As a seasoned researcher with over two decades of experience in the financial markets, I have seen my fair share of market cycles and trends. The recent surge of Bitcoin to $66,000 is indeed an intriguing development, particularly given its correlation with riskier assets like altcoins and equities.

This week, the value of Bitcoin has shown a decent increase, reaching an all-time high of $66,000, which is the highest it’s been since July 31.

Bitcoin moves into bull market

Bitcoin’s recovery has mirrored the rise of more volatile investments such as alternative cryptocurrencies and stocks. Notably, the Dow Jones Industrial Average and the S&P 500 have hit new record peaks, while the Nasdaq 100 is just a few points shy of its all-time high.

As a crypto enthusiast myself, I recently came across an insightful prediction by Miles Deutscher on X.com. He suggested that Bitcoin could potentially surge in the short term, possibly peaking at an impressive $81,000.

He argued that the S&P 500 index, which tracks the biggest American companies, was up by 9% above its highest level this year. As such, he told his 541,000 followers that the coin would hit $81,000 if it caught up with equities as it has done in the past.

#Bitcoin might hit all-time highs much more quickly than anticipated.

— Miles Deutscher (@milesdeutscher) September 28, 2024

As a researcher examining the crypto market, I’ve noticed an optimistic outlook on Bitcoin from various analysts. For instance, analysts at BlackRock, the global leader in asset management, have characterized Bitcoin as a “unique diversifier” in their report dated September 17th.

The New York-based firm argued that the top cryptocurrency was a unique asset that is uncorrelated with equities, especially in periods of elevated risks.

BlackRock has persisted in including Bitcoin in its financial records, an action which might prompt other companies to begin purchasing it.

Currently, MicroStrategy is still amassing Bitcoin. Its founder, Michael Saylor, foresees the value of Bitcoin reaching beyond $13 million by the year 2045. At present, the company owns more than 252,000 Bitcoins.

According to Michael van de Poppe, founder of MC Consultunacy and a fervent advocate for Bitcoin, he predicts that the value of Bitcoin could reach anywhere between $90,000 and $100,000 by year-end. He attributes this projection to the rising global liquidity, which is expected to escalate further as central banks lower interest rates.

As a researcher, I’m observing that Gold is climbing steadily, while Silver has hit its highest price mark in over a decade. It appears that global liquidity is on the rise and the altcoin market is just beginning to show signs of life. By year-end, my predictions lean towards Bitcoin trading within the range of $90,000 – $100,000.

— Michaël van de Poppe (@CryptoMichNL) September 26, 2024

It appears that Bitcoin tends to perform better during the last quarter of the year, as indicated by CoinGlass data. Compared to a 6.3% average return in the third quarter and a 27% return in the second quarter, the fourth quarter’s average return stands at an impressive 88%.

October and November are usually the best months for the coin.

Polymarket traders are betting that the coin will jump to a new all-time high in 2024 — 63% odds.

Bitcoin technicals

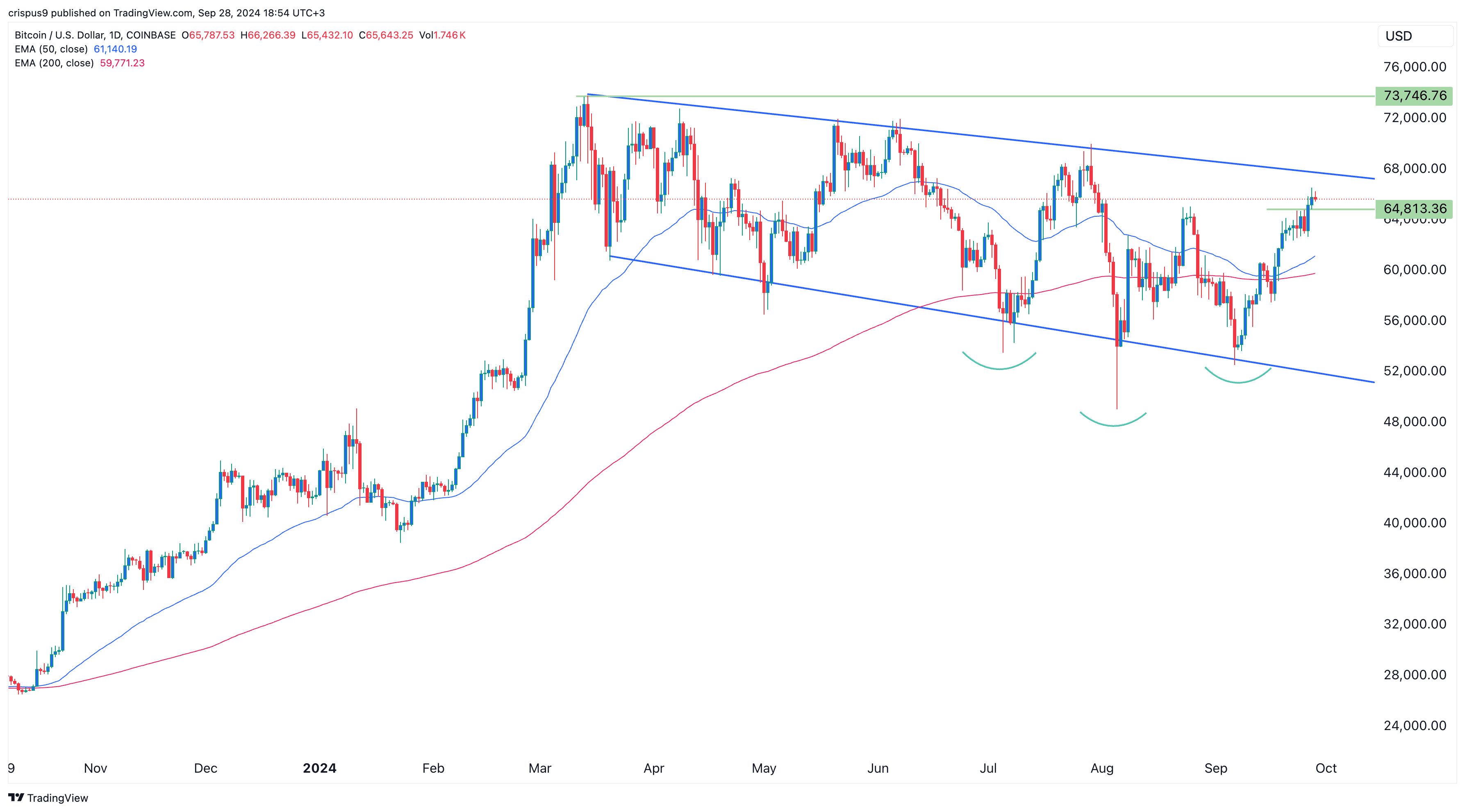

Today’s graph indicates that Bitcoin exhibits strong technical characteristics. It has developed an inverted head and shoulder pattern, which is often seen as a positive signal for buyers. Additionally, it appears to be constructing a falling broadening wedge formation.

Bitcoin has successfully steered clear of a “death cross” formation and instead, climbed over its 50-day and 200-day moving averages. To maintain this bullish momentum and surpass the year-to-date high of $73,777, it needs to break through the upper boundary of the current wedge. This could help speed up the ongoing recovery process.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Maiden Academy tier list

2024-09-28 21:34