As a seasoned crypto investor with over a decade of market experience under my belt, I must say that the recent surge in Bitcoin mining stocks and the overall crypto market has certainly piqued my interest. The Federal Reserve’s decision to slash interest rates by 50 bps is a welcome move, as it indicates a more accommodative monetary policy stance, which historically has been favorable for risky assets like cryptocurrencies.

In the early trading hours, shares of Bitcoin mining companies surged more than 5%, due to the fact that the Crypto Fear & Greed Index moved out of the ‘fear’ category.

As an analyst, I observed a notable surge in the share prices of various mining companies today. Mara Holdings, the market-leading miner, experienced a nearly 6% increase, peaking at $16.7. Remarkably, Riot Platforms’ stock followed suit, rising by 5.3%, while Argo Blockchain mirrored this trend with a 5% climb. Additionally, companies such as CleanSpark, TeraWulf, and Core Scientific demonstrated similar price action in the market.

The improvement in sentiment within the cryptocurrency sector led to this recovery. Notably, the widely monitored Crypto Fear & Greed Index reached a neutral score of 44, which is its highest point in about two weeks.

On this particular day, many cryptocurrencies showed an upward trend. Bitcoin (BTC) surpassed $63,000, while Ethereum (ETH) reached $2,500. Over the past week, these two digital coins have increased by approximately 8% for Bitcoin and about 4% for Ethereum.

This price movement occurred alongside a robust recovery of the stock market. For instance, Dow Jones futures surged by 1.33%, and the Nasdaq 100 index, which is primarily tech stocks, increased by 417 points. In contrast, government bond yields decreased, and the U.S. dollar index retreated as well.

Federal Reserve slashed interest rates

On Wednesday, the Federal Reserve reduced its interest rates by 0.5 percentage points, aiming for a gentle economic slowdown rather than a hard crash. Moreover, they suggested that further rate reductions might be forthcoming, particularly if the U.S. economy continues to report subpar employment figures.

Other major banking institutions have been reducing interest rates as well. For instance, the European Central Bank has made reductions on two occasions, and the Bank of England has suggested that they may lower rates again during their last two gatherings this year.

In this current scenario, global central banks have entered a fresh era, as they’ve increased interest rates to levels not seen in several decades due to the surge in inflation following the pandemic. Typically, risky assets thrive when the Federal Reserve and other central banks adopt a more accommodating stance, causing funds to shift from low-yielding government bonds.

Still, it is too early to predict whether the gains in Bitcoin mining stocks will hold. Their price action will depend on how Bitcoin trades in the coming months.

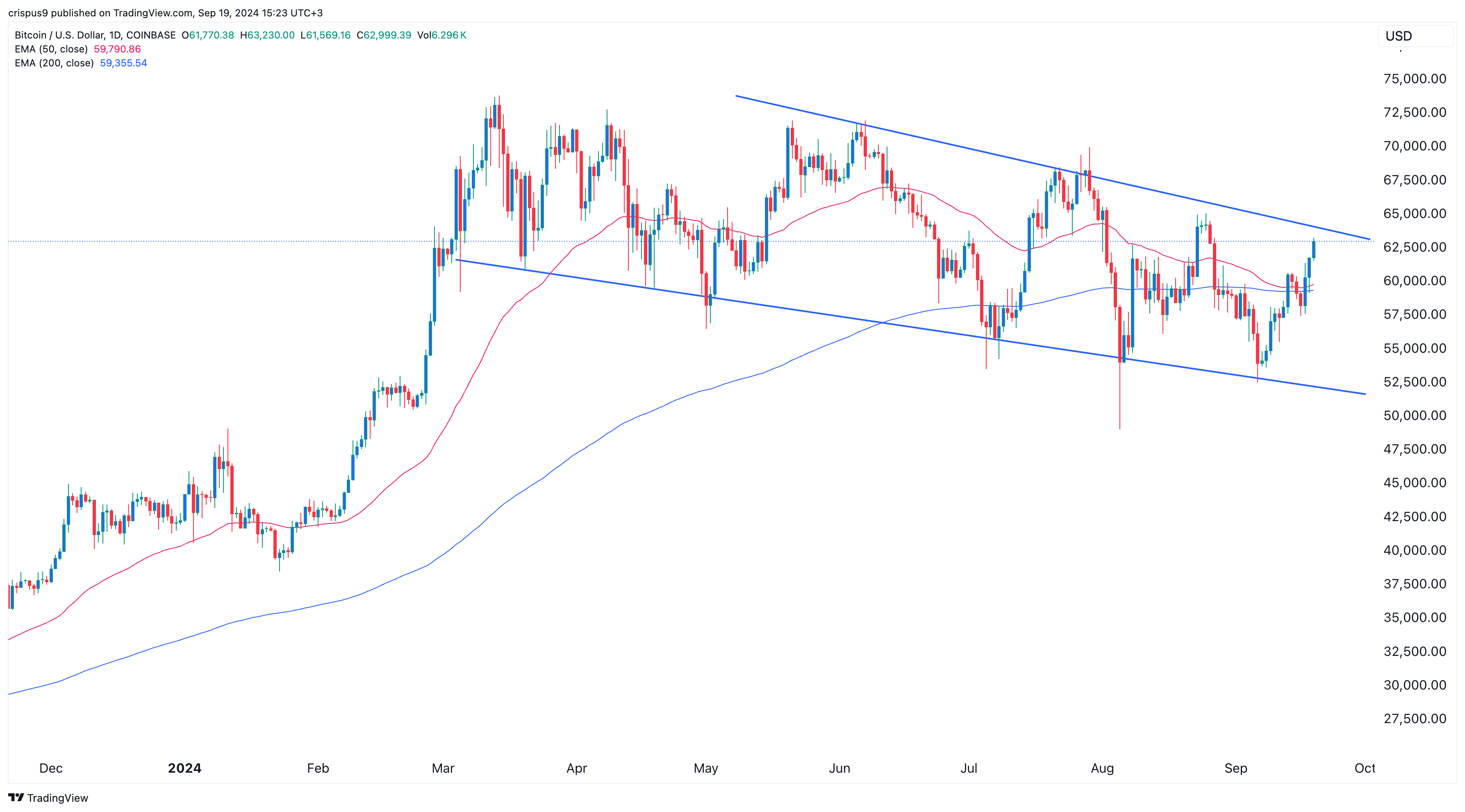

From a favorable perspective, Bitcoin has managed to steer clear of a bearish death cross chart configuration. Instead, its value has climbed above both the 200-day and 50-day moving averages, indicating a promising outlook for the cryptocurrency. Additionally, it has developed the three white soldiers candlestick pattern, which is created when there are three consecutive bullish price movements or ‘candles’.

Bitcoin is nearing the top boundary of its downward trendline. If it surpasses this level, it might indicate further price increases, potentially benefiting mining stock investments.

Read More

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

2024-09-19 15:54