As a seasoned crypto investor with over a decade of experience in this volatile market, I find myself constantly navigating through the ebb and flow of the digital currency landscape. The recent Bitcoin price action has been particularly intriguing, with Goldman Sachs’ investment in Bitcoin ETF shares worth over $400 million contrasting sharply with Morgan Stanley’s reduced holdings during the second quarter.

On Friday, the value of Bitcoin remained confined within a narrow band, reflecting a decline in trader and investor enthusiasm, while Goldman Sachs and Morgan Stanley showed contrasting views.

Bitcoin’s value hovered around $59,000, experiencing a nearly 7% decrease from its peak reached just recently. On the other hand, worldwide equities are poised for their strongest week in nearly nine months, with concerns about a potential recession subsiding.

Goldman Sachs invests in BTC

A key event in the Bitcoin market happened in this week’s filings by major American banks. Goldman Sachs, one of the most prestigious names on Wall Street, revealed that it had acquired Bitcoin ETF shares worth over $418 million.

Several well-known firms have chosen to invest in these funds, and Millennium Management – headed by Israel Englander – is among the largest institutional investors. Millennium, renowned as one of the world’s most successful hedge funds, manages assets totaling more than $68.2 billion. Englander himself is counted among the wealthiest individuals in America, with a net worth exceeding $12 billion.

Besides some other well-known financial institutions, such as Barclays, Nomura, HSBC, Bank of America, Jane Street, and Susquehanna, have also invested in Bitcoin Exchange Traded Funds (ETFs).

On the contrary, other financial institutions hold a differing perspective on Bitcoin. The leading institution among them is Vanguard, an asset management company that manages over $7.1 trillion in assets. Unlike competitors such as BlackRock, Franklin Templeton, and Invesco, Vanguard has chosen not to introduce spot Bitcoin ETFs, and has declined to provide Bitcoin and Ethereum ETF options to its clients.

It appears that Goldman Sachs and Morgan Stanley are showing contrasting stances regarding Bitcoin ETFs. Notably, Goldman Sachs has been increasing its investments in this area during the recent quarter, while Morgan Stanley has chosen to decrease its holdings.

As an analyst, I can confirm that Morgan Stanley continues to own shares of Bitcoin ETFs. In light of recent market fluctuations, we have encouraged our financial advisors to present these investment opportunities to our clients. The decrease in our holdings during the second quarter is primarily attributed to the significant drop in Bitcoin’s price.

Bitcoin price is sending mixed signals

There’s a split perspective among experts who analyze markets based on underlying principles (fundamental analysts) and those who focus on statistical trends and charts (technical analysts), regarding Bitcoin’s future trend in the upcoming months. Some, such as Wolfe Research, for instance, predict that the most likely direction for Bitcoin is downwards.

Some, such as Cryptonary, posit that Bitcoin could have several triggers in the near future, like the approaching fall season, the wrapping up of the U.S. presidential election, and the initiation of Federal Reserve’s reduction in interest rates.

During this period, the market is experiencing a consolidation, but we anticipate that both Q4 of this year and 2025 will be highly favorable for cryptocurrencies. Here are some key events that could significantly boost crypto in the near future:

— Cryptonary (@cryptonary) August 15, 2024

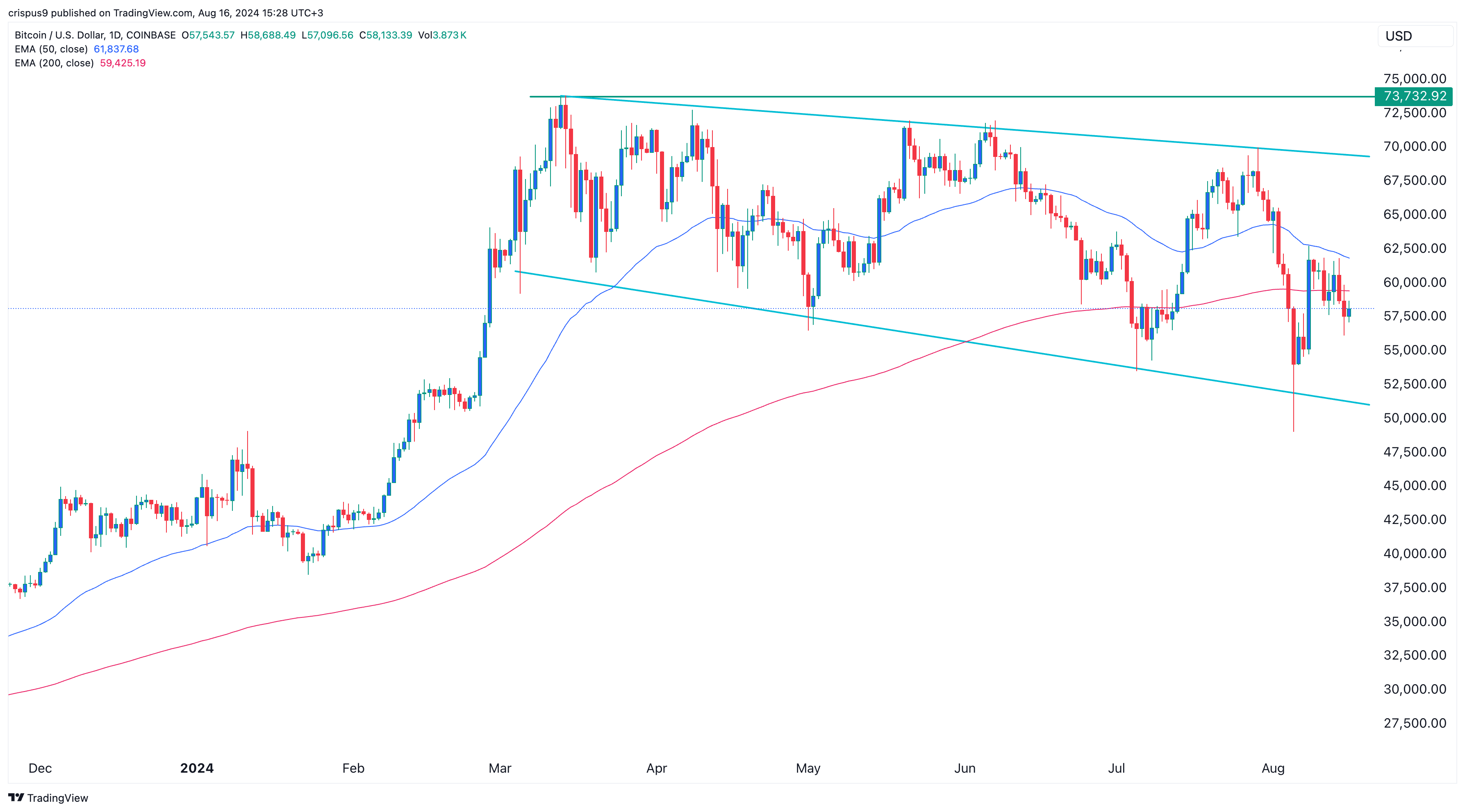

In simpler terms, Bitcoin’s value currently falls within an uncertain zone because it hasn’t surpassed its 200-day moving average yet. Moreover, a bearish trend signal, known as a “death cross,” has been formed due to a downward crossing of shorter and longer term average prices.

From a favorable perspective, the cryptocurrency is displaying a descending broadening wedge formation, which is often interpreted as a positive sign for bullish movements. However, this pattern will be validated only if the cryptocurrency manages to surpass its year-to-date high of $73,732.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-08-16 16:25