As a seasoned crypto investor with over a decade of experience navigating the ever-evolving digital asset landscape, I find the recent trends in Bitcoin and Ethereum ETF inflows intriguing. The consistent inflows into Bitcoin ETFs, particularly from institutional heavyweights like BlackRock and Goldman Sachs, underscore a growing institutional interest in Bitcoin that I’ve been anticipating for some time now.

As a seasoned crypto investor with years of experience navigating the volatile landscape of digital assets, I have learned that understanding the ebb and flow of Exchange Traded Funds (ETFs) can provide valuable insights into market trends. This week, I’ve witnessed an encouraging development as Bitcoin ETFs experienced their third consecutive inflow day. This is a positive sign for the crypto market, as institutional investors are increasingly showing confidence in Bitcoin’s potential.

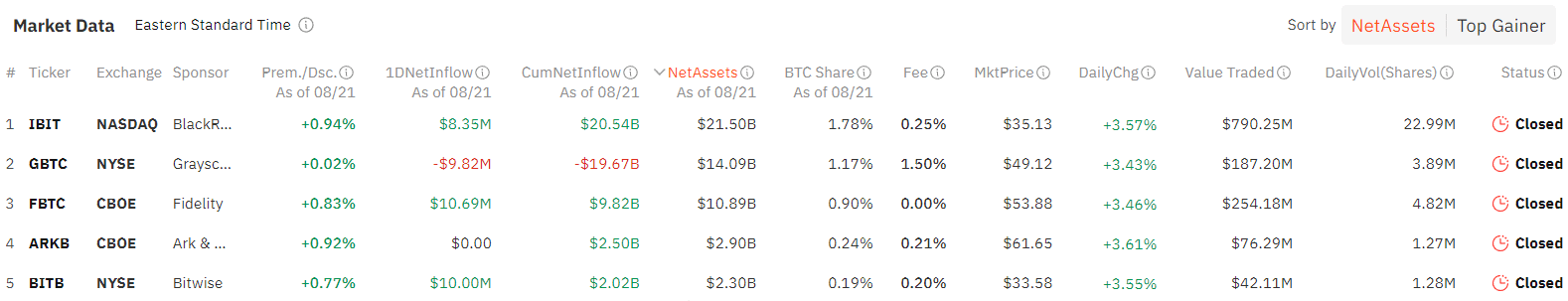

Based on information from SoSoValue, Bitcoin exchange-traded funds saw a decrease of approximately 55% in net inflows on August 21st, with only $39.42 million compared to the $88.06 million recorded on August 20th.

In just three days after no prior activity, Grayscale’s Mini Bitcoin Trust took the lead with approximately $14.2 million in reported investments. Close behind were Fidelity’s Bitcoin Trust (FBTC) with inflows of around $10.7 million and Bitwise’s Bitcoin Trust (BITB) with around $10 million.

On a single day, BlackRock’s IBIT Bitcoin ETF saw an inflow of $8.4 million, increasing its total inflows since inception to a massive $20.5 billion. In comparison, Invesco Galaxy’s BTCO and Franklin Templeton’s EZBC reported more moderate daily inflows of $2.5 million and $3.5 million respectively.

These inflows were offset by Grayscale’s GBTC, which logged outflows of $9.8 million, bringing its total outflows from its launch date to $19.6 billion. The remaining five BTC ETFs remained neutral.

Trading volume for BTC ETFs jumped to $1.42 billion on Aug. 21, higher than the $1.35 billion seen on Aug. 20. These funds have recorded a cumulative net inflow of $17.56 billion since inception. At the time of writing, Bitcoin (BTC) was up 1.8% over the past day, trading at $60,788, per data from crypto.news.

Matt Hougan, Chief Investment Officer at Bitwise, points out that contrary to popular belief, it’s not just retail investors driving the increase in Bitcoin ETF adoption; instead, there’s substantial involvement from institutional investors as suggested by the data.

By the close of Q2 2024, institutional ownership in U.S. Bitcoin spot ETFs climbed to 24%, despite a challenging market and declining Bitcoin values. Notable entities such as Goldman Sachs and Morgan Stanley now hold approximately $412 million and $188 million respectively, in shares of these ETFs.

Over the last five days, I’ve noticed a steady stream of withdrawals totaling $17.97 million from the Ethereum-focused ETFs I’m invested in. August 21st was no exception to this trend.

Grayscale’s ETHE led the outflows once again, with $31.1 million leaving the fund, bringing its total outflows to the $2.5 billion mark since its launch on July 23. Meanwhile, Fidelity’s FETH, Grayscale’s ETH, and Franklin Templeton’s EZET were the only offerings to record inflows of $7.9 million, $4.2 million, and $1 million, respectively. The remaining five ETH ETFs saw no flows on the day.

On August 21st, the daily trading volume for these investment instruments increased to approximately $201.03 million, marking a slight surge compared to the previous day. So far, Ether exchange-traded funds (ETFs) have recorded a total net withdrawal of about $458.08 million. At the time of writing, Ethereum (ETH) was also experiencing an uptick of 1.3%, with its current market value standing at $2,633 per unit.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-08-22 11:14