U.S. He articulated that the central bank is neither seeking a legislative change nor authorized to own Bitcoin. Consequently, this statement led to a significant correction in Bitcoin’s value following its temporary surge to an unprecedented peak of $108,000 earlier this week.

The impact was felt across the market, with major altcoins also seeing significant losses. Ethereum (ETH) dropped 6.5%, and XRP fell by 12.64%. The GMCI 30 index, which tracks the performance of top cryptocurrencies, declined by 7.18% in the past day.

The surge in Bitcoin’s value lately can be attributed to the remarks made by the U.S. President-elect Donald Trump regarding the establishment of a federal Bitcoin reserve. Furthermore, states such as Texas and Florida have been making attempts to create their own state-backed Bitcoin reserves, which has increased market enthusiasm.

Regarding the crypto market’s dip, Powell’s comments were merely a small part of a broader economic scenario. The U.S. Federal Reserve’s move to reduce interest rates slightly by 0.25% on Wednesday, coupled with hints at fewer rate reductions in 2024, seems to have played a role in the market’s recent downturn.

Keeping a keen eye, people are eagerly awaiting the market’s response as it navigates through the upcoming political transitions and economic fluctuations in the near future.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- USD CNY PREDICTION

- Black Myth: Wukong minimum & recommended system requirements for PC

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Arknights celebrates fifth anniversary in style with new limited-time event

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

2024-12-19 09:08