As a seasoned researcher with over two decades of experience in the financial markets, I find the recent technical analysis by Peter Brandt on Bitcoin intriguing. Having closely followed the evolution of chart patterns since Richard Schabacker’s groundbreaking work in 1934, I must say that the inverted right-angled broadening triangle pattern on Bitcoin looks promising.

According to renowned technical analyst Peter Brandt, a unique chart formation in Bitcoin‘s price suggests it may experience a substantial increase over the coming months.

As a researcher, I recently came across a post from well-known analyst Peter Brandt, who boasts over 700,000 followers. In his analysis, he highlighted a bullish chart pattern in Bitcoin (BTC). Specifically, he referenced the inverted right-angled broadening triangle, a pattern first introduced by Richard Schabacker in 1934.

In 1934, Richard W. Schabacker introduced the concept known as an “inverted right-angled expanding triangle” in his book titled “Technical Analysis and Stock Market Profits.” Here’s a chart of Bitcoin $BTC. Although its upper boundary isn’t perfectly horizontal, I find that the pattern aligns reasonably well with it.— Peter Brandt (@PeterLBrandt) August 7, 2024

Over time, this particular pattern, frequently referred to as a “widening downward trend,” usually culminates in a robust upward price surge or breakout, indicating a positive market trend.

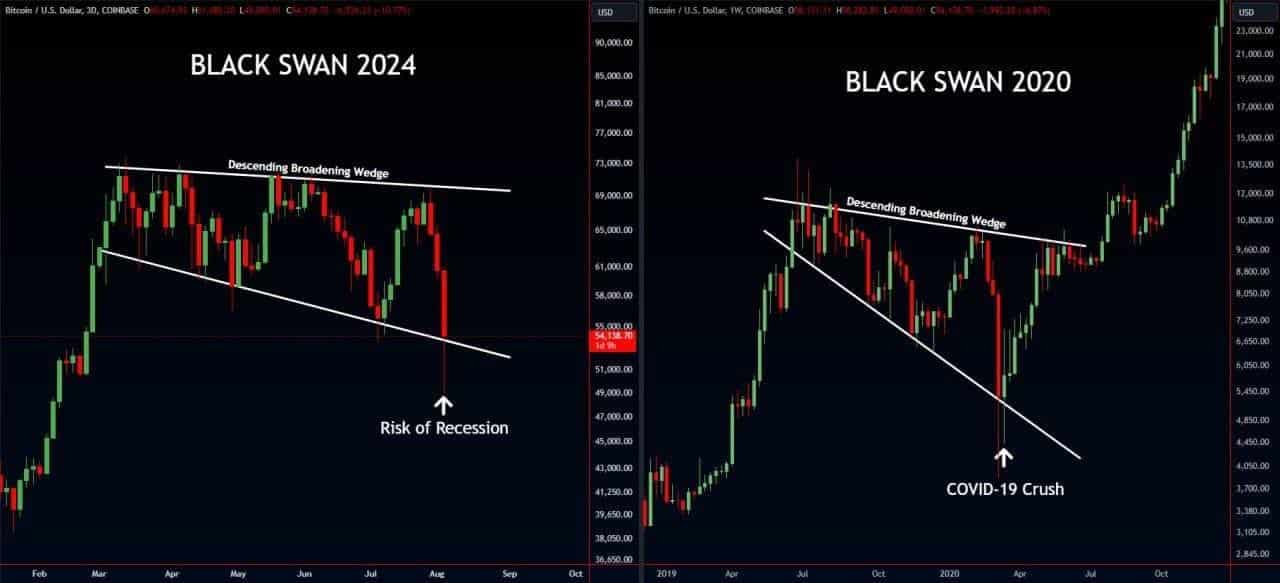

As someone who has spent years studying financial markets and trends, I have seen many different patterns emerge over time. One pattern that stands out to me is when an asset forms a descending wedge, as shown in the diagram below. This pattern is formed by connecting the highest points of an asset’s price movement (in this case, in March, May, June, and July) to create an upper trendline, and then connecting the lowest levels of those same months to create a lower trendline.

In previous instances, this particular approach proved effective, especially during the initial three months of 2020 when the Covid-19 virus was rapidly spreading globally on a massive scale.

As a crypto investor, I’ve noticed an interesting development with Bitcoin – it’s forming a hammer candlestick pattern. This pattern is distinctive due to its long lower shadow and short upper one, suggesting potential for price reversal.

To ensure the bullish ‘right-angled broadening triangle’ formation in Bitcoin holds true, it’s crucial for its price to remain stable above the lower boundary of the hammer candlestick. If the price falls below this level, the pattern will be considered invalid, leading to a potential further decline in value.

Potential catalyst for Bitcoin

To ensure the success of the pattern, Bitcoin might require a significant event or factor boosting its value – much like the one we saw in March 2020. This influential element could potentially originate from the Federal Reserve, should they take an action that positively impacts Bitcoin’s market.

In his latest statement, Chicago Federal Reserve President Austan Goolsbee hinted that if the economy experiences a downturn leading to a potential recession, the Fed stands ready to take action. This action could include lowering interest rates and possibly implementing a policy known as quantitative easing.

As a crypto investor, I’ve been closely monitoring the economic landscape, and there are indicators suggesting a potential recession might be on the horizon. Recently, I’ve taken note of the Sahm Rule mentioned in a report by crypto.news. This rule focuses on the jobless rate. In a recent update, The Kobeisi Letter pointed out that unemployment has been steadily increasing for four consecutive months. Historically, whenever this pattern has emerged over the past 75 years, it’s preceded a recession.

Based on my personal experience and the economic history I have witnessed over several decades, I find it quite alarming to see that the U.S. unemployment rate has been rising for four consecutive months – a streak not seen since the 2008 Financial Crisis. In my career as an economist, I’ve noticed that every time unemployment increased for four consecutive months, the U.S. economy followed suit by entering into recession. The recent surge in joblessness is a trend that warrants close attention and careful monitoring of economic indicators, as it could potentially have significant implications for individuals and businesses alike.

— The Kobeissi Letter (@KobeissiLetter) August 7, 2024

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- USD CNY PREDICTION

- Gold Rate Forecast

- Arknights celebrates fifth anniversary in style with new limited-time event

- Hero Tale best builds – One for melee, one for ranged characters

- Every Upcoming Zac Efron Movie And TV Show

2024-08-07 18:27