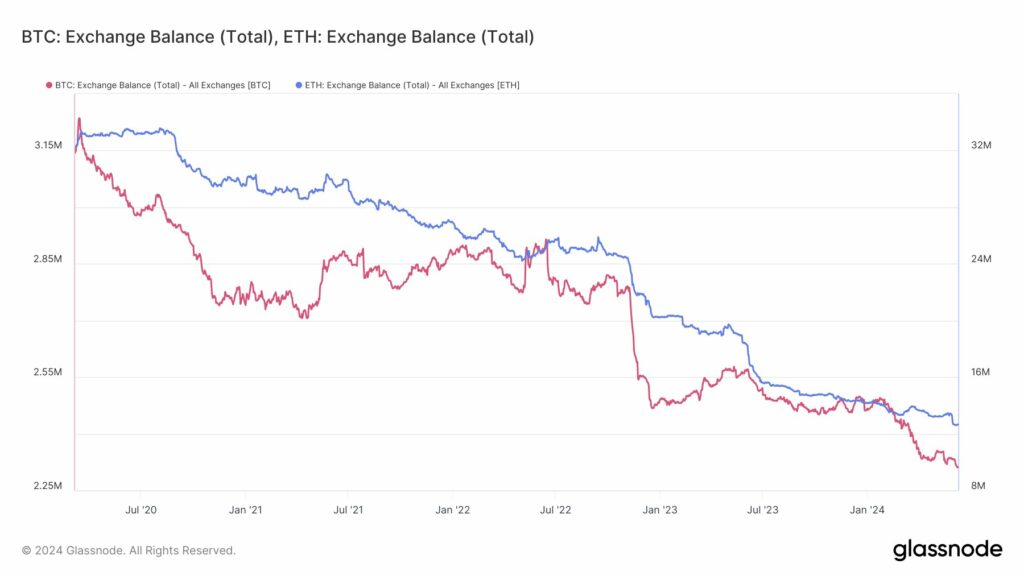

As a researcher with a background in cryptocurrencies and blockchain technology, I find the current situation of Bitcoin (BTC) and Ethereum (ETH) exchange balances dropping to four-year lows quite intriguing. The data from Glassnode reveals that investors have been holding onto their assets rather than selling them on centralized exchanges.

Bitcoin and Ethereum user balances have dropped to levels not seen since 2020.

According to Glassnode’s latest findings, the amount of Bitcoin (BTC) and Ether (ETH) held by users in centralized exchanges hit a four-year minimum. This indicates that investors are holding onto their cryptocurrencies in anticipation of price increases during the current bull market.

The quantity of Bitcoins in circulation decreased to approximately 2.3 million coins, which is equivalent to roughly $160 billion in value. On the other hand, Ethereum balances fell below 16 million tokens, translating to a value of under $59 billion.

Why Bitcoin and Ethereum exchange levels dropped

As a crypto investor, I’ve noticed that the quantity of Bitcoin (BTC) and Ethereum (ETH) held on cryptocurrency exchanges has been decreasing since before July 2020, based on data from Glassnode. This trend continued even during significant events such as the pandemic, the peak of 2021, the Terra-FTX contagion in 2022, and after the approval of spot Bitcoin ETFs. Users have been withdrawing their assets from these platforms consistently throughout this period.

Based on the four-year trend, it appears that crypto enthusiasts have embraced a positive, long-term perspective towards these assets. They remain optimistic about their value increase despite any market fluctuations.

Following the COVID-19 pandemic in 2020, economies around the world faced additional challenges with inflation. This economic instability led investors to seek refuge in technologically advanced assets. Bitcoin, due to its limited supply and unchangeable features, emerged as an attractive hedge against inflation. Even sovereign nations, such as El Salvador, have started recognizing Bitcoin as legal tender.

The bullish case for Bitcoin is strengthened as major financial institutions, such as BlackRock and Fidelity, increase their demand by investing in spot Bitcoin ETFs. Additionally, companies like MicroStrategy, led by Bitcoin advocate Michael Saylor, have poured large sums of money into Bitcoin.

I, as an analyst, would rephrase it as follows: With a market capitalization second only to Bitcoin, Ethereum holds significant weight in the crypto world and boasts a compelling investment case as the primary alternative to BTC. The token fuels the most extensive decentralized finance (DeFi) landscape valued at almost $70 billion, according to DefiLlama.

In the year 2020, developers initiated the Beacon chain, marking the beginning of the shift from proof-of-work (mining) to proof-of-stake (staking) as the method for securing the Ethereum network. This transformation enabled Ether holders to stake their coins, which involves keeping ETH tokens safely in the network to support its security and earn passive income.

As a crypto investor, I can tell you that approximately one quarter of Ethereum’s total circulating supply is currently being staked at the present moment. This equates to over $119 billion in Ethereum (ETH) value that users have locked away in reputable staking platforms such as Coinbase, Lido, and EigenLayer.

The excitement surrounding Ethereum ETF approvals, DeFi expansion, and staking increases has led to a optimistic perspective among cryptocurrency investors. This positivity has even inspired some to aggressively hold onto their Ethereum, a popular practice in the crypto world referred to as “hodling.”

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-06-10 21:52