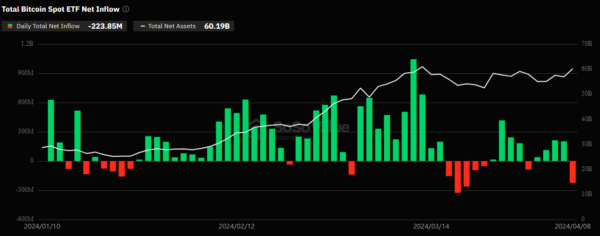

On Mondaysession, there was a substantial reversal for Bitcoin ETFs, moving from attracting over $223 million in investments to experiencing a large withdrawal instead.

According to SoSo Value’s report, last week’s Bitcoin ETF outflows represented the biggest drain in over two weeks. The preceding week experienced daily inflows worth almost $570 million, causing Bitcoin’s price to reach an all-time high of $72,000.

On Monday, a large amount of Bitcoin left the markets, resulting in a 6% decrease in daily trading volume and causing the price to drop back to $69,000. Among the Bitcoin Exchange-Traded Funds (ETFs), Bitwise experienced significant net inflows of approximately $40.3 million that day, while GBTC faced substantial outflows to the tune of about $303 million.

After the SEC gave its approval for ETFs in January, Bitcoin’s price fluctuations have significantly impacted the amount of money flowing into these investment tools. Looking ahead, major institutions are anticipated to increase their involvement, leading the London Stock Exchange to introduce Bitcoin ETNs by next month.

Some analysts, such as Anthony Scaramucci and Mark Plamer, are optimistic about Bitcoin’s near-term prospects, believing it will soar past $150,000 following the halving event. Contrarily, a poll conducted by Deutsche Bank reveals that one-third of investors anticipate Bitcoin’s price to fall below $20,000 before the end of the year.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Mech Vs Aliens codes – Currently active promos (June 2025)

- PUBG Mobile heads back to Riyadh for EWC 2025

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Arknights celebrates fifth anniversary in style with new limited-time event

- USD CNY PREDICTION

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2024-04-10 07:00