Bitcoin Halving, an highly anticipated occurrence in the cryptocurrency world, is being closely watched by crypto fans worldwide as they anticipate significant price movements for Bitcoin (BTC), known for its extreme volatility, potentially reaching new record highs.

The historical record of bitcoin and other cryptocurrencies undergoing a halving reveals a significant price increase in a brief period following the event. Market experts argue that these occurrences have the capacity to shake up markets, causing digital currencies to either soar or plummet, ultimately leading to a transformation in the economic dynamics of the crypto sphere.

In this piece, we delve into the past of Bitcoin’s halving process and describe the series of bullish market conditions and inventions that propelled it to greater heights.

BTC Halving

In simpler terms, the reward for mining Bitcoin is automatically cut in half each time a new block is added to the blockchain by miners. This process, called halving, ensures that only 21 million Bitcoins can be produced in total. After approximately every 210,000 blocks (around four years), the reward for creating new blocks decreases by a certain percentage. Halving helps maintain Bitcoin’s value as a limited resource by regulating the amount in circulation and supply.

History of Bitcoin Halving

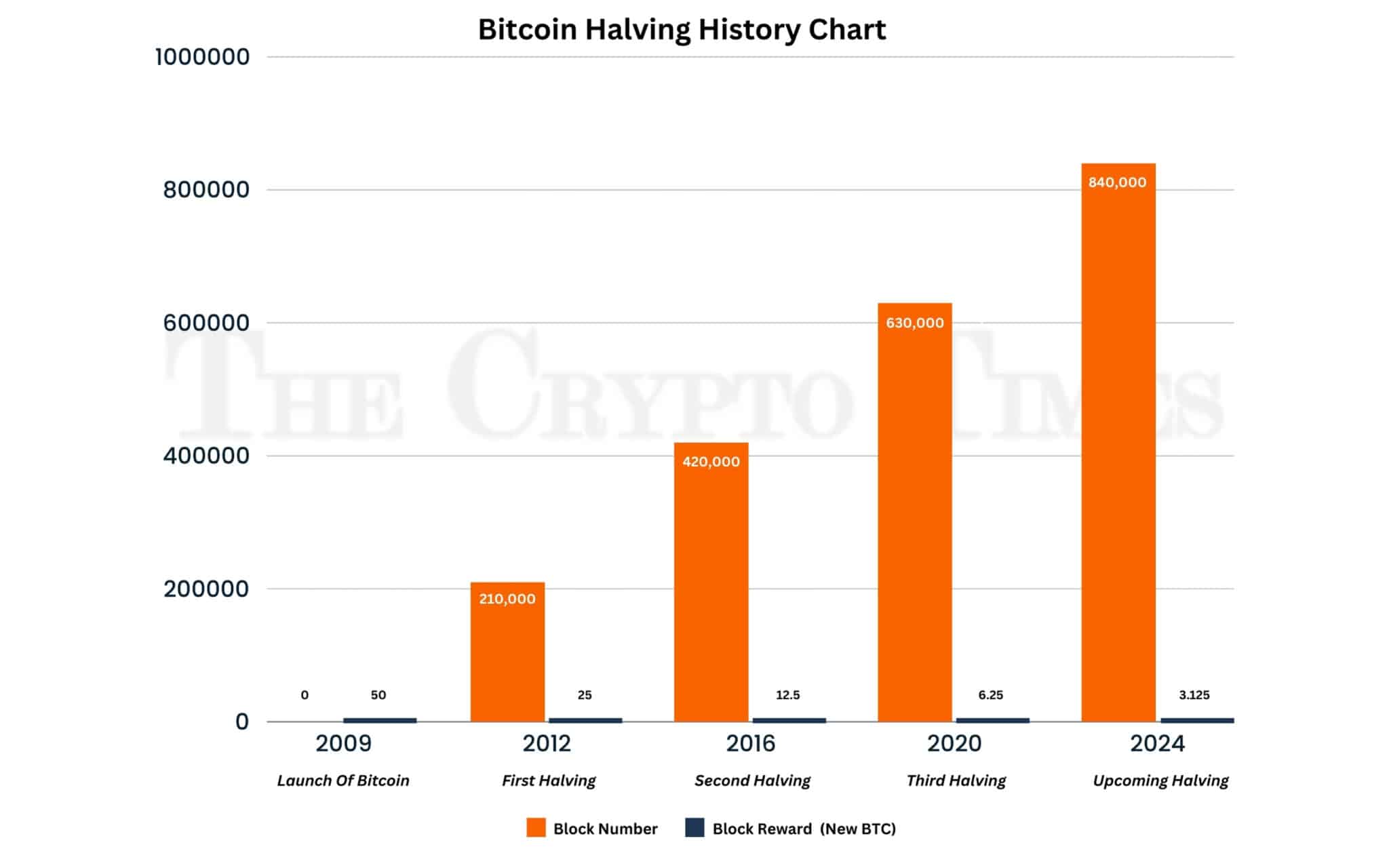

Starting from its debut in 2009, Bitcoin has undergone three halving cycles, which typically happen around every four years. The initial event took place in 2012, then came 2016, the most recent one was in 2020, and the next one is predicted to occur in 2024.

First Halving

The first reduction in Bitcoin rewards for miners occurred once the network had verified 210,000 blocks. This change resulted in a decrease from 50 to 25 BTC as the reward per block. At that moment, the value of Bitcoin was around $12 in the market. Following this event, there was an uptrend in Bitcoin’s price, which reached approximately $1,000 by the following year.

Second Halving

On July 9, 2016, at block 420,000, the second Bitcoin halving took place, decreasing the reward for mining new blocks from 25 to 12.5 Bitcoins. This reduction occurred when Bitcoin’s market price was approximately $650. After this event, Bitcoin experienced a remarkable increase in value. Its price climbed up to nearly $20,000 within the next 18 months, representing a tremendous gain of around 3,000%.

Third Halving

After the third Bitcoin halving on May 11, 2020, where the block reward was lowered to 6.25 BTC from 12.5 BTC at block 630,000, Bitcoin showed remarkable strength in the face of global economic instability. Its value saw a significant rise, reaching over $69,000 by April 2021 – a stunning 690% increase from its price before the halving which was around $9,000.

Fourth Halving

The bitcoin network is set to undergo its fourth halving on April 19, 2024, around block 840,000. This event will decrease the reward for mining new blocks from 6.25 to 3.125 bitcoins. With bitcoin currently trading at around $70,000, many believe the value will significantly increase following this halving.

Where will BTC reach post 2024 halving?

Based on historical trends, Bitcoin’s price is likely to continue rising, possibly reaching new heights of $100,000 or even $200,000 in the coming years. Institutional investment and growing public acceptance are driving this upward momentum. However, it’s important to note that predicting the exact price increase is difficult.

According to historical records, the rise in Bitcoin’s price seems to slow down after each halving, decreasing by around 3.5 to 3.9 times the growth rate experienced during the preceding halving period.

Based on this noticed trend, it’s possible that Bitcoin’s price will increase by approximately 100% to 200% from its lowest point before the 2024 halving event.

Despite the fact that Bitcoin’s past prices may provide some insight, it’s crucial to remember that they don’t guarantee future performance. Numerous elements have an impact on Bitcoin’s price fluctuations, such as investor sentiment, adoption rates, regulatory changes, and economic situations.

Currently, there are over 19 million Bitcoins in circulation, with around 2 million still waiting to be mined. However, it will take roughly a century to mine these last 2 million Bitcoins due to the Bitcoin halving process.

In around 128 years from now, the last Bitcoin halving is anticipated to take place. This event aligns with the mining of all 21 million Bitcoins that will ever exist.

As Bitcoin’s fourth halving approaches, the cryptocurrency world is buzzing with anticipation, poised to witness the impact of this event. With every halving, Bitcoin reinforces its role as the digital counterpart to gold, its restricted supply reflective of that precious metal’s scarcity.

Conclusion

Bitcoins value has a tendency to surge significantly following certain events, as history has demonstrated. This defies conventional market norms and brings about significant financial returns. However, Bitcoin signifies something deeper than just monetary profit; it embodies the decentralized concept, providing financial autonomy in an unpredictable world.

Moving forward in the aftermath of Bitcoin’s post-2024 halving, it’s evident that this digital currency’s journey is far from over. It’s a testament to human ingenuity, a groundbreaking development that has the power to redefine economies, uplift individuals, and fundamentally alter our perspective on money.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- USD CNY PREDICTION

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2024-04-15 14:45