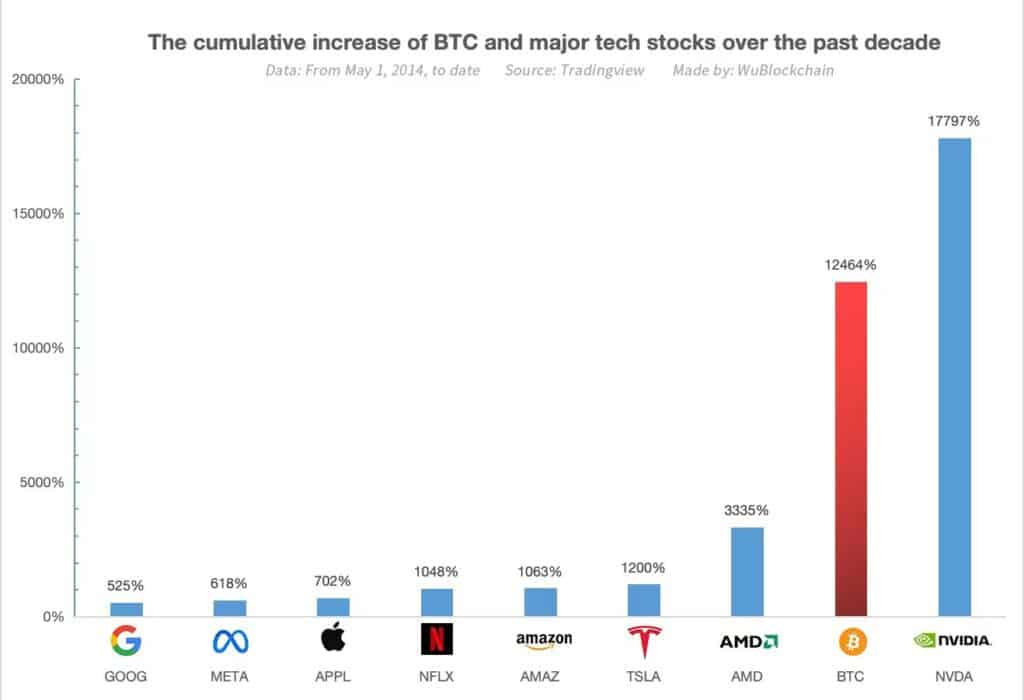

As an experienced financial analyst, I find it remarkable how Bitcoin has managed to outperform some of the biggest tech giants like Amazon, Google, and Netflix over the past 10 years. Although it may not have been a consistent upward trend, Bitcoin’s price increase of 12,464% is nothing short of impressive.

As a seasoned crypto investor, I can confidently assert that Bitcoin, the pioneering cryptocurrency, has surpassed the returns of tech titans such as Amazon, Google, and Netflix during the past decade.

In just 15 years since its introduction, Bitcoin (BTC) has managed to hold its ground against tech giants.

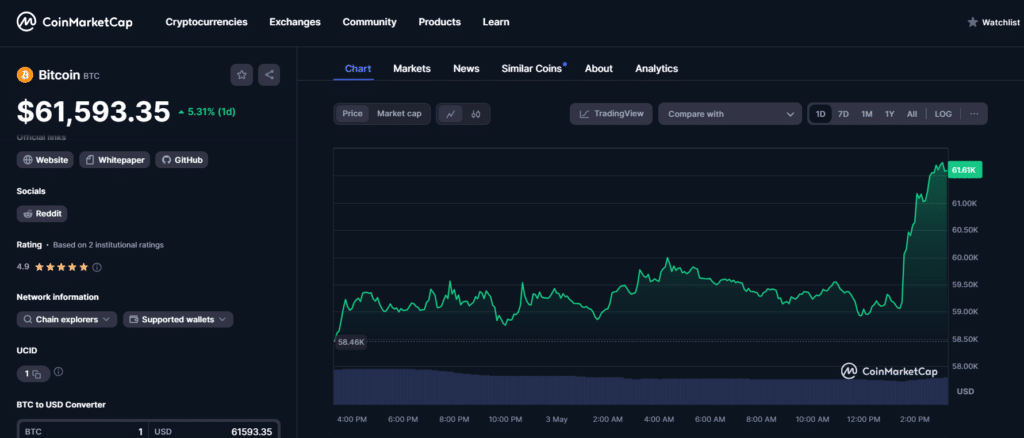

Towards the end of 2014, a single Bitcoin cost approximately $378. However, digital assets have experienced a significant downturn more recently. The price of a Bitcoin now stands 16% lower than its record high in March, which was $61,500 according to CoinMarketCap.

Bitcoin ranked second among tech investments

Over the last decade, data from TradingView revealed that among technology giants, only Nvidia’s stock (NVDA) surpassed Bitcoin in terms of total return. Specifically, Nvidia’s stock yielded a remarkable cumulative gain of 17,797%, whereas Bitcoin managed a 12,464% increase.

Advanced Micro Devices (AMD) came in third place with a remarkable price surge of 3,335%. Tesla (TSLA), led by Elon Musk, ranked fourth with an impressive 1,200% rise in stock price. Amazon, headed by Jeff Bezos, rounded out the top five with a significant 1,063% increase in value. Other notable tech companies included Netflix (NFLX), Apple (APPL), Meta (META), and Google (GOOG), each experiencing substantial growth.

What’s next for BTC?

As a crypto investor, I’ve recently witnessed an on-chain event designed by Bitcoin’s creator, Satoshi Nakamoto, come to life. This event, known as the Bitcoin halving, reduced block rewards for miners by half. Consequently, miner revenues have been put under pressure. However, this change is crucial for preserving Bitcoin’s scarcity. By cutting token inflation in half, we introduce a new supply dynamic to the market that helps maintain Bitcoin’s value and rarity.

Historically, a market downturn occurs after a cryptocurrency’s halving event, and prices may remain relatively stable for a while before eventually increasing. Some speculators have suggested that this trend could shift in the near term during this cycle. However, an authority on crypto matters emphasized to crypto.news that the long-term consequences carry more significance than short-term price fluctuations.

Expert: Peter M. Moricz, the Partnerships Lead at DCL.Link, emphasized that Bitcoin miners need to shift towards more energy-efficient methods and hedge their operations to manage expenses. Stronghold Digital Mining is exploring various strategies to preserve its business and maximize value for its shareholders.

Moricz expressed worry over the growing trend towards business consolidation in Bitcoin mining, which he believes could lead to greater government intervention. With more entities merging, the potential for government influence becomes a significant concern for the entire Bitcoin community, according to Moricz.

As a seasoned crypto investor, I’ve observed the market closely and firmly believe that Bitcoin’s (BTC) price will continue to rise, disregarding the doubts expressed by certain Wall Street veterans.

“The BTC ETF has pulled all the price movement forward rather than after the halving. Even then, the historical pattern showed that each price action was lower than 4 years prior. BTC rallied for the past 7 months, ever since the BlackRock BTC ETF application was rumored, and with IBIT pulling in a record amount of money for any ETF, the steam had run out for now.

As a seasoned crypto investor, I believe that a correction, followed by some sideways trading, is essential for a robust market before the next significant surge in Bitcoin’s price. The scarcity of Bitcoin is undeniable – there are only 21 million units in existence, regardless of Jamie Dimon’s opinions.

Peter M. Moricz, DCL.Link Partnerships Lead

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-05-03 18:02