As a seasoned researcher and crypto enthusiast with years of experience under my belt, I’ve seen the rollercoaster ride that is the crypto market more times than I can count. The recent dip in Bitcoin price, while concerning, isn’t entirely surprising given the market’s volatility.

Over the last fortnight, the value of Bitcoin and the overall cryptocurrency sector has experienced difficulties. As prices continue to drop, investors are shifting their assets towards exchange platforms.

On September 6, Bitcoin (BTC) dipped to a one-month low of approximately $53,000, intensifying the negative trend in the cryptocurrency market. The following day, BTC and other digital assets experienced over $295 million worth of liquidations.

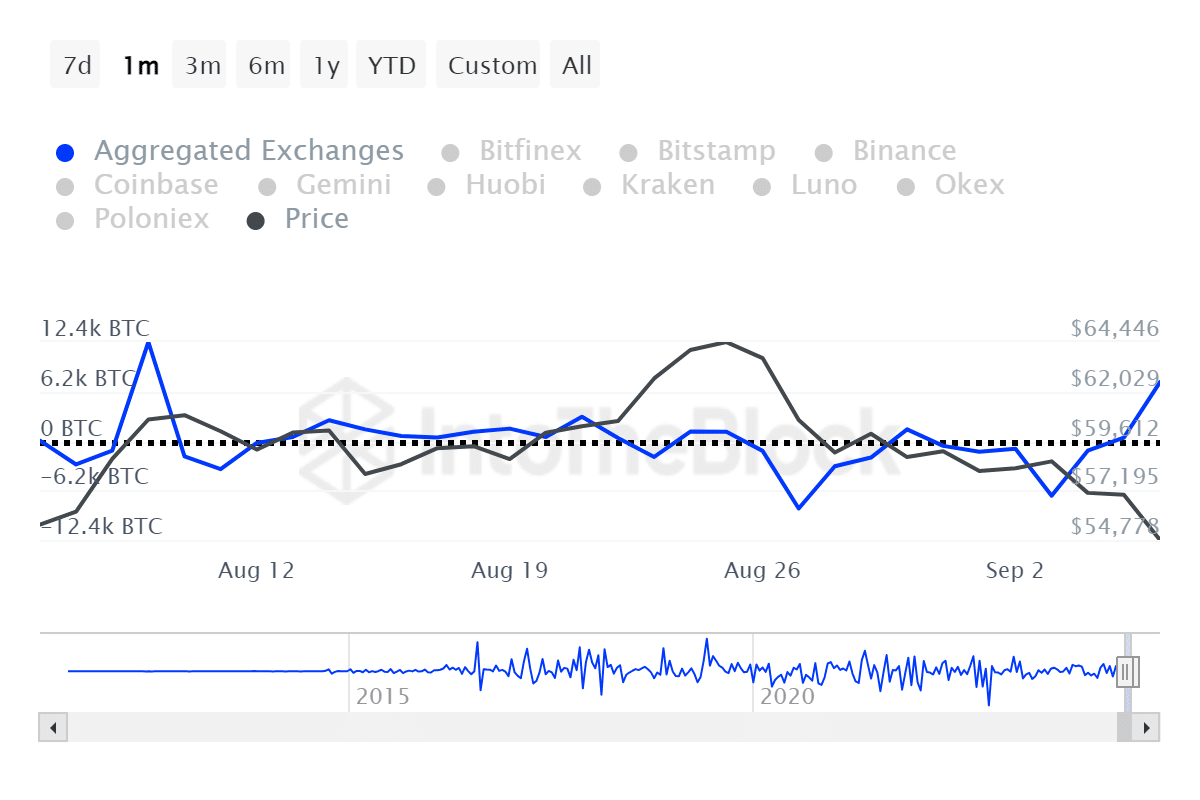

I’m excited to report that my Bitcoin investment saw a modest increase in value over the past day, contributing to the overall crypto market cap crossing the $2 trillion threshold. At the moment, BTC is trading at approximately $54,450, a 0.25% rise. However, it’s worth noting that this price point represents a 15% decrease from its recent peak of around $64,400 on Aug. 25.

Based on figures from IntoTheBlock, approximately 7,300 Bitcoins worth around $400 million were moved to centralized cryptocurrency exchanges when the Bitcoin price dipped below the $54,000 level.

As a crypto investor, I recently observed that the dominant digital currency experienced an influx of approximately 10,310 Bitcoins into its exchanges over the past month, which equates to over half a billion dollars ($560 million) at the time of reporting.

According to data from ITB, transactions involving whales (large investors) who traded at least $100,000 in Bitcoin collectively amounted to approximately $68 billion over the last seven days.

According to ITB’s data, the rate at which big investors are transferring Bitcoin to exchanges compared to the total exchange flow stands at 1.4%. This suggests that ‘whale’ investors are more actively moving Bitcoin in and out of exchanges than retail wallet users, as the price of Bitcoin decreases.

Significantly, individual retail accounts represent about 88.4% of all Bitcoin owners. On the other hand, fewer than 12% of all Bitcoin is stored in large “whale” wallets as per ITB data.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Maiden Academy tier list

- Castle Duels tier list – Best Legendary and Epic cards

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- The 15 Highest-Grossing Movies Of 2024

2024-09-08 14:50