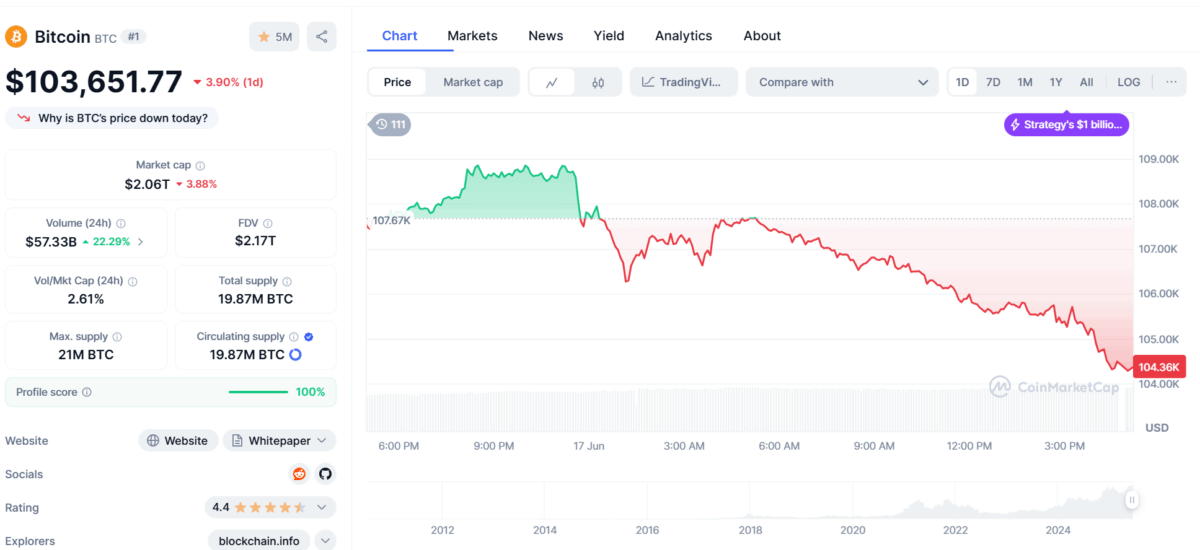

If you’ve ever wondered how fast money can turn into an existential crisis, you only had to watch Bitcoin today as it slipped beneath $105,000 like a banana peel under a real estate agent at an open house. One minute you’re riding high at $109,000, conjuring visions of Lamborghinis and NFT art installations; the next, you’re at $103,651, desperately searching CoinMarketCap for some reassurance and perhaps a coupon for therapy. It’s nearly a 4% drop in 24 hours, Bitcoin’s seventh straight day as a financial hemophiliac. And yes, in case you were wondering, that’s even too volatile for the people who get excited about mayonnaise-flavored Oreos.

Apparently, market panic is the new brunch. In just about the same amount of time it takes to lose an argument on Twitter (that is, one hour), the crypto-verse managed to liquidate more than $100 million. That’s a lot of imaginary money to vanish, even for folks who genuinely believe in Dogecoin as a retirement plan. Everyone’s asking “what’s going on?” which is also the subtitle to every family group chat during Thanksgiving.

Bitcoin Market Manipulation—Because Reality Was Getting Boring

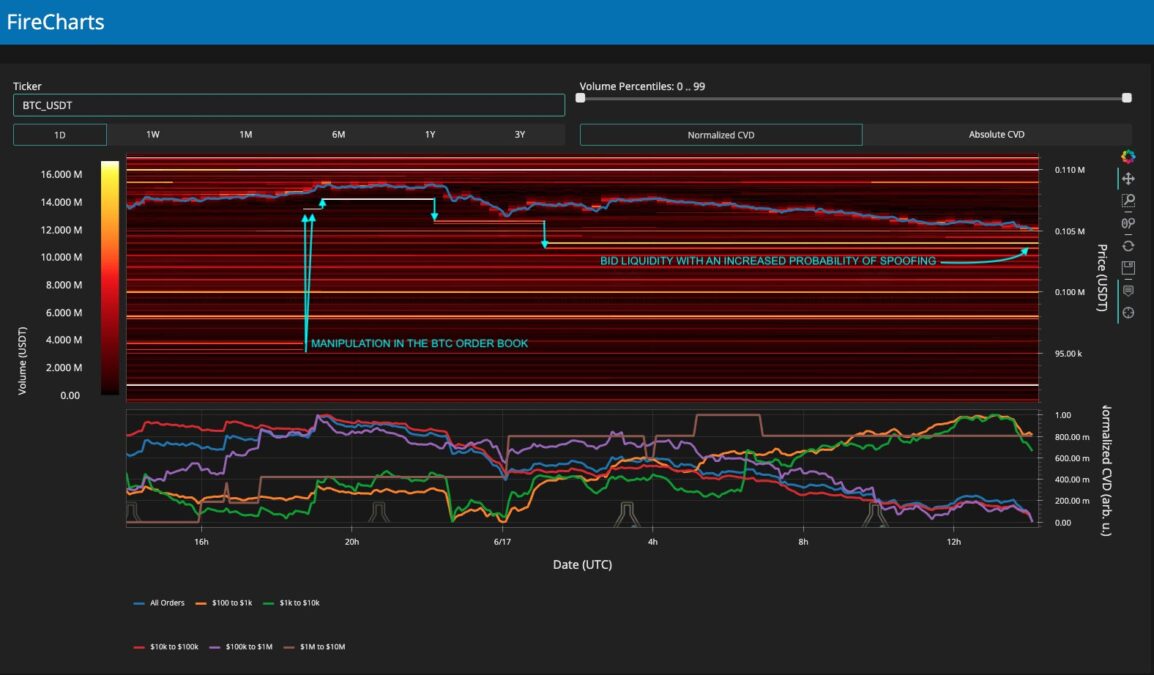

According to a crypto analyst named Material Indicators (because apparently Satoshi Nakamoto was too subtle), “This is what manipulation looks like in the $BTC order book.” He might as well have waved a red rag at a bull—or at a Reddit moderator. Material Indicators notes a suspicious shift in liquidity, warning that if Bitcoin drops below $105,000, it might just do a full David Copperfield and disappear at $104,000. Cheers to the blockchain, where even your money ghosts you.

What’s behind this, you ask? Well—spoofing, for one: placing big trades and pulling them back for maximum confusion. Basically, it’s catfishing for finance bros.

Another trader, named Stew because the crypto crowd has the best usernames, says that despite the sell-off, the market isn’t exactly panicking—it’s just letting out a slow, haunted sigh. As Stew (probably not his real name but wouldn’t it be great if it was?) points out, traders aren’t going full Shakespearean sorrow—there’s still “a big move brewing.” Translation: They’re not sure if this is the bad breakup or just pre-breakup drama.

Meanwhile, the U.S. dollar decided to flex after being ignored for weeks, putting pressure on Bitcoin just as gold stumbled and oil got dramatically expensive. Evidently, world events—particularly the Israel-Iran saga—are playing financial Jenga with everyone’s portfolio.

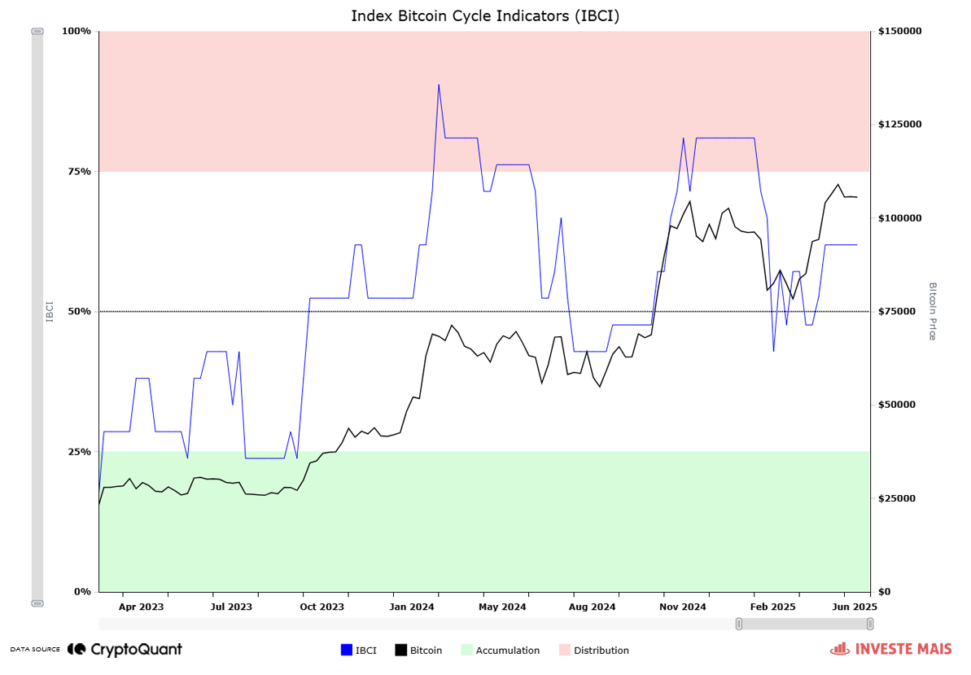

But wait, hope comes in the form of a tool called IBCI (which probably stands for “I Believe Crypto’s Invincible,” but actually just tracks blockchain data). Analyst Gaah—another name, another mystery—says the IBCI has “stabilized in the 50% range,” which analysts say is neutral, but the rest of us hear as “the universe has not made up its mind.”

Here’s the punchline: Bitcoin hit its all-time high of $112,000 as recently as May 22, which honestly feels like three marriages and a haircut ago. Analysts say this is only the beginning. Sure, there’s a war, market chaos and some extra spicy macroeconomics, but don’t worry: Bitcoin will eventually outperform everything—including your therapist’s patience.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Hero Tale best builds – One for melee, one for ranged characters

2025-06-17 20:53