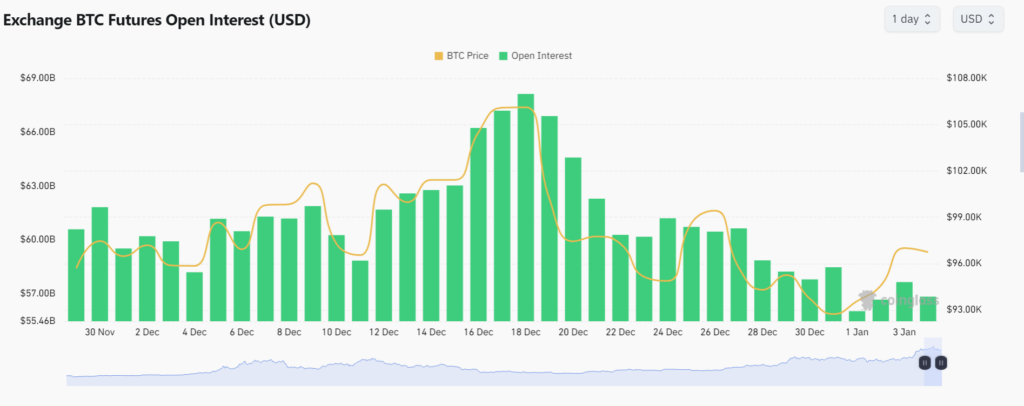

As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous market cycles and trends. The recent drop in Bitcoin futures open interest to $56.6 billion is indeed a concern, especially considering its peak at $68.13 billion just last month.

From my perspective, this decline suggests a shift in investor sentiment, possibly due to regulatory uncertainties or macroeconomic factors. It’s important to remember that the crypto market is highly volatile and susceptible to rapid changes in perception.

However, it’s not all doom and gloom. If history serves as any guide, such downturns have often been followed by periods of recovery and growth. In fact, I recall a time when some people doubted the potential of the internet and its impact on our lives, yet look at us now!

As for the current situation, it’s crucial to keep a close eye on key players like CME, Binance, and Bybit. Their significant contributions to Bitcoin futures open interest could potentially indicate future trends.

Lastly, let me leave you with a bit of humor to lighten the mood – Remember when people used to say “What’s up with Bitcoin?” Now it seems to be more like “What’s down with Bitcoin?” Jokes aside, I believe in the resilience and potential of this revolutionary technology. It’s just a matter of time before we see Bitcoin soaring again!

As a researcher, I’ve observed a significant decline in Bitcoin futures open interest, dropping to approximately $56.6 billion. This drop was initially noticed at the beginning of 2025. Regrettably, since then, the Bitcoin Open Interest (OI) has struggled to regain its footing and has returned to its all-time high (ATH) reached in November.

Despite hints of recovery, Bitcoin Open Interest (OI) dropped to approximately $56.6 billion on January 3rd, as reported by Coinglass. In stark contrast, just a day earlier on January 1st, the OI had plummeted to its lowest point in the last two months, reaching a total of only $56.03 billion.

This afternoon, the Open Interest (OI) for Bitcoin (BTC) seemed encouraging as it momentarily surpassed $57 billion, however, it has since declined and now stands at around $56 billion.

During December, Bitcoin’s total open interest has been climbing to unprecedented levels. In fact, the Bitcoin Open Interest (OI) hit its latest record high on December 18, peaking at approximately $68.13 billion. Notably, the Chicago Mercantile Exchange (CME) was the leading contributor with around $22.7 billion.

After almost touching $70 billion, the Open Interest (OI) of Bitcoin has been decreasing steadily, and this decline culminated on January 1 when it dropped to $56 billion.

The term “Bitcoin open interest” refers to the number of ongoing futures agreements related to Bitcoin being utilized across various cryptocurrency platforms. A higher open interest indicates increased demand and potential for liquidation in this digital asset.

Currently, at this point in my writing, Bitcoin Open Interest (BTC OI) hasn’t managed to surpass the $60 billion mark yet. Intriguingly, it has actually dropped back down to its previous all-time high of $57 billion, as seen on November 22nd. At present, there are no indications suggesting a swift recovery is imminent.

According to data from Coinglass, CME is the leading provider of Bitcoin futures open interest (OI), accounting for approximately 30% of the total market value. Currently, CME has an OI of about 172,650 BTC, which equates to a staggering $16.7 billion at current prices.

Binance ranks as the second largest contributor to Bitcoin Options Instrument (OI) volume, accounting for about 21.3% or approximately 126,770 BTC worth an astounding $12.3 billion. Following closely behind is Bybit in third place, boasting a BTC OI of around $7.83 billion, which represents roughly 13.5% of the total BTC OI volume.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-01-03 16:52