As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market fluctuations and trends. The recent downturn in Bitcoin mining stocks, as highlighted by the performance of Marathon Digital, CleanSpark, Riot Platform, and others, is a classic example of the cyclical nature of the markets.

Bitcoin mining stocks trended lower as volatility in the cryptocurrency continued.

On August 28th, Marathon Digital, the largest mining company, experienced a 2.3% decrease, representing a 38% drop from its peak this month. CleanSpark’s stock decreased by 1.75% to $11.25, while Riot Platform saw a decline of over 1.4%. Similarly, other significant Bitcoin (BTC) mining stocks such as Argo Blockchain, Core Scientific, TeraWulf, and Cipher Mining also witnessed decreases.

A significant number of these shares are still experiencing a prolonged downturn, having dropped more than 20% from their peak value this year.

The way their success is linked is that it largely depends on the fluctuations in Bitcoin’s value since March. After reaching an all-time high of $73,800, Bitcoin has dropped by approximately 18.78% to currently stand at $60,000. Typically, Bitcoin miners tend to prosper when Bitcoin is increasing in value, and conversely, they struggle during periods of decline.

Furthermore, these businesses have faced challenges following the Bitcoin halving incident in April, leading to an increase in the mining hash rate. Consequently, many of them have been mining fewer Bitcoins compared to their pre-halving production levels.

In March, Marathon Digital mined 894 coins, followed by 692 in July. CleanSpark also saw a similar pattern with 806 coins in March and 494 in July. Meanwhile, Riot Platforms produced 425 coins initially, then 370 in July.

Consequently, these firms are dealing with twofold challenges: reduced output from mining activities and a drop in Bitcoin’s market value.

In a unique approach to the current predicament, some entities, like Bitfarms – a prominent Canadian miner – have chosen expansion as their strategy. This month, Bitfarms made an acquisition of Stronghold Digital, its rival. Furthermore, Riot Platforms has shown interest in Bitfarms and has now become one of its major stockholders.

Marathon Digital recently began mining Kaspa (KAS) and has been increasing its ownership of Bitcoin. Just last week, it purchased $249 million worth of Bitcoin, positioning itself as the second-largest corporate Bitcoin holder following MicroStrategy.

Bitcoin price to support mining stocks

The cost of shares for Bitcoin mining companies is mainly influenced by the fluctuations in the value of Bitcoin itself. Various factors might cause an increase in Bitcoin’s worth.

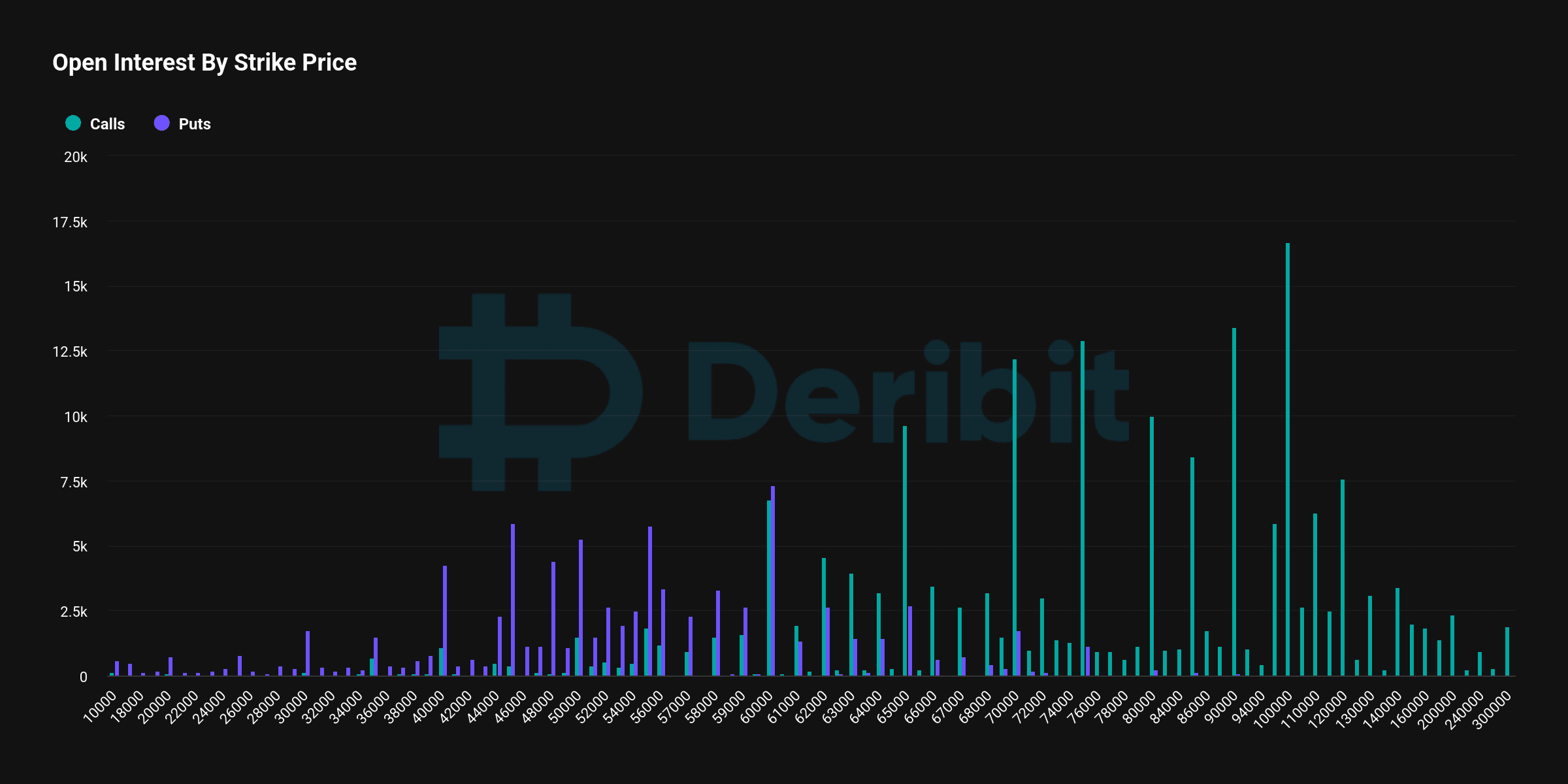

93% of the call options for the August 30 expiration are currently worthless, as their strike prices exceed $60,000, meaning the holders have no financial incentive to exercise the right to purchase the underlying asset.

Looking ahead, there’s an indication from the options market that a significant rise to around $90,000 might occur before this year ends.

Despite experiencing outflows of $127 million on August 27th, Bitcoin-related ETFs have amassed over $17.95 billion this year. Currently, Blackrock’s ETF holds over $22.2 billion in assets, while Fidelity’s fund stands at approximately $11 billion, poised to surpass Grayscale’s Bitcoin Trust soon.

Some possible triggers for Bitcoin could be the anticipated reduction in interest rates by the Federal Reserve, a possible win by Donald Trump in elections, the end of summer, escalating U.S. debt levels, and growing institutional interest.

If the conditions for these catalysts line up and Bitcoin recovers, it’s likely that many stocks associated with Bitcoin mining will see a significant increase as well.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2024-08-28 16:20