As a seasoned crypto investor with a knack for spotting trends and analyzing charts, I must admit that the recent Bitcoin surge to $104,000 has left me quite exhilarated. The continued inflow of institutional investments and the record-breaking net inflows into spot Bitcoin ETFs are undeniably bullish indicators.

This week, Bitcoin‘s price has shown impressive growth, surpassing a significant threshold of $100,000 and reaching an all-time high of approximately $104,000.

The rise in Bitcoin (BTC) can be attributed to persistent demand from investors, as suggested by the data. Interestingly, figures from SoSoValue reveal that Bitcoin exchange-traded funds experienced a significant increase in net investment amounting to more than 33 billion dollars.

After six straight days with increased investments, these funds are currently managing a historic $109 billion in assets.

As a researcher studying this particular digital currency, I am buoyed by the optimism expressed by analysts regarding its future performance. Specifically, analysts from Standard Chartered and BitWise have indicated that they anticipate the coin reaching $200,000 by 2025. This bullish outlook is primarily driven by the strong institutional demand and dwindling supply levels they’ve observed.

The evidence from past trends indicates a potential for rapid economic expansion. To illustrate, the Dow Jones index surpassed $10,000 in 2000, doubled to $20,000 by 2017, and has now reached $40,000 this year. Likewise, the S&P 500 doubled from 1,000 in mid-2008 to 2,000 in mid-2014 but took another seven years to double again.

Beyond just institutional investment, the price of Bitcoin could surge even further if governments decide to purchase it. For instance, the U.S. already owns about 198,109 Bitcoins, while China, the UK, and Ukraine each hold approximately 190,000, 61,000, and 46,000 coins respectively. Notable other holders include Bhutan, El Salvador, and Venezuela.

Given the likelihood of heightened geopolitical conflicts under the Trump administration, some nations might contemplate investing in Bitcoin. Moreover, the United States might choose to transform its existing reserves into strategic assets, as suggested by the appointment of David Sacks as a cryptocurrency authority.

Bitcoin price technicals point to more gains

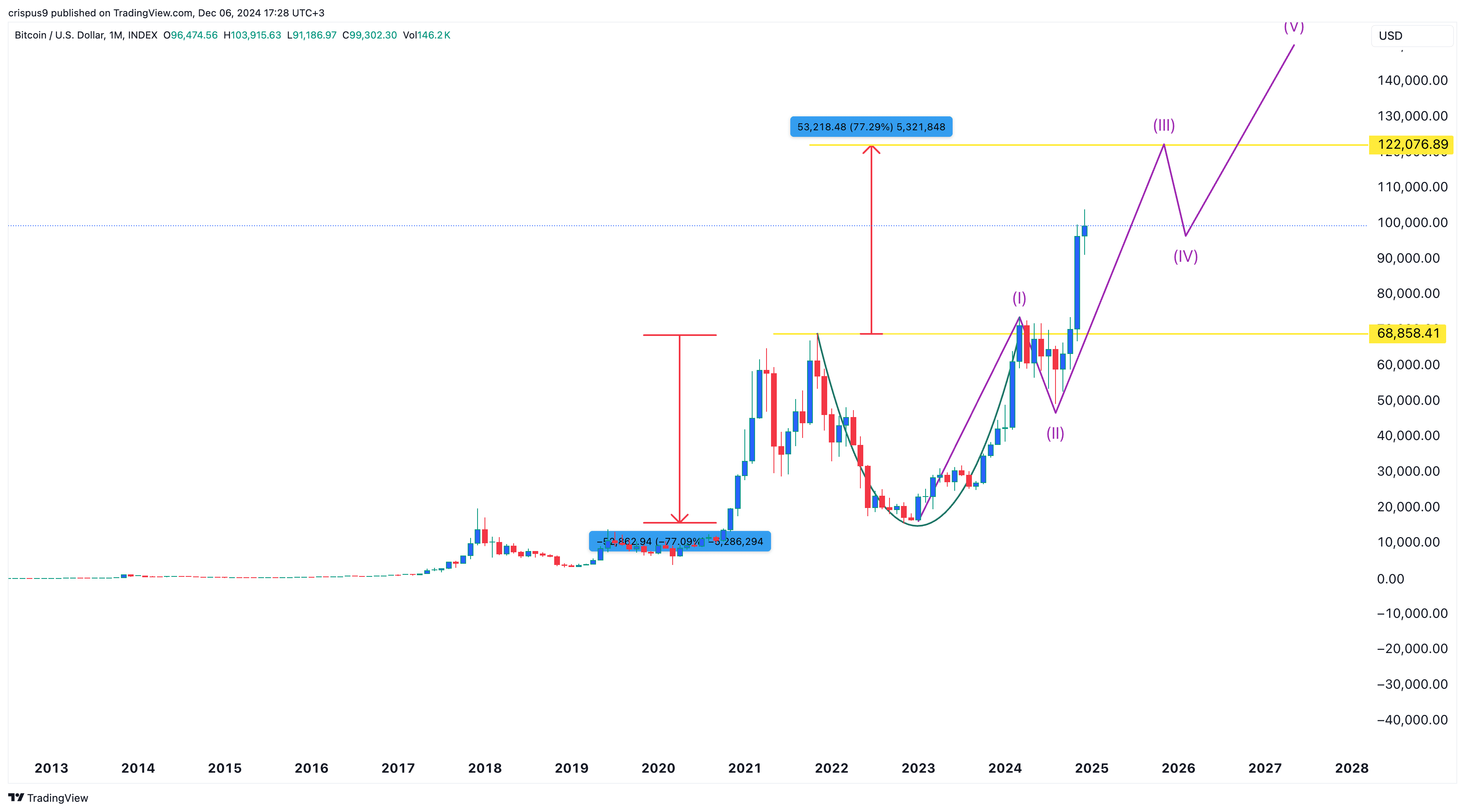

According to several cryptocurrency experts, Bitcoin might soar up to $200,000. However, a closer look at its long-term trend indicates possible obstacles around the $122,000 mark.

The monthly chart shows that Bitcoin has just completed the formation of a cup and handle pattern. The upper side of this cup was at $68,858. It then formed the handle between March 2024 and November.

If this cup is approximately 77% full, then measuring the same height from its rim indicates a potential increase of around 25%. This suggests that if we’re currently at $0, the coin could potentially reach a value of about $122,000.

According to Elliot Wave theory, it appears that this trend could progress towards approximately $122,000, which might represent the third significant wave. Afterwards, a brief retreat or correction, known as the fourth wave, could occur before ultimately reaching a potential peak of around $200,000.

Consequently, even though the Bitcoin price may reach $200,000, it might experience fluctuations or a significant dip around the $122,000 mark.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-12-06 17:48