As a seasoned researcher with years of experience navigating the tumultuous waters of the cryptocurrency market, I can confidently say that today’s dip in Bitcoin and other major cryptos feels all too familiar. The rollercoaster ride we’ve been on these past few weeks is reminiscent of a wild bull run I witnessed back in 2017 – only to be followed by an equally dramatic crash.

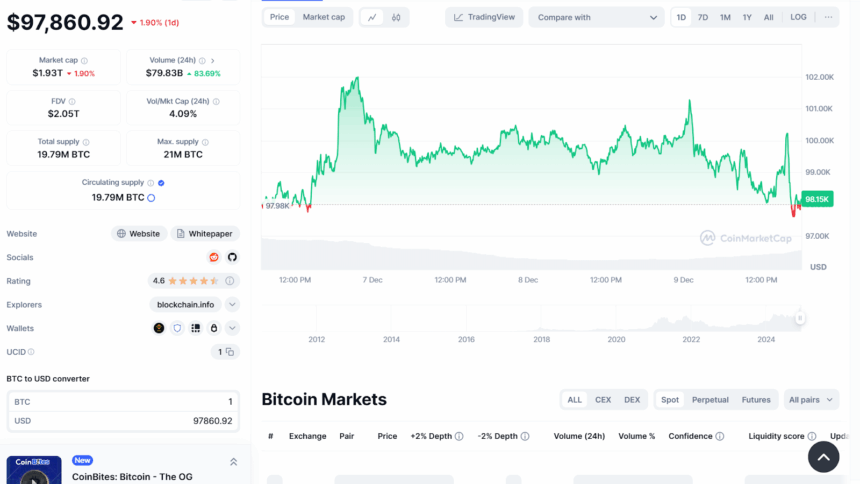

The value of Bitcoin fell to approximately $97,860 today, marking a decline after nearly a month of consecutive price increases. Not long ago, Bitcoin was reaching new heights at an astounding $103,900 due to the positive impact of Donald Trump’s election victory on November 6.

Nevertheless, the upward price trend for Bitcoin began to decelerate as it found difficulty in holding onto its recent increases over the last several days.

Other significant cryptocurrencies besides Bitcoin have seen a price decline as well. For example, Ethereum reached approximately $4K earlier today, but then fell by 3%. This dip occurred around the same time that Justin Sun sold a substantial amount of Ethereum, worth about $119 million, to HTX. This sale may have contributed to the market’s overall pressure.

Nevertheless, certain alternative coins (altcoins) continue to demonstrate strong performance. The meme-inspired token PEPE achieved a fresh all-time high, while X Empire experienced an impressive surge of 47%, providing some encouragement for investors.

The demand for buying has significantly dropped, as indicated by Coinglass data, with approximately 204,384 traders being liquidated for a combined loss of $509.48 million. Furthermore, the Bhutan Government’s sale of $40 million in Bitcoin to QCP Capital has only intensified this negative trend.

Moreover, the ending of approximately 39,960 Bitcoin options expirations on December 27 has sparked concerns among investors regarding potential price decreases in the upcoming weeks. Furthermore, the Cardano Foundation’s social media platform being hacked has added to the unease surrounding cryptocurrency investments.

Although there are many factors at play, certain analysts remain optimistic that the upward trend in the market may continue, with predictions of a bullish outlook for most of next year.

Some believe we might witness a surge in popularity for lesser-known cryptocurrencies, often referred to as “altcoins,” as Bitcoin’s influence weakens. The Altcoin Season Index has fallen from 86 to 73 this month, indicating that altcoins are maintaining their position in the market.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2024-12-09 21:40