As a seasoned analyst with years of experience navigating the volatile world of cryptocurrencies, I find myself closely watching the recent drop in Bitcoin’s price below $59,000. The whale’s 2,300 BTC transfer to Kraken before the downturn has certainly raised some eyebrows and sparked concerns about potential sell-offs. It’s a reminder that in this market, one whale’s decision can significantly sway the tide.

The cost of a single Bitcoin dipped beneath $59,000, sparking worries amongst investors and triggering inquiries regarding the causes of this decrease. A variety of essential elements, such as broader economic occurrences and market movements, seem to be fueling this downward trend.

A significant sale of Bitcoin by a major investor (often referred to as a “whale”) might be one reason for the recent drop in Bitcoin’s price. As reported by Whale Alert, a big Bitcoin holder moved around 2,300 BTC, equivalent to approximately $141.81 million, to Kraken prior to the market decline.

Such a significant shift of resources within the cryptocurrency sphere has sparked concerns among crypto enthusiasts. However, this large investor, or ‘whale’, continues to possess 18,141 Bitcoins, currently worth approximately $1.07 billion. If this whale chooses to sell even more, it could potentially exert additional influence on Bitcoin’s price, possibly causing it to decrease further.

Investor caution is also evident as they await significant earnings reports from major tech companies. Nvidia, Salesforce, CrowdStrike, and HP Inc. are set to release their Q2 results soon, with Nvidia’s report due on August 28.

It’s anticipated that these earnings might impact the overall market mood, possibly affecting speculative assets such as Bitcoin. According to Wolfe Research, Nvidia’s results may significantly influence investor expectations.

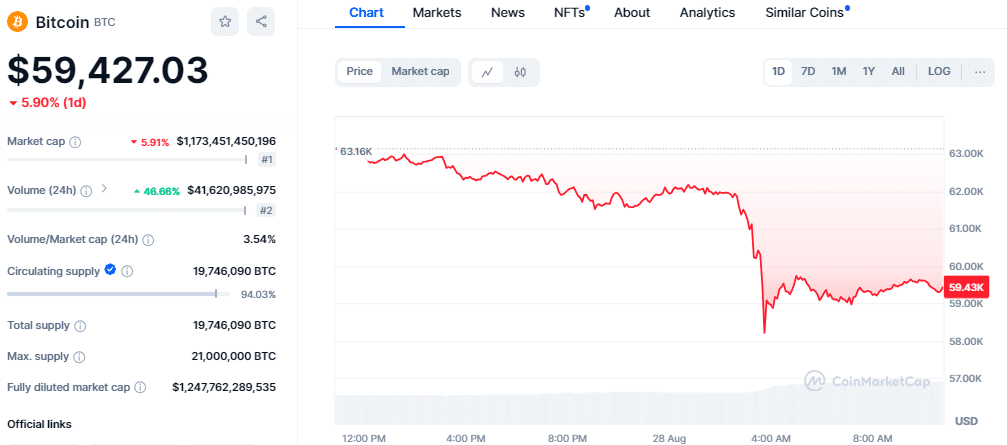

At present, Bitcoin is being traded at approximately $59,427, marking a 6.59% decrease. However, there has been a notable surge in trading activity, with a 46% rise in volume to around $41.62 billion. In the past day, Bitcoin reached a low of $58,211 and peaked at $63,210.80.

As a crypto investor, I’ve noticed that the Open Interest for Bitcoin Futures has dipped by 7% to reach $31.09 billion, and in the last hour alone, approximately $26.35 million worth of Bitcoin has been liquidated. Despite this recent downturn, some analysts are optimistic about Bitcoin’s potential recovery, predicting it could surge back up to $65,000 if it manages to break through a crucial resistance level.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Every Upcoming Zac Efron Movie And TV Show

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-08-28 09:24