As a seasoned crypto investor with a knack for spotting trends and patterns, I find myself increasingly optimistic about Bitcoin’s future. The recent surge past the $65,000 mark and the strong rally in global equities are clear signs that we might be witnessing the early stages of another bull run.

To begin the week, Bitcoin and various digital currencies showed a positive trend, supported by continuous talks about economic stimulus in China, one of the largest economies globally.

For the first time since September 30, Bitcoin (BTC) surpassed a significant barrier at $65,000. This marks an increase of over 10% from its lowest point this month and a 32% rise from its August low, indicating that it is currently experiencing a bull market.

The increase in Bitcoin’s value occurred simultaneously with a robust upswing in the worldwide stock market, following Chinese authorities announcing a set of stimulus plans.

Today, the Shanghai Composite Index climbed by 2%, and the Shenzhen index went up by 2.65%. This growth pattern was also seen in various Asian and European markets. In the United States, futures linked to the Nasdaq 100 and Dow Jones indices continued to rise as well.

The surge in Bitcoin’s price was mirrored by a rise in institutional investment, as more and more investors opted to purchase shares in Bitcoin Spot Exchange-Traded Funds (ETFs). According to SoSoValue, these ETFs experienced net inflows of $308 million last week.

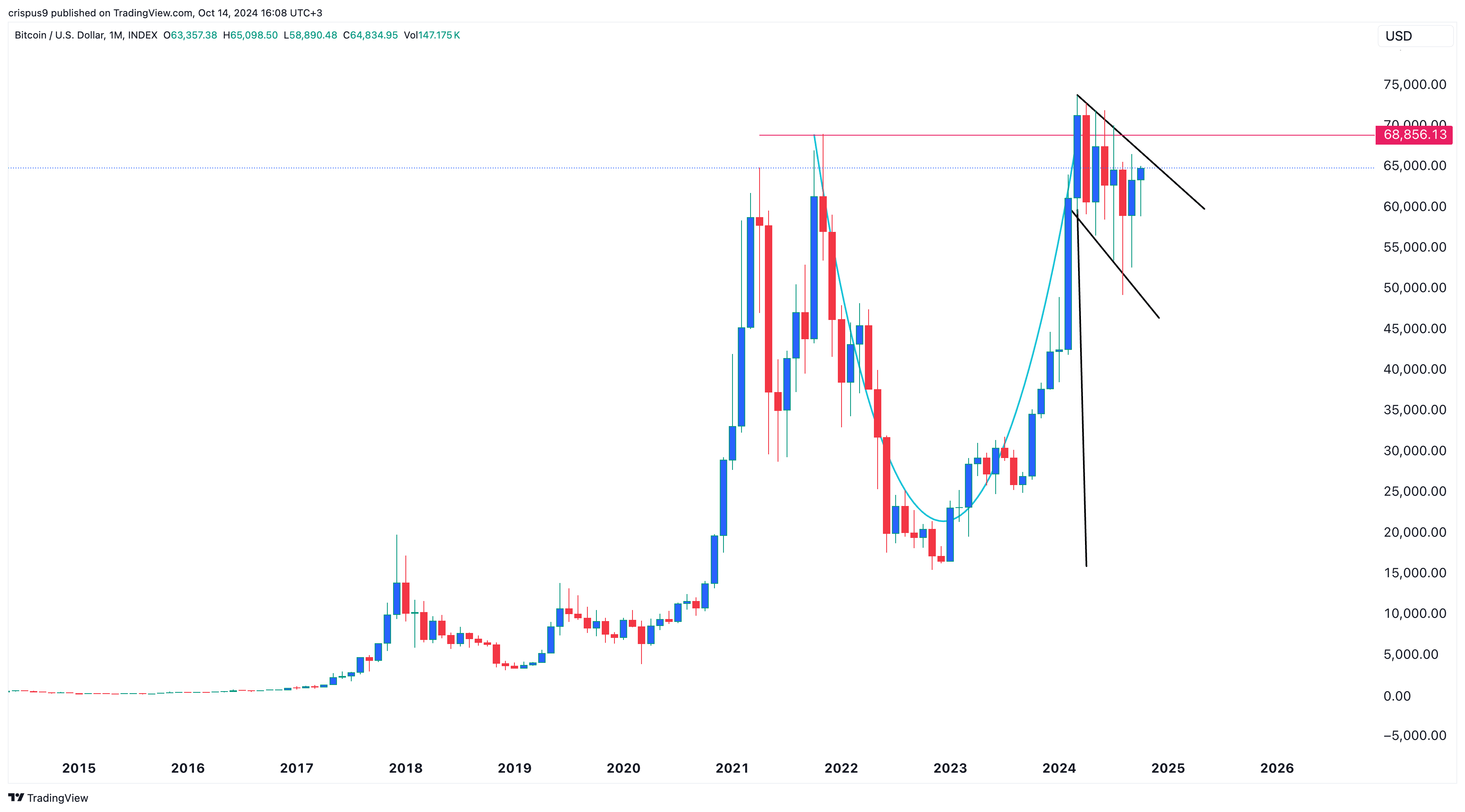

BTC monthly chart points to more gains

Based on the monthly chart analysis, it appears that Bitcoin could potentially see further long-term growth. This pattern suggests that the price of BTC has been shaping like a cup-and-handle configuration since reaching $68,856 in 2021. More recently, this year, it revisited that peak level and formed a well-rounded base.

In simpler terms, the recent consolidation occurs before a significant bullish surge, often found at the end of a handle-like phase.

This consolidation is additionally a component of what’s known as a ‘bullish pennant formation’, which typically follows a long upward trend (the pole) and then a period of sideways movement within a rectangular shape (the consolidation).

Furthermore, the graph indicates that Bitcoin exhibited a hammer-like candlestick formation in August. This specific shape, marked by a lengthy lower wick and a substantial body, is often viewed as a very optimistic sign.

Consequently, a stronger confirmation of further growth will occur if Bitcoin surpasses its highest point this year ($73,800). But keep in mind that such trends, particularly on the monthly graph, may require some patience to completely unfold.

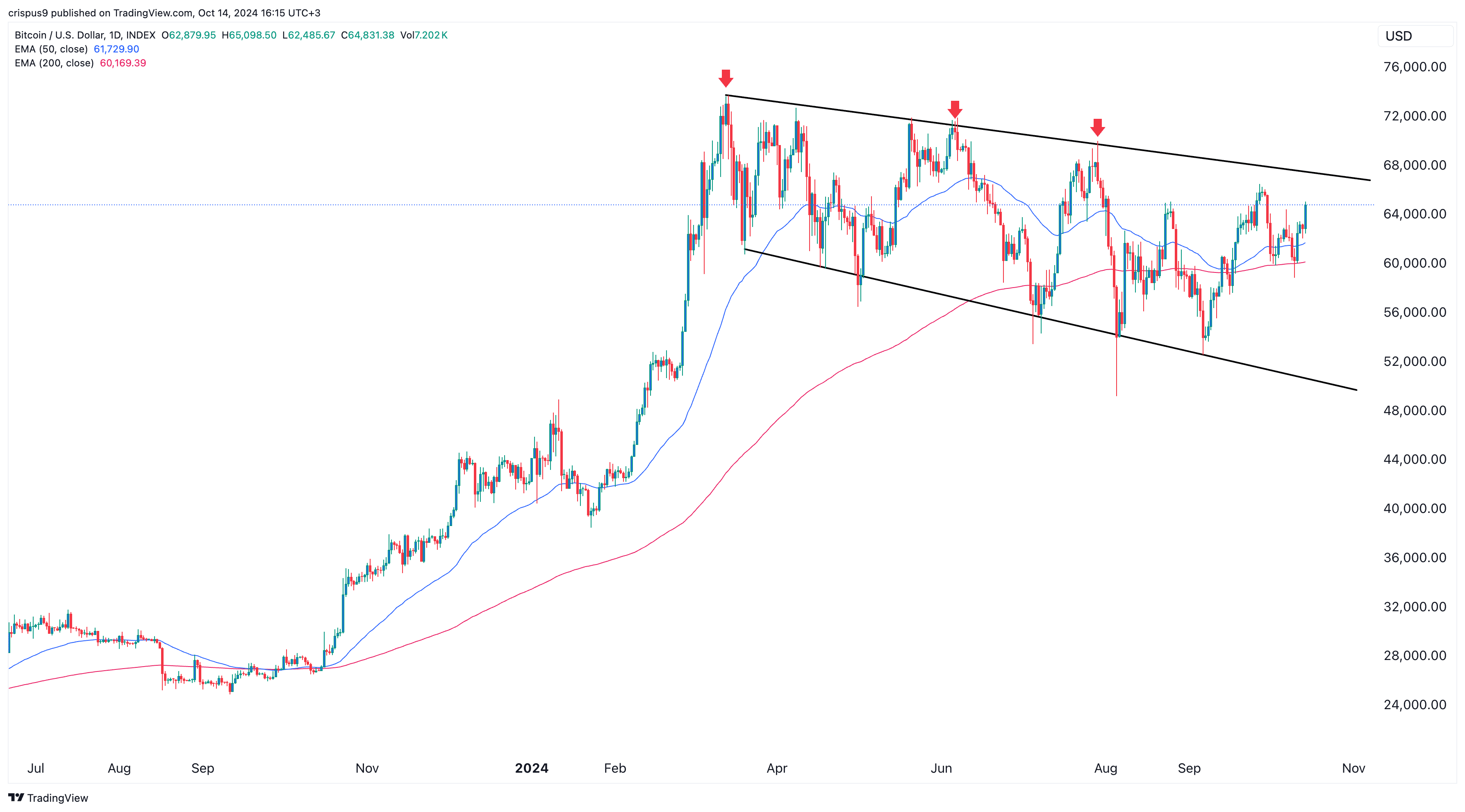

Bitcoin daily chart catalysts

In simpler terms, the graph suggests that Bitcoin might increase in value soon. Currently, it’s consistently staying above both its 50-day and 200-day moving averages. Additionally, it hasn’t developed the ‘death cross’ pattern, which usually foreshadows a further drop in price.

Since March, Bitcoin’s price action has been shaping like a broadening pattern known as a wedge, which is marked by successive lower highs and higher lows. Specifically, its higher lows were observed at approximately $73,800, $72,000, and $70,000.

If Bitcoin surpasses its previous high at $73,800 by breaking above the current downward trendline, it would signal a strong bullish trend. This could potentially pave the way for even higher prices this year, suggesting that the likelihood of Bitcoin reaching another record high is becoming more probable.

Based on Polymarket’s predictions, it’s estimated that Bitcoin could reach $63,800 this year, with a probability of approximately 62%, which is the highest likelihood since September 29. This is also significantly higher than the lowest odds of 32% recorded this month.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-10-14 16:44