As a seasoned researcher with decades of experience observing financial markets and their trends, I find myself cautiously optimistic about Bitcoin’s current price rise. While the technical indicators suggest potential downside in the near term, history has shown us that Bitcoin, much like other high-value assets, can defy expectations and continue to climb.

On August 6th, Tuesday saw an increase in Bitcoin‘s price, with certain investors seizing the opportunity for a drop in cost and a general tranquility arising among crypto and stock market participants.

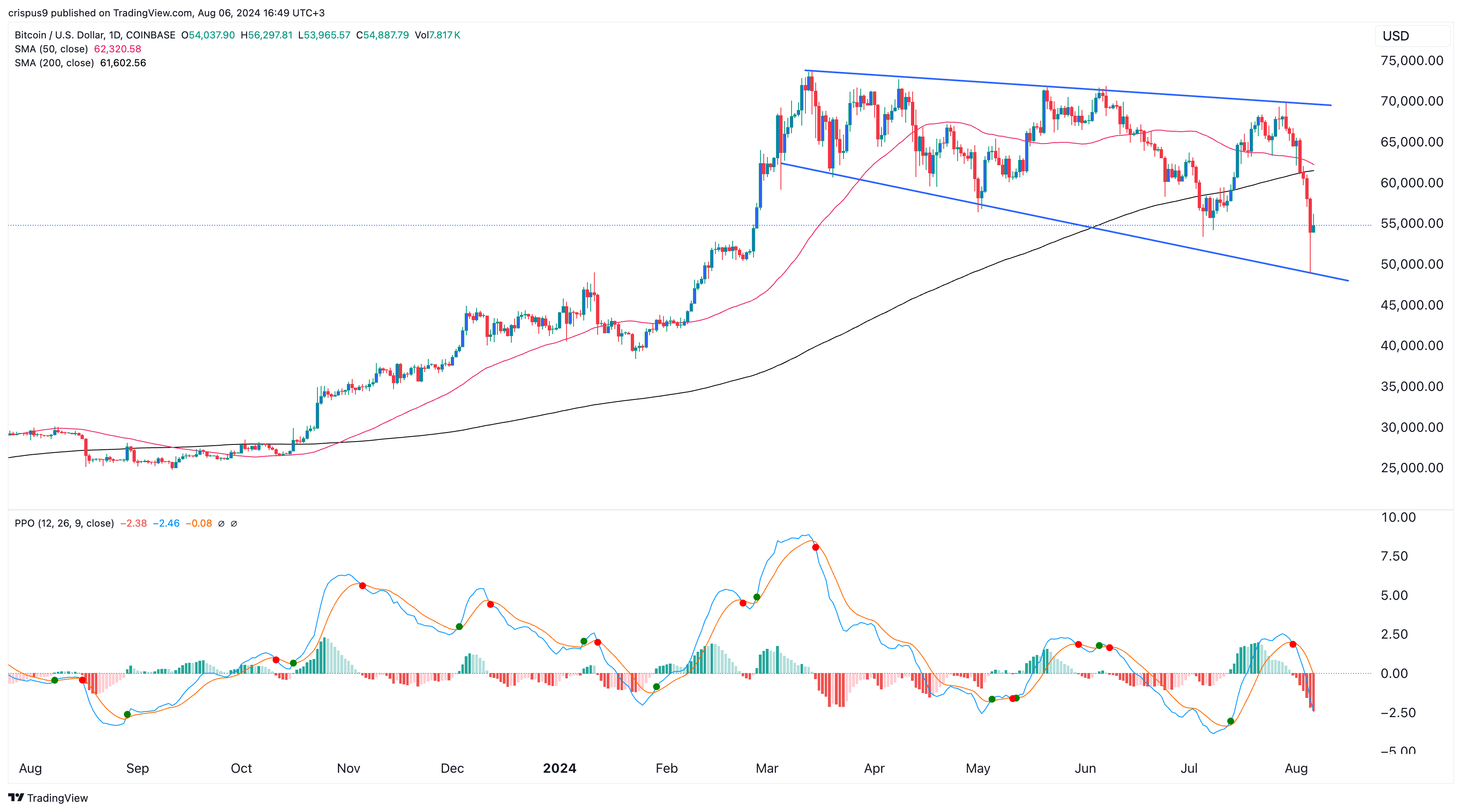

Bitcoin price nears a death cross

As a researcher observing the cryptocurrency market, I noticed that on August 6th, Bitcoin (BTC) surged to an intraday peak of $56,000. However, it encountered significant resistance at this level. This price surge was likely fueled by some investors, including those within the Exchange Traded Fund sector, who took advantage of the market dip and made purchases.

While it’s currently unclear if these profits will persist over an extended period, a potential “death cross” on the daily chart could indicate further declines. The 200-day and 50-day Simple Moving Averages are approaching a pattern where the shorter one dips below the longer one, which historically has been followed by downward trends.

In simpler terms, Bitcoin’s value continues to stay beneath the Ichimoku cloud, and the Percentage Price Oscillator (PPO) is below its neutral threshold. The PPO, similar to the Moving Average Convergence Divergence (MACD), determines the gap between two moving averages, but it expresses this difference as a percentage value.

In simpler terms, these technical signals suggest a possible price decrease in the short term. If the price falls beneath Monday’s lowest point of $49,000, which represents the bottom end of a ‘hammer’ candlestick pattern, it would confirm a full bearish breakout.

Black Swan author warns on Bitcoin

Currently, some influential figures are expressing doubts about the purpose of Bitcoin. For instance, in an interview on CNBC, Nassim Taleb – author of “The Black Swan” – cautioned that Bitcoin does not serve as a safeguard against anything.

As a researcher, I observed that the coin functions similarly to high-end Manhattan real estate, exhibiting speculative characteristics.

For quite some time, Taleb has been vocal about his criticism towards Bitcoin. In the year 2022, he explained that the currency’s rising fame could be linked to the Federal Reserve’s sustained low-interest rate policy for a decade. According to him, this situation resulted in the formation of bubbles and tumors similar to Bitcoin.

Nassim Taleb isn’t the sole influential figure cautioning about Bitcoin; Peter Schiff persistently argues that Bitcoin holds no value, and he believes it would be illogical for governments to maintain it as a reserve asset.

The bill put forward by @SenLummis suggests that the U.S. government should establish a “Bitcoin Reservation” by acquiring 1 million Bitcoins to hold onto for a period of 20 years. This bill compels the Federal Reserve to print money to finance this acquisition. In essence, Senator Lummis’s proposal aims to induce inflation in order to purchase Bitcoin.

— Peter Schiff (@PeterSchiff) August 5, 2024

In a statement made on August 6th, Kathleen Breitman, one of the founders of Tezos (XTZ), cautioned that the function of Bitcoin as a means for storing value is under threat.

Over the years, it remains to be seen if Peter Schiff’s and Nassim Taleb’s Bitcoin price forecasts are accurate. However, they, along with other skeptics, seem to have overlooked a significant asset that started at virtually nothing in 2009 and is now worth $55,000. In contrast, gold, a favorite of Schiff, has only doubled from $1,000 to $2,400 during the same timeframe, representing a growth of merely 115%.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- The 15 Highest-Grossing Movies Of 2024

- Mech Vs Aliens codes – Currently active promos (June 2025)

- USD CNY PREDICTION

2024-08-06 17:57