As a seasoned analyst with over two decades of experience in the financial markets and a keen interest in digital assets, I find CleanSpark’s CEO, Zachary Bradford’s bullish prediction on Bitcoin intriguing. His perspective is further validated by his company’s significant investments in Bitcoin and its leading position in the mining industry.

A senior Bitcoin mining executive expects prices to continue rising in the ongoing bull market cycle.

During an interview with Bernstein, a significant player on Wall Street, CleanSpark’s CEO anticipates that Bitcoin (BTC) could soar up to $200,000 within the next 18 months. If his forecast holds true, he estimates that the value of the coin would surge by approximately 210% from its current market price.

CleanSpark’s CEO is bullish on Bitcoin

I, as an analyst, highlighted several potential triggers for Bitcoin’s price movement in my recent analysis. These catalysts include anticipated interest rate reductions by the Federal Reserve, the resolution of the U.S. general election, and the influence of the post-halving cycle, as reported by The Block.

Additionally, he anticipates that efficiently managed, cost-effective mining companies focusing solely on mining will surpass businesses such as Core Scientific and TeraWulf, which are broadening their scope to include artificial intelligence.

Bradford’s assertion is significant due to his role as head of CleanSpark, which ranks third among mining companies in the sector by market capitalization, following Marathon Digital and Core Scientific.

In the past nine months leading up to June, CleanSpark’s revenue significantly increased to approximately $289 million, and their adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) also saw a rise, surpassing $238 million.

CleanSpark is among the top corporations in America that holds a substantial amount of Bitcoin. Specifically, they possess approximately 7,558 Bitcoins, valued at around $482 million, according to their current holdings.

Bradford follows in the footsteps of notable analysts voicing optimistic opinions about Bitcoin. Recently on CNBC, Michael Saylor, founder of MicroStrategy, projected that the cryptocurrency could hit $13 million by 2045. If achieved, this would value MicroStrategy’s over 252,000 Bitcoins at an astounding $3.2 trillion.

In simple terms, the world’s largest investment firm, BlackRock, managing more than $10.4 trillion in assets, has endorsed Bitcoin as a beneficial addition to investment portfolios. This perspective is outlined in a research document, where three top-level executives make the case for Bitcoin as a smart diversification choice.

According to Ki Young Ju, the innovative mind behind CryptoQuant, he too thinks that we’re right smack in the midst of an upward trend for Bitcoin, which might just propel it even further upwards.

Hey bears, I’m sorry, but #Bitcoin is still in the middle of the bull cycle.

— Ki Young Ju (@ki_young_ju) September 30, 2024

The likelihood of Bitcoin reaching a fresh record high has increased significantly on Polymarket, a rapidly expanding prediction marketplace.

Bitcoin needs to flip key resistance level

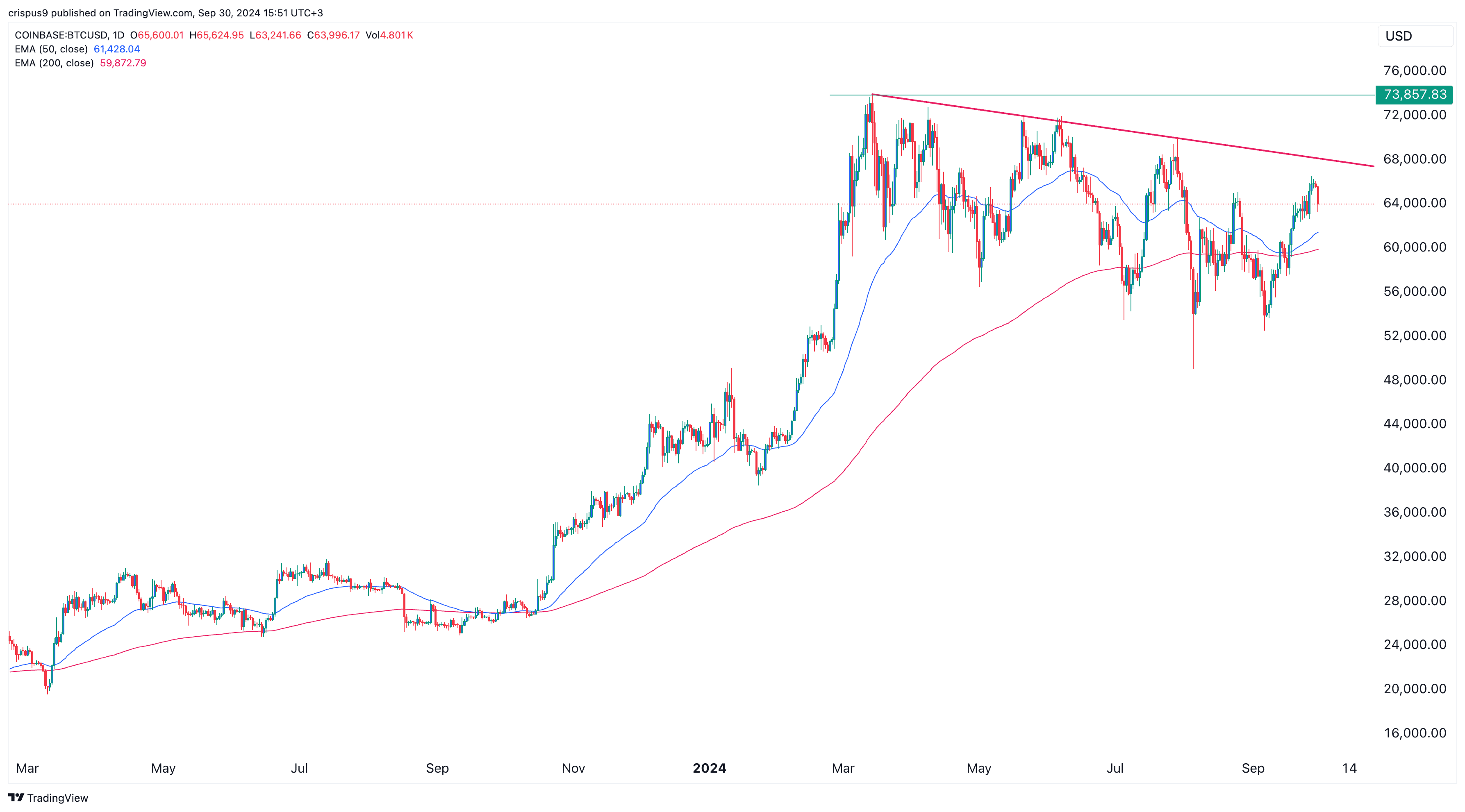

Bitcoin is exhibiting some encouraging technical formations. On the daily graph, it’s showing an inverted head-and-shoulders formation, and it’s consistently staying above both its 50-day and 200-day Exponential Moving Averages (EMAs). Additionally, since March, it has been trending within a falling broadening wedge pattern.

Nevertheless, the primary hurdle lies at approximately $68,000, where it has repeatedly hit a roadblock and been unable to surpass this resistance line on five occasions since March.

Consequently, if we surpass the established trendline, it suggests potential for additional growth. The first significant goal in this case would be reaching $73,777, which is its peak value for this year.

Read More

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

2024-09-30 16:16