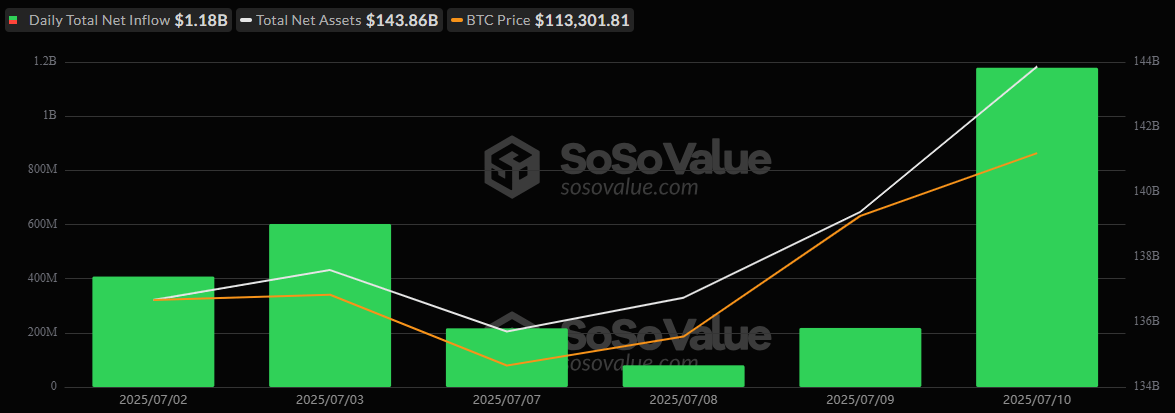

Oh my, oh me! 🤯 It’s a Bitcoin bonanza, folks! On Thursday, June 10, those clever Bitcoin ETFs (that’s Exchange-Traded Funds for you non-finance wizards) broke their 2025 record with a whopping $1.2 billion inflow! 💸 And, as if that weren’t enough, Ether ETFs joined the party with a tidy $383.10 million of their own. 🎉

It seems that seven ETFs were the life of the party, with Blackrock’s IBIT being the belle of the ball, pulling in a staggering $448.49 million. Fidelity’s FBTC was a close second, with $324.34 million, and Ark 21shares’ ARKB wasn’t far behind with $268.70 million. 🤩

But wait, there’s more! Other notable inflows came from Grayscale’s Bitcoin Mini Trust ($81.87 million), Bitwise’s BITB ($77.15 million), Vaneck’s HODL ($15.24 million), and Valkyrie’s BRRR ($3.21 million). It’s a regular ETF extravaganza! 🎊

Now, we know what you’re thinking: “Was it all sunshine and rainbows?” Well, not quite. Grayscale’s GBTC did register an outflow, but a paltry $40.17 million exit was hardly a drop in the bucket compared to the overwhelming inflows. Total trading volume soared to $6.31 billion, and net assets rose to a record $143.86 billion, with ETFs now representing 6.37% of bitcoin’s total market cap. 📈

And, as if all that weren’t enough, Ether ETFs saw a strong $383.10 million in net inflows, marking another day of significant traction. Blackrock’s ETHA led the charge with $300.93 million, followed by Fidelity’s FETH ($37.28 million), Grayscale’s Ether Mini Trust ($20.70 million), and ETHE ($18.89 million). 🚀

So, what does it all mean? Well, it seems that momentum is rising significantly, and institutional demand is showing no signs of slowing. In other words, it’s a wild ride, and we’re all just along for the ride! 🎢

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Hero Tale best builds – One for melee, one for ranged characters

2025-07-11 23:02