Bitcoin’s mining difficulty achieved a record high of 86.4 trillion amid upcoming halving in April.

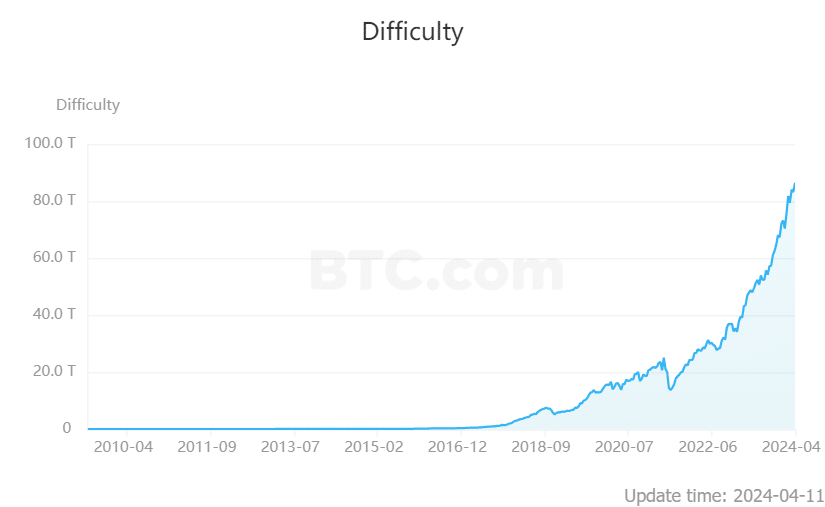

According to data from btc.com, the mining difficulty for Bitcoin (BTC) reached an all-time high of 86.4 trillion, with companies ramping up their computing power in preparation for the upcoming bitcoin halving event scheduled for later this month.

The mining difficulty is a measure of the computational power necessary to solve the intricate math problems essential for releasing new Bitcoins into circulation. With Bitcoin set for an upgrade on April 20, the most recent mining difficulty report represents the last piece of information prior to the upcoming halving event.

Based on data from btc.com, the mining difficulty for Bitcoin has surged approximately 600% since the last halving in 2020. Furthermore, there has been a steady increase in mining difficulty since May 2021.

Bitcooin miners are working harder than ever before to add computing power, in preparation for decreased rewards and increased cash reserves. These rewards, derived from mining new blocks, serve as a primary income source for miners. Soon, the reward will shrink to 3.15 Bitcoins, while daily Bitcoin issuance will be cut in half from 900 to 450 coins.

Bitcoin halving could trigger short-term market decline

Historically, according to CoinMarketCap, Bitcoin (BTC) has experienced declines ranging from 15% to 40% prior to a halving event. After the code change, there is typically a prolonged increase in its value. Nevertheless, Bakhrom Saydulloev, Mercuryo’s product lead, cautions that a short-term to medium-term price correction could occur due to miners selling off their Bitcoin.

After a Bitcoin halving, historical information indicates that prices often drop initially. However, over the longer term, these decreases have frequently set the stage for significant price increases, or bull runs. Miners, who receive 50% fewer rewards after a halving, may be forced to sell some of their Bitcoins to meet expenses, potentially leading to a market downturn as uncertainty about future price directions grows among investors.

Bakhrom Saydulloev, Mercuryo product lead

Saydulloev added his perspective, noting that past bitcoin halvings took place when economic conditions and investment opportunities were more favorable. He pointed out the current unclear situation regarding crypto regulations as a contrast. However, there’s a widespread belief that the availability of Spot Bitcoin ETFs could draw more funds into cryptocurrency. These ETFs have already accumulated over $200 billion in trading volume within just a few months.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- USD MXN PREDICTION

2024-04-11 21:15