- Ah, the heart of the matter: Crypto capital inflows have skidded down like a sleigh on ice—plummeting 70% within a mere fortnight, yet fear clings stubbornly like a guest who won’t leave.

- Amidst the retail retreat, Bitcoin ETFs stride boldly forward, proving institutions sometimes have nerves of steel (or just better footwork).

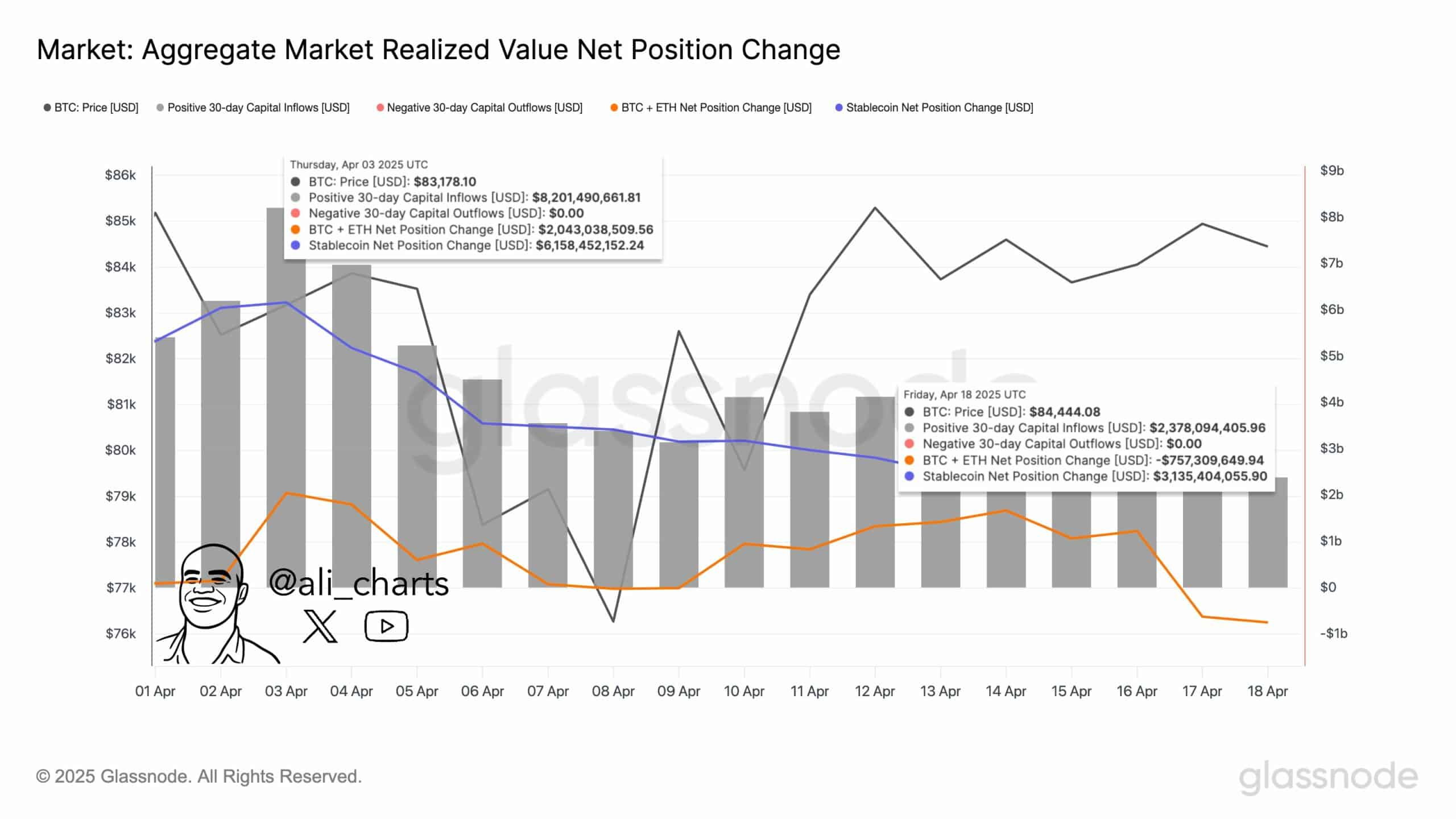

Imagine, if you will, a mighty river of coins, once gushing with $8.2 billion on the 4th of April, now reduced to a meek trickle of $2.38 billion by the 18th. Such is the tale of capital flowing into the crypto market, suddenly hemmed in by the frost of uncertainty.

This abrupt freeze in enthusiasm speaks of investors wrapped tightly in their overcoats, shivering beneath the storm clouds of volatility and the unrelenting gale of macroeconomic pressures.

What once was a dance of daring and fortune now slows as merchants—both grand and modest—hesitate, their appetites for risk tempered by the chill in the air.

The earlier part of the year may have been a grand ball, with market spirits buoyant and optimistic; yet the present hour finds these players questioning their fortunes, peering anxiously at the wider, gloomier horizon.

The Grip of Fear: A Market Caught in Its Own Reflection

The sentiment, like an old clock’s pendulum caught between ticks, holds firm at a score of 33 on the Fear and Greed Index—comfortably nestled in the “Fear” chamber, unable or unwilling to move.

An unchanging figure for weeks: 32, then 31—not unlike a stubborn mule refusing to budge from its path. Buyers stand hesitant, their hands quivering between hope and doubt.

History, that stern old teacher, reminds us that such prolonged fear can precede flourish or famine—rebound or collapse—but this moment bears the air of indecision rather than despair.

The market watches and waits, as if for a signal from the heavens or a whisper from economic omens, before daring to leap again.

Inflation’s Specter: The Shadow Chilling Crypto Confidence

Meanwhile, the specter of inflation marches ever onward. Like an uninvited guest overstaying his welcome, 1-year inflation expectations have climbed 1.7 points in April alone, reaching 6.7%—a height last seen when bell-bottoms were fashionable and disco ruled the night.

Four months in a row of such ascent; a total gain of 4.1 points since November, like a balloon ascending, threatening to burst.

The 5-year outlook stands grimly at 4.4%, towering like an ancient oak since June 1991. Consumer spirits, meanwhile, have slumped as if caught in the rain without an umbrella.

Together, these numbers conjure the dreadful tale of stagflation, sending crypto—ever the volatile wild colt—into a frenzied dance of fear.

Bitcoin ETFs: The Stoic Knights in Shining Armor?

But hark! Amid this murky tableau there flickers a brighter flame. On 17th April alone, Bitcoin ETFs saw a noble $107 million ride into the arena, swelling the monthly total to $156 million.

Over the past quarter, these net inflows have surpassed $1 billion, a sign that some institutions have not entirely fled the battlefield but are holding their ground with steely resolve.

While Ethereum ETFs merely twitched and stammered, Bitcoin shows itself the steadfast champion—the “safe” fortress in a tempest.

Perhaps, these steady injections may temper the market’s panic and delay the plunge into despair.

The Road Ahead: Crypto’s Fate Lies in Patient Hands

The sudden halt in capital rains and the lingering chill of fear reveal a crowd growing cautious, eyes darting for signs of shelter and sunnier skies.

Yet the persistent stream of institutional funds through ETFs whispers a tale of hope and endurance. This is no abandonment but a pause—a market catching its breath amid the storm.

Should inflation’s breath slow and public mood brighten, the crypto world might yet awaken from its frostbitten slumber, ready once more to dance with fortune.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Hero Tale best builds – One for melee, one for ranged characters

- Every Upcoming Zac Efron Movie And TV Show

- Grimguard Tactics tier list – Ranking the main classes

2025-04-20 23:08