As a seasoned crypto investor with a keen interest in Bitcoin’s market trends, I find the recent price decline below $67,000 disheartening. The intraday high of around $67,600 was a promising sign, but the subsequent 0.7% drop to $66,500 and the failure to hold above the crucial resistance level is concerning.

The price of Bitcoin (BTC) has dipped back beneath the significant threshold of $67,000 following a brief peak at approximately $67,600 during the trading day.

I’ve analyzed the cryptocurrency market and found that Bitcoin (BTC) experienced a 0.7% decrease in value over the past 24 hours, currently priced at $66,500 as of now. The digital asset hovers precariously near the $1.3 trillion mark for its total market capitalization. Notably, Bitcoin’s daily trading volume has surged by 40%, reaching a significant level of $22.2 billion.

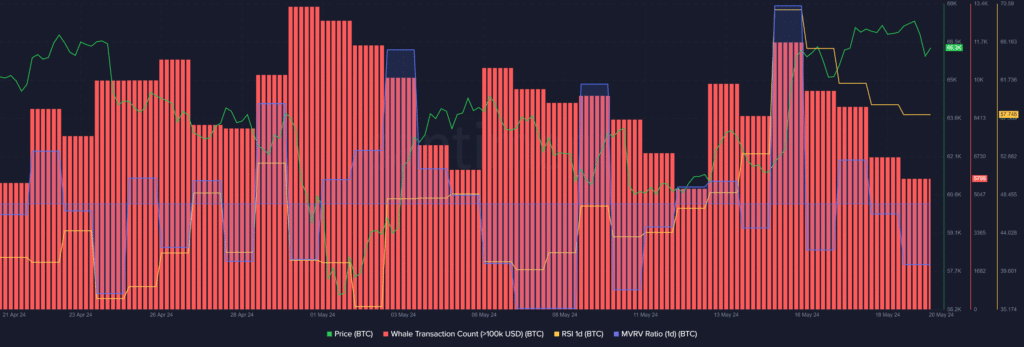

As an analyst, I’ve observed that the recent significant drop in Bitcoin (BTC) prices coincides with a substantial decline in whale activity. Based on data from Santiment, the frequency of whale-sized transactions, which involve over $100,000 worth of BTC, has decreased by approximately 51% during the past five days. The number of such transactions dropped from 11,757 daily occurrences on May 15 to only 5,756 unique transactions at the time of reporting.

As a crypto investor, I’ve noticed that the Bitcoins Relative Strength Index (RSI) has been mirroring the asset’s recent trend with a consistent decline. According to market intelligence data, the Bitcoin RSI dropped from 70 to 57 in just five days.

Based on the data, Bitcoin seems to have moved away from being overpriced. A possible increase in its value may occur subsequently.

As a crypto investor, I’d interpret the current situation as follows: With large investors, or “whales,” displaying less activity at this price level and the Relative Strength Index (RSI) indicating a potential trend reversal, it seems plausible that Bitcoin’s volatility could decrease significantly. In simpler terms, the market might become calmer, making price swings smaller for the leading cryptocurrency by market capitalization.

Based on Santiment’s data, the Bitcoin Market Value to Realized Value (MVRV) ratio currently stands at a level of 143% or 2.86 times the original purchase price for all Bitcoins in circulation. This signifies that the average cost basis for all previously owned Bitcoins has risen by an amount equivalent to 143%.

Furthermore, the Bitcoin MVRM (Market Value to Realized Value) ratio dropped to 146% in the previous three days. Traditionally, Bitcoin investors tend to postpone selling their coins until there’s a significant price increase once this ratio decreases.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-05-20 10:40